Fixed broadband services will be an important driver of SME revenue growth over the next 5 years

Fixed broadband services will account for almost 20% of operators’ retail revenue growth from small and medium-sized enterprises (SMEs), worldwide, between 2022 and 2027, contributing USD4.3 billion to an expected overall increase of USD23.1 billion (the bulk of the increase is driven by low-margin ICT services). Much of this growth will come from an increase in connections, with competitive pressure limiting ARPU growth below the level of inflation. Fixed–wireless access (FWA) poses an opportunity for operators to grow their number of SME broadband connections with some incremental use cases.

While IT services will deliver the most revenue growth for operators from SMEs, it is important that they prioritise investment in fixed broadband services. Fixed broadband is a foundational offering for SMEs and is also a higher-margin product compared to operators delivering IT services.

This article is based on Analysys Mason’s Operators business services for SMEs: worldwide forecast 2022–2027.

Fixed broadband services will contribute to almost 20% of operators’ retail revenue growth from SMEs between 2022 and 2027

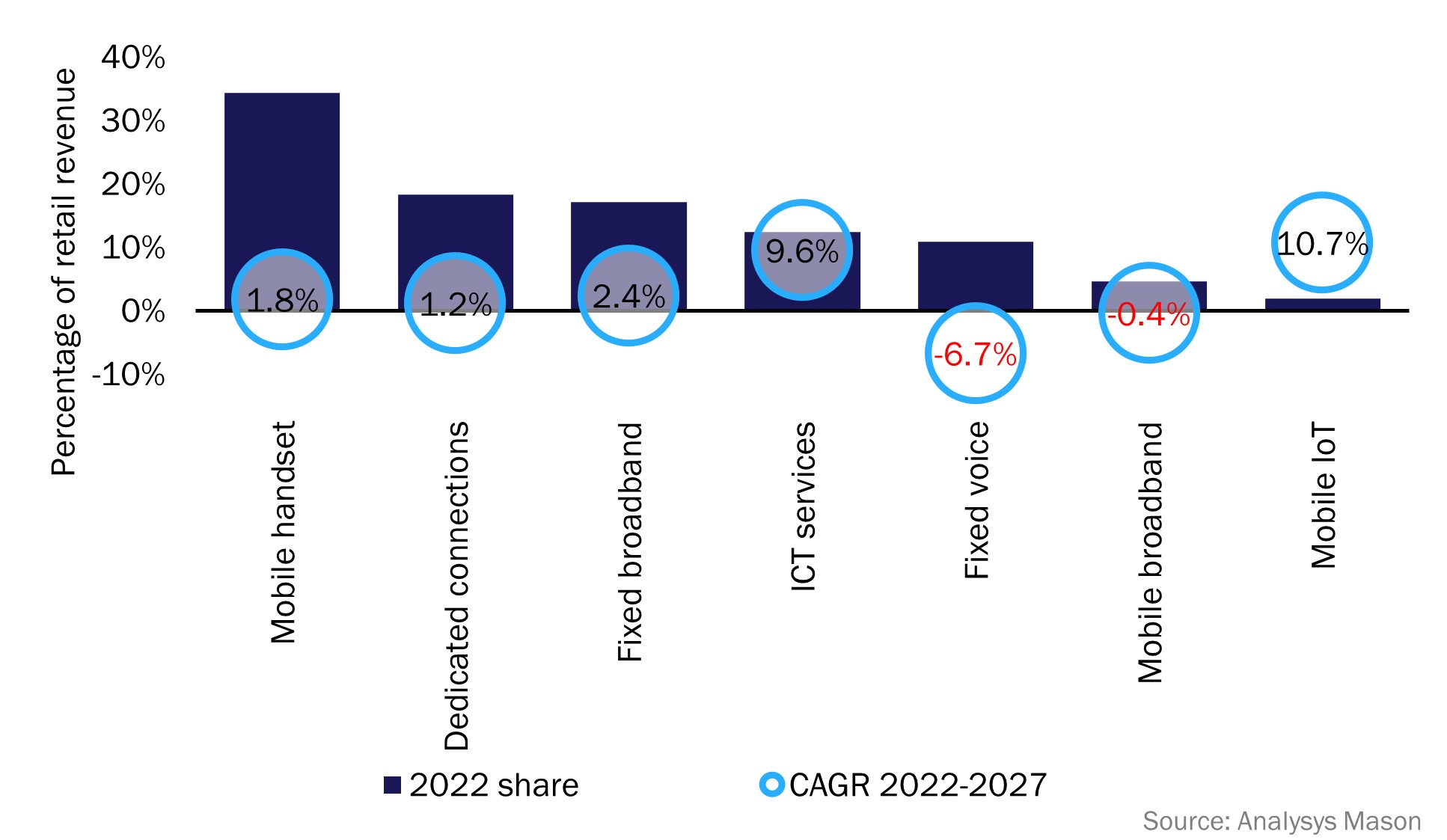

Operators’ retail revenue from SME services was estimated to be USD198 billion in 2022, rising to USD221 billion in 2027, at a CAGR of 2.2%. While the majority (62%) of the revenue increase will be generated by ICT services, USD4.3 billion of the USD23.1 billion increase will be generated by a rise in revenue from fixed broadband services. Fixed broadband services will be the third-fastest growing service type for operators after ICT services, as well as the small, but rapidly growing, IoT connectivity market, as seen in Figure 1. Fixed broadband revenue is expected to increase at a CAGR of 2.4% between 2022 and 2027.

Figure 1: Percentage of telecoms operators’ retail revenue from SMEs in 2022 and CAGR from 2022–2027 by service type, worldwide

Fixed broadband services from SMEs generated an estimated USD34.1 billion in retail revenue for operators in 2022, forecast to rise to USD38.5 billion by 2027. North America will account for the largest portion of this revenue by region. Growth rates in North America will also be strong, due to operators’ investment in extending the availability of high-speed services including FTTP and 5G FWA deployments. Other developed regions, such as Western Europe, will see more limited growth (CAGR of 1.1%), due to fibre coverage already being extensive in some countries. There are greater growth opportunities in emerging markets, such as emerging Asia–Pacific, where fixed broadband revenue is expected to grow at a CAGR of 5.3% as operators extend coverage to areas that are currently poorly served by fixed broadband. Fixed broadband revenue will grow at a CAGR of 7.0% in the region, excluding China (where fibre coverage is already almost ubiquitous).

Growth in broadband revenue will primarily be driven by an increase in the number of connections, which will rise from 114 million in 2022 to 131 million in 2027, at a CAGR of 2.8% worldwide. By contrast, competitive pressure means that ARPU is expected to remain fairly flat in most regions. Growth in ARPU will come mainly from migrating customers away from DSL connections to new FTTP connections or from upgrading them to higher-bandwidth services.

Fixed–wireless access poses an opportunity for operators to further extend their business broadband connections

There is limited reporting on the uptake of business fixed–wireless access, but where operators or regulators do report uptake, connections growth has been generally strong in recent years and at levels above other fixed broadband connection types. In particular, Verizon has seen extremely high adoption rates for its business FWA solution. It had 32 000 business FWA connections in 1Q 2021, rising to over 720 000 in 1Q 2023. The relative share of business connections compared to consumer connections is very high in the USA (business connections accounted for 9% of all connections at the end of 2022). Consumer connections are now growing more quickly, but this is mainly due to circumstances unique to the US market.

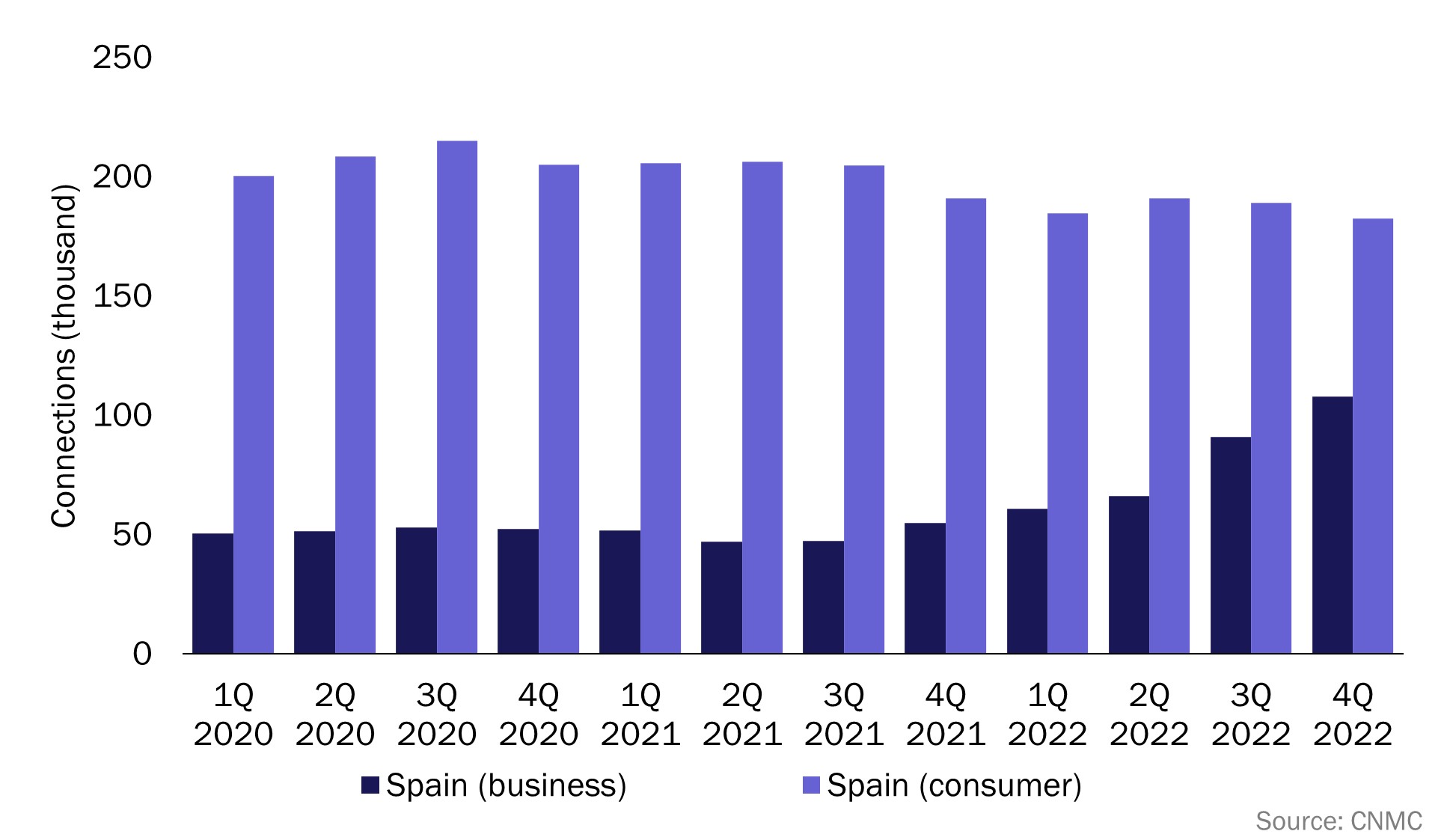

In other countries, business FWA connections are also growing faster than consumer FWA connections. Indeed, in Spain (Figure 2) business FWA connections have begun to rise rapidly since 4Q 2021, while consumer connections are beginning to fall. Spain has some of the most extensive fibre coverage in Europe, which explains the falling number of consumer FWA connections. However, business FWA can provide operators with opportunities beyond being a fibre substitute, such as connecting temporary or transient business sites. This is how Vodafone Spain is marketing its business FWA offering, with only a 3-month minimum contract commitment compared to 12 months for its business fibre offerings.

Figure 2: Number of FWA connections by segment, Spain, 1Q 2022–4Q 2022

Worldwide, we expect business FWA connections to increase at a CAGR of 7.5% between 2022 and 2027, notably higher than the overall growth of business broadband connections in the same period. Growth will be higher than average in emerging Asia–Pacific (CAGR of 18%) driven by Jio’s aggressive deployment in India. It will also be high in the Middle East and North Africa (CAGR of 14%) as mobile operators use FWA to enable them to play in highly regulated fixed markets. We also believe that business FWA represents operators with an opportunity for incremental revenue growth from higher-than-average connection growth as ARPU increases are going to remain limited.

Fixed broadband forms a basis to upsell other SME services

Despite IT services delivering faster absolute and relative revenue growth than fixed broadband services, it is important for operators to keep investing in fixed broadband services as it is a key offering for SME customers. Without a strong base of fixed broadband customers, there is limited opportunity to upsell IT services. The emergence of multiple fibre alternative network providers (altnets) in many countries presents challenges to more established operators, but we expect to see significant consolidation in the market over the next 2–3 years.

Additionally, the margins for delivering IT services tend to be relatively low, with fixed broadband margins being higher. With much of the world facing a harsh economic climate, focusing on higher margin services is already a priority for most operators.

Article (PDF)

DownloadAuthor