Collaboration and line-of-business applications will account for strong growth in the SMB SaaS market

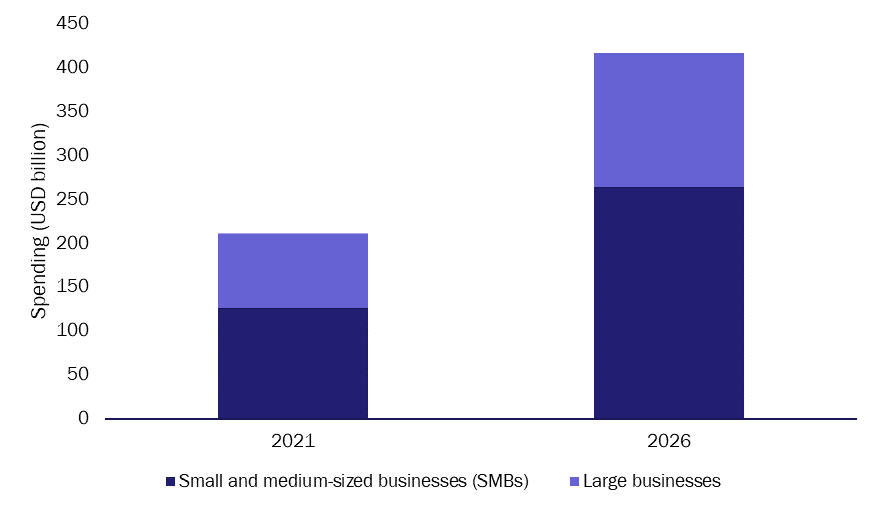

The prolonged effects of the pandemic during 2021 have encouraged small and medium-sized businesses (SMBs) to continue to digitalise their businesses and adopt SaaS solutions. SMB spending on SaaS-based business applications and collaboration tools worldwide is expected to grow at a CAGR of 17% to reach USD291 billion by 2026. SMBs’ share of total spending on SaaS-based business applications will reach 63% in 2026, driven by their continuing digital transformation efforts (Figure 1).

SMBs’ priorities for SaaS deployments have evolved in the past few years. Before the pandemic, SMBs were investing in digitalising customer engagement-related areas. However, their investment focus has shifted to business operation-related areas to ensure business continuity during the COVID era.

This article examines the high-growth SaaS-based business application areas to provide SaaS vendors and cloud service providers with insights that will enable them to engage SMB customers.

Figure 1: Spending on SaaS-based business applications by business size segment, worldwide, 2021 and 2026

Source: Analysys Mason

Spending on business operations and management-related solutions will have the highest growth in the SMB space

According to Analysys Mason’s SMB Technology Forecaster, the 16 sub-categories of SaaS solutions can be grouped into three segments based on SMB spending growth rates between 2021 and 2026:

- those with hyper growth (20% CAGR or more)

- those with high growth (between 15% and 19% CAGR)

- those with healthy growth (7% to 15% CAGR) (Figure 2).

This view illustrates the direction of SMBs’ investments in SaaS and the underlying direction of their digital transformation journeys.

Figure 2: SaaS-based business solutions by SMB spending segment

| Spending segment (CAGR between 2021 and 2026) | SaaS solution sub-category | Market size in 2026 (USD billion) |

| Hyper growth (20% or more) |

|

~120 |

| High growth (15%–19%) |

|

~40 |

| Healthy growth (up to 15%) |

|

~130 |

Source: Analysys Mason

‘Hyper growth’ segment (SMB spending in these sub-categories will increase at a CAGR of 20% or more between 2021 and 2026). Spending on collaboration tools for file-syncing, backup and storage will continue to increase as SMBs seek to maintain business resilience and support flexible business operations. However, the key for spending growth will be LoB applications. Traditionally, LoB software was hosted on-premises, particularly the engineering- and healthcare-related solutions that collectively account the largest share of spending on LoB software. For example, small doctors’ offices that had lagged behind in terms of digitalisation will continue to invest in online tools to ensure operational safety and efficiency by linking health records with external networks. Also, 3D CAD software usage is expanding from its traditional manufacturing, architecture and construction verticals to industries such as dentistry, fashion design and media and entertainment.

The growth of spending on PoS and ERP solutions is inter-related. For example, major PoS vendors experienced record high sales growth in 2021, driven by rapid adoption of ecommerce and online transaction capabilities. Increased adoption by smaller firms will sustain sales growth for PoS vendors in the coming years. As a result of the growing popularity of the online business model, ERP solutions will need to efficiently manage multiple sales/delivery channels, inventory, logistics and the supply chain.

‘High growth’ segment (SMB spending in these sub-categories will increase at a CAGR of between 15% and 19% during the forecast period). This segment consists of solutions in three functional areas:

- financial management-related solutions (travel and expenses, quotes and invoicing, and payroll)

- collaboration (workflow for communications between employees and customers, and project management)

- BI.

Financial management and collaboration solutions are directly related to improving operational productivity and efficiency. Migrating financial management and collaboration solutions to the cloud has become essential for running businesses because remote working patterns look likely to continue. The increasing popularity of SaaS-based BI solutions is a result of SMBs’ need for solutions that are flexible and easy to deploy in a rapidly changing business environment. The growth in the number of new deployments of BI tools is related to the increased popularity of ERP solutions, but ERP is not a must for all SMBs. Just 1% of SMBs will be using an ERP solution in 2026 whereas 4% will have deployed a BI solution.

‘Healthy growth’ segment (SMB spending in these sub-categories will increase by a CAGR of up to 15% between 2021 and 2026). This segment includes basic essential business tools (general accounting, productivity suites, CRM, HR, email and marketing automation). These tools are already widely deployed, but the demand for upgrading and adding features to support the new business operations will boost SMB spending. In terms of dollar volume, this area accounts for the largest share of the total spending throughout the forecast period.

Vendors and cloud service providers should expand their integrated solution partner networks to address SMBs’ various needs

The key tips for vendors and cloud service providers to capture the growth opportunities in this market are as follows.

- Increase the number of independent software vendor (ISV) partners from the high-growth SaaS sub-categories to satisfy the diverse requirements of SMBs.

- Expand the managed service provider (MSP) reseller partner network. In the past year, SMBs’ have increased their use of MSPs for IT management. MSPs are set to be the highest-growing channel for SaaS-based business applications in terms of sales in the next 5 years.

- Expand into the emerging Asia–Pacific (EMAP) region where spending on SaaS-based solutions will increase most quickly in the next 5 years. North America will continue to be the largest market for SaaS solutions with 44% of total spending throughout the forecast period with healthy growth of 16% per year. However, spending in EMAP will grow at 26% and is expected to surpass that in developed Asia–Pacific countries by 2026.

SMBs are looking for solutions that are quick to deploy and easy to use and maintain. Creating a one-stop service to cater to SMB needs, engaging influential reseller channels and developing region-specific strategies will be essential for capturing the growth opportunity.

Article (PDF)

Download