IT and managed services forecast: remote IT services to drive SMB spending growth

Small and medium-sized businesses (SMBs) with 1–999 employees are allocating a large share of their IT budget to IT and managed services as they look to vendors and channel partners to help them manage their IT environments. SMBs’ demand for managed services is driven by a range of factors, including the adoption of cloud-based solutions, lack of in-house IT expertise and a shift away from traditional on-site IT and IT support.

IT and managed services include products support services, professional services and remotely managed IT services (RMITS) (see Figure 1). Analysys Mason’s SMB Technology Forecaster shows that SMBs spent USD337 billion on IT and managed services in 2022, which accounted for 24% of total SMB IT spending. We expect spending to grow to USD406 billion by 2026 as SMB demand for consultative IT support grows.

Figure 1: Categories included in IT and managed services

| ICT level 1 | ICT level 2 | ICT level 3 |

| IT and managed services | Product support services |

Computing support Networking support Security support Software support Storage support |

| Professional services |

Development and integration IT consulting Process management |

|

| Remotely managed IT services |

Remotely managed IT services (other) Remotely managed mobile device (MMS) Remotely managed networking (wired) Remotely managed networking (wireless) Remotely managed PBX (TDM and/or IP-PBX) Remotely managed PC Remotely managed security Remotely managed server Remotely managed storage |

Source: Analysys Mason

Spending on remotely managed IT services is the key growth area in the IT and managed services space

Our latest SMB study, Analysys Mason’s SMB Barometer 1Q 2023, shows that only 46% of SMBs in the USA have fully managed IT environments by internal IT staff. Another 15% have their IT managed by external IT service providers. This indicates that there is a sizable portion of the SMB market that is underserved when it comes to IT services and support. As a result, spending in some categories within the managed services space will experience rapid growth through 2026 as highlighted below.

Remotely managed IT services – SMB spending on RMITS will far outpace spending on professional services and product support services. Spending will increase from USD119 billion in 2022 to USD180 billion in 2026 at a CAGR of 11% and will account for 44% of the total IT and managed services spending by 2026. This surge is expected because of SMBs’ growing demand for expertise in various IT areas such as managed security, networking, server, storage, etc. RMITS allow SMBs to gain the services and support they need without the requirement of hiring IT personnel or increasing capex. SMBs can leverage managed services providers’ expertise, knowledge and experience and allocate resources to their core competencies, making managed services an increasingly popular option for SMBs.

Product support services – SMB spending on product support services is projected to grow from USD104 billion to USD108 billion in 2026, at a CAGR of about 1%. SMBs will continue to need professionals to design, develop and install their IT systems. However, spending on on-site visits and break/fix services will slow down significantly as SMBs look to have more of their IT managed remotely.

Professional services – SMB spending on professional services will grow slowly, going from USD114 billion to USD118 between 2022 and 2026, at a CAGR of less than 1%. MBs will be the primary drivers of the modest growth as they will invest in IT consulting and design and integration services for their more complex requirements. However, growth will face headwinds as more SMBs deploy cloud-based solutions.

Value-added resellers will lose share to MSPs and SIs, operators and vendors

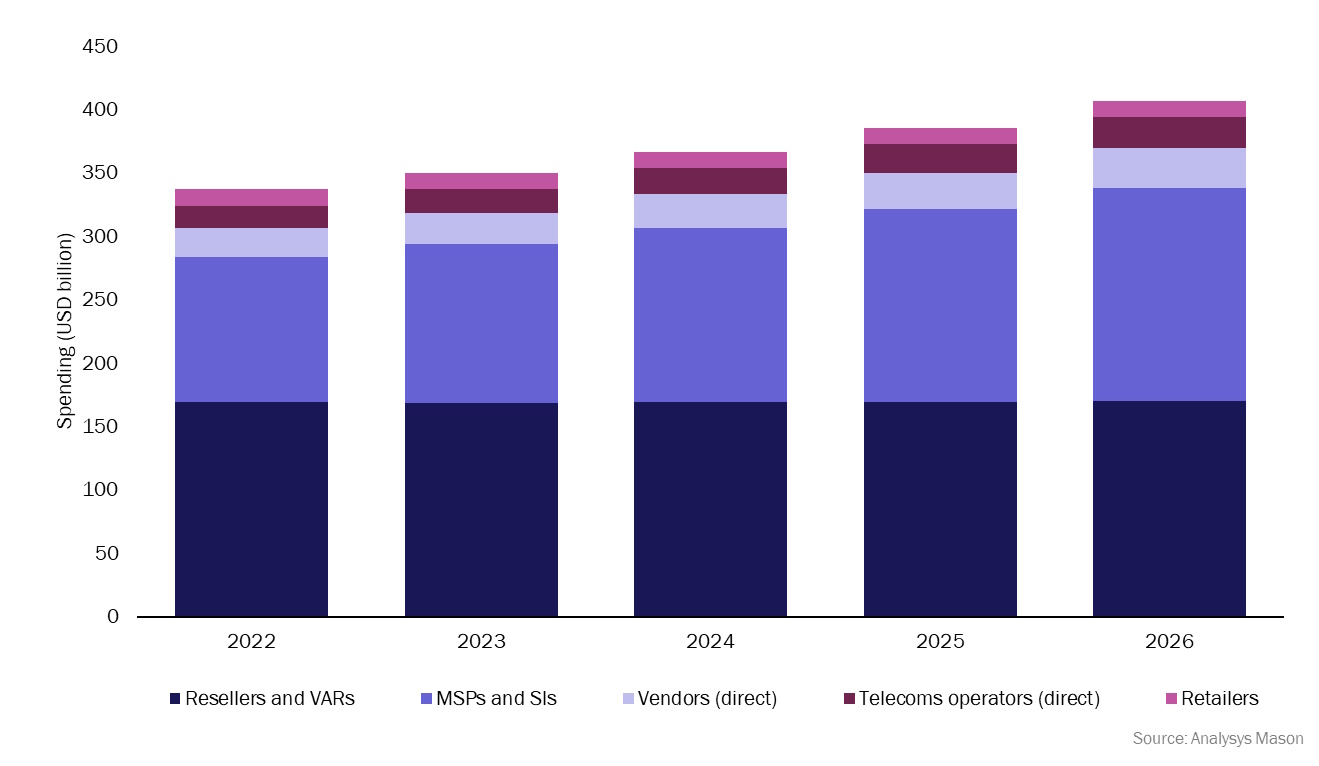

SMBs are shifting away from traditional value-added resellers (VARs), with a larger share of their IT and managed services budgets now being allocated to managed service providers (MSPs) and systems integrators (SIs). In 2022, resellers and VARs accounted for 50% of SMBs’ IT and managed services spending. However, we anticipate that growth in spending through VARs will be flat. By 2026, VARs will only capture 42% of SMB spending on IT and managed services as more end-user dollars flow through MSPs.

Figure 2: SMB IT and managed services spending by channel, 2022–2026

Spending via MSPs and SIs is expected to grow rapidly as RMITS grow in importance. We estimate that SMB IT and managed service spending via MSPs and SIs will increase from USD115 billion to USD168 billion between 2022 and 2026 at a CAGR of 10%. Vendors and telecoms operators will also see rapid growth in this area, with SMB spending growing at a CAGR of 9%. While these channels only make up 11% of the captured spending, SMBs are showing a growing willingness to purchase from existing vendors and services providers that they have already built relationships with.

The growth in IT and managed services presents a significant opportunity for vendors working with channel partners. By optimising their offerings to meet the evolving business needs of SMBs, providers will continue to be in high demand. Understanding SMBs’ business requirements, and raising awareness about available solutions, will be key factors for the success of MSPs in capturing revenue in this growing market. Vendors will want to work with MSPs to ensure that they are well trained in the solutions that they are selling through to SMBs and that they have the right tools to market to end-customers.

Vendors and partners should focus on consultative support and remotely managed services to capture SMB share

SMBs are increasingly looking for advisory support from vendors and channel partners when it comes to IT. This need for consultative services will drive growth for managed services spending. Business leaders and decision makers also want to focus their time on their core businesses. As a result, demand for managed services will be sustained because SMBs typically lack the time and expertise to fully manage their own IT environments.

As vendors and telecoms operators begin to offer more managed services, they should aim to improve the integration of their products with the managed services to maximise their revenue opportunity and to remain competitive. They should partner with MSPs in developing and providing compatible solutions, as well as conducting collaborative marketing campaigns to educate SMBs on their offerings. With MSPs rapidly gaining SMB market share, vendors and operators should consider providing tailored solutions that meet SMB-specific requirements that can be delivered by MSPs and other partners offering managed services.

Article (PDF)

Download

Our SMB Technology Forecaster provides key fact-based insights and answers to help shape your SMB strategy

Related items

Report

SMB IT spending forecast report: driving business growth and increasing efficiency

Report

SMB IT spending forecast report: a new beginning

Article

SMBs in manufacturing and professional service industries are making big investments in CRM solutions