IT vendors and operators need to identify the SMB ‘super spenders’ to drive revenue growth

The COVID-19 pandemic has had a significant impact on the small and medium-sized business (SMB) market. It has forced businesses to not only rethink their models, but also to change their IT investment priorities. Our research shows that there is a distinct dichotomy: many SMBs are planning to invest more in technology, while others are delaying or cancelling IT projects. The mindsets, vertical industries and needs of high-spending SMBs have changed as a result of the pandemic, so vendors and operators must work out how to identify those that are planning to spend more in this unprecedented time. We refer to these companies as ‘super spenders’.

Vendors and operators must identify pockets of opportunity in the new working environment

Approximately 70% of the respondents of our survey of over 400 SMBs across the USA have implemented or expanded their work-from-home measures due to COVID-19. This shift has created significant opportunities for vendors and operators because many SMBs are managing this increasingly distributed workforce by adopting new technologies and digital tools. Some have had to reprioritise their IT investments as a result. Indeed, 36% of SMBs surveyed plan to increase their IT budgets in four or more categories as a result of the pandemic.

SMBs’ IT investments are spread across a range of areas, with a particular focus on cloud services and cyber security. Many SMBs have had to change how they do business. For example, restaurants and retailers have had to shift to home delivery and contactless ordering. Vendors need to be able to identify who the super spenders are in the new working environment, and develop a marketing plan to address this segment.

US SMBs can be split into four unique market segments

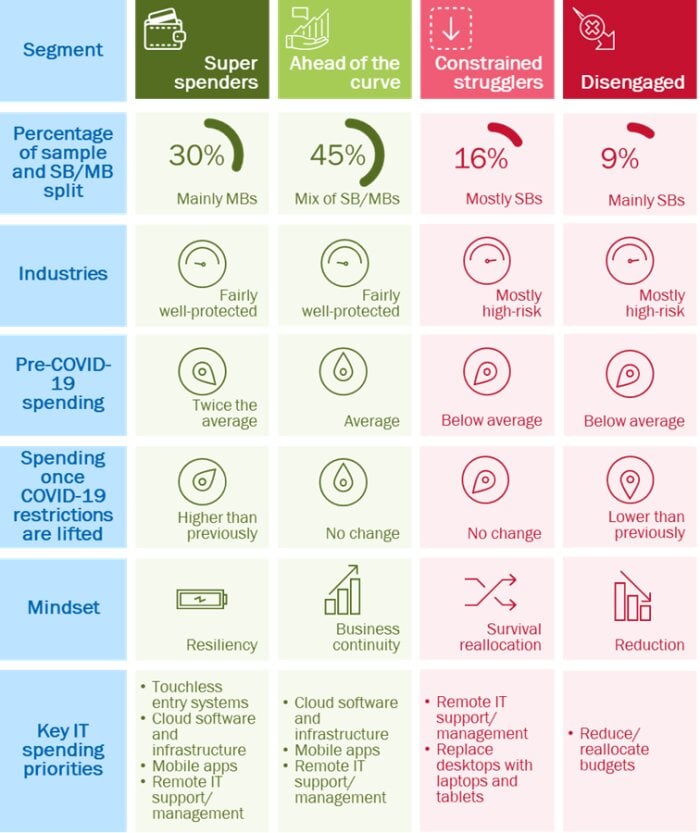

Our COVID-19-related research shows that US SMBs can be split into four unique market segments, each characterised by specific vertical industries, spending patterns, mindsets and IT priorities. We describe SMBs in each of the segments as super spenders, ahead of the curve, constrained strugglers or disengaged (Figure 1).

Figure 1: Segmentation of US SMBs, according to our COVID-19-related research

Source: Analysys Mason, 2020

The super spenders make up roughly one third of our sample. These businesses tend to be found in well-protected industries such as professional services. Their pre-COVID-19 IT expenditures were approximately twice the average, and their plans for spending once all COVID-19-related restrictions have been relaxed continue to be above average. Additionally, our segmentation shows that the super spender mindset is founded on agility and innovation, but the immediate strategic urgency has shifted towards enabling a hybrid workforce via the cloud.

The ahead of the curve segment consists of a mix of small businesses (SBs. 1–99 employees) and medium-sized businesses (MBs, 100–999 employees). The IT spend of these businesses is in line with the average of the whole sample. They are currently more focused on business continuity (for example, day-to-day operations) than the super spenders are. The super spenders and the ahead of the curve SMBs are the two priority segments for vendors.

The other two segments (constrained strugglers and disengaged SMBs) are mostly formed of SBs and, unlike the super spenders and the ahead of the curve SMBs, they tend to be more insular and focus on cost cutting and survival. Spending in most cases has been severely reduced by the COVID-19 pandemic. These businesses tend to be found in high-risk industries such as retail, construction and manufacturing.

Analysys Mason can help to identify the super spenders

The pandemic has had a significant effect on the SMB landscape. However, there are pockets of opportunity for vendors and operators. The super spenders and the ahead of the curve SMBs have specific IT needs and mindsets and it is important for vendors and operators to identify who they are.

Analysys Mason successfully assists clients in identifying high-value targets (such as super spenders) by deploying its SMB segmentation know-how. This approach offers strategic planners, marketers and sales executives the insights needed to pinpoint rich sales opportunities among companies that are often overlooked when considering just business size and vertical industry taxonomy.

We understand the complexities of the SMB ecosystem and how the pandemic is transforming this landscape. To book a consultation, please contact Bob Takacs.

Article (PDF)

DownloadAuthors

Li Lin

Senior AnalystRelated items

Report

SMB IT spending forecast report: driving business growth and increasing efficiency

Report

SMB IT spending forecast report: a new beginning

Article

SMBs in manufacturing and professional service industries are making big investments in CRM solutions