Software-defined satellites: is the GEO communications market at a breaking point?

The satellite communications market has experienced notable geostationary (GEO) satellite failures in 2023. For example, SES’s recent power failures on its mPower satellites have delayed its start-of-service to 2024, which is forcing a ‘reshaping’ of the constellation. Earlier in 2023, Viasat’s and Arcturus’s satellites also failed, setting these programmes back considerably. As low-Earth orbit (LEO) LEO constellations continue to be deployed, the pressures on GEO architectures and approaches will only rise. These developments will force industry players to ask the questions “is the GEO market doomed, and if not, how will it avoid that fate?”

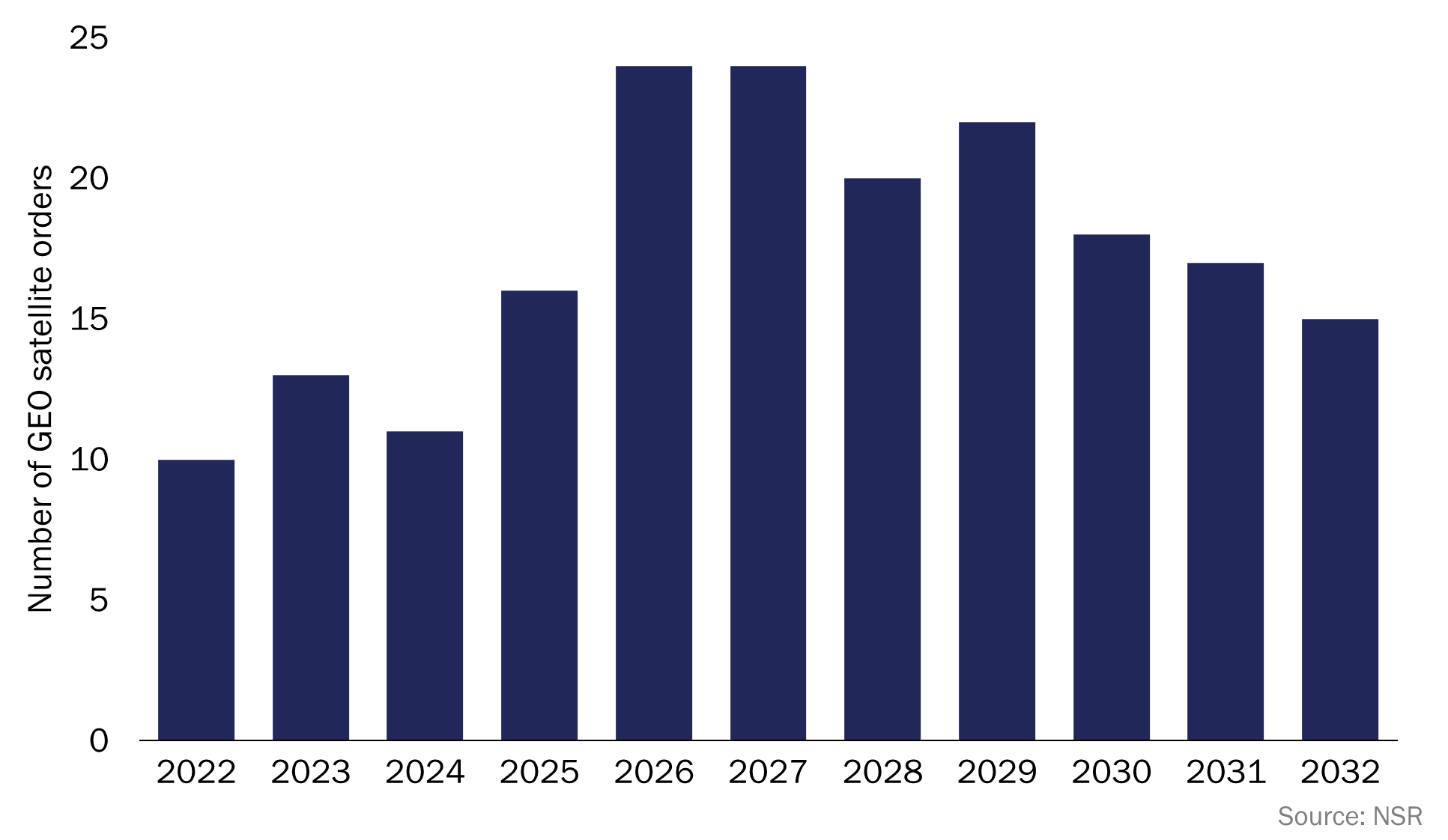

Figure 1: GEO communications software-defined orders forecast, worldwide, 2022–2032

Despite these recent failures, NSR’s Software-Defined Satellites, 3rd Edition forecasts strong growth in the GEO market, with orders growing from a hesitant 10 in 2022 to over 200 cumulative orders by 2032, averaging around 17 per year. The winning factor is GEO’s software-defined flexibility, which will drive up the number of orders: software-capable satellites will account for 90% of GEO orders and cumulative manufacturing revenue will reach USD31 billion by 2032. Flexibility will be the main priority for both supply and demand, which will be driven by improvements in the manufacturing of hardware-standard, software-driven satellites and the growing need for operational flexibility. However, while there has been significant progress on the build side of the business, with both prime (leading/established) and emerging manufacturers unveiling hardware-standardised, software-flexible platforms, the buy side of the GEO market is only now beginning to change.

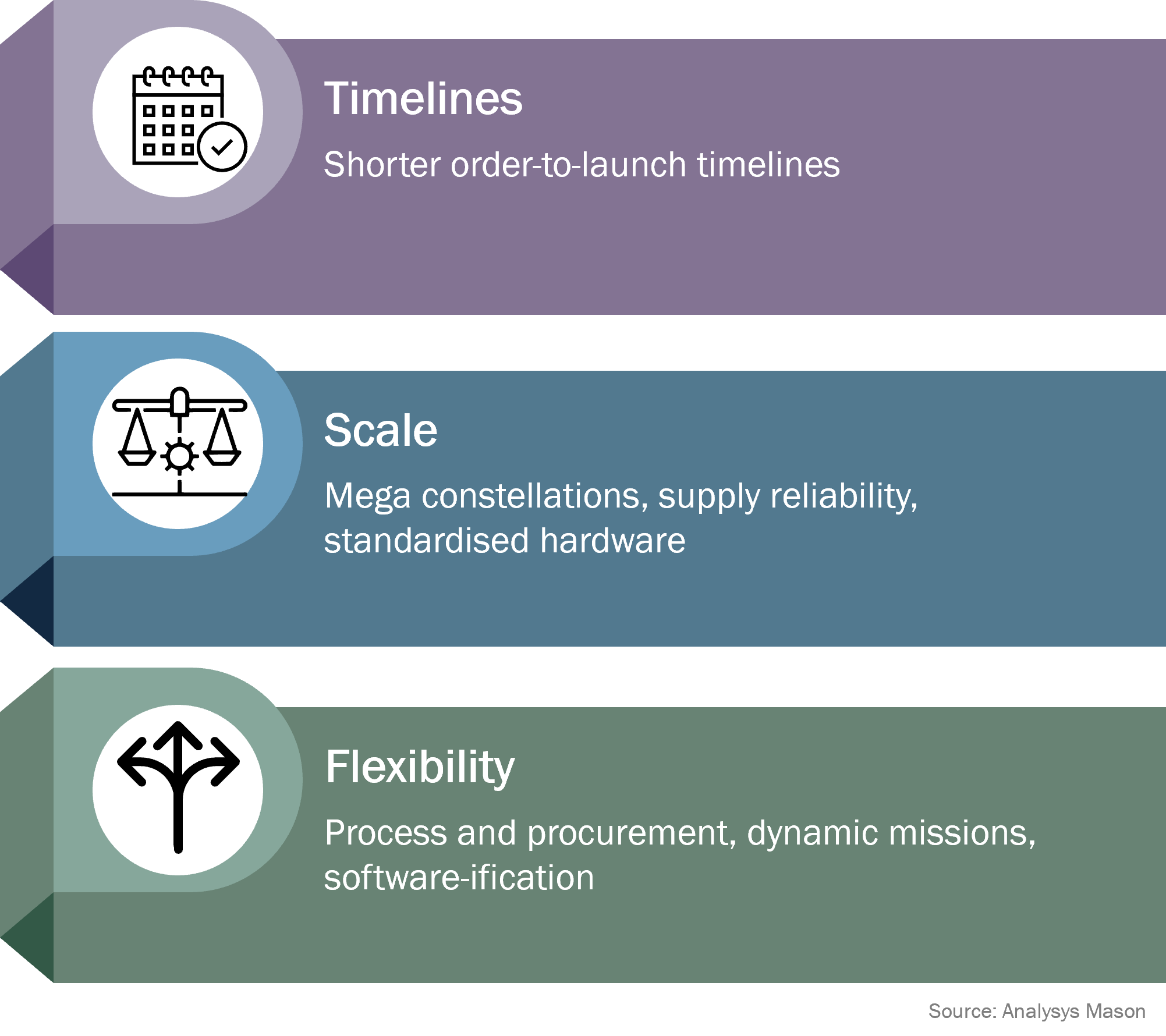

Figure 2: Market pressures on satellite manufacturing

Significant market pressures are causing GEO failures

While it is difficult to lay specific blame for the recent satellite failures, a large portion of it may simply be growing pains. Customers are demanding and designing more-complex networks. Software-flexible platforms are relatively new and the capabilities of GEO satellites will have to expand to meet the requirements for customers’ networks. In addition, there is increasing pressure for shorter order-to-launch timelines in response to growing competition from LEO satellite manufacturers, which may put GEO manufacturing under further strain. Despite this, flexible satellites are the future, and there will be more orders for more-flexible satellites over time. NSR’s report forecasts fully flexible satellites to account for 56% of all software-defined GEO satellite orders by 2032.

Procurement practices need to evolve to keep pace

To keep up with the fast-paced, diversified risk profile of LEO constellations, GEO satellites have become smaller and more flexible. The infrastructure-as-a-service (IaaS) model was initially developed to enable non-prime manufacturers to compete more aggressively, but it may now be the best way forward. Two examples point towards growing collaboration and flexibility between players in the value chain: Thaicom recently entered a partnership to launch a GEO satellite with Eutelsat over Asia, and SES’s capex and satellite deployment risk-sharing with Boeing together. Adaptation is key for evolution, and if GEO is to survive and thrive in an increasingly LEO-focused market, all aspects of the business will need to become more flexible.

The Bottom Line

The GEO satellite business needs to evolve, not just in terms of onboarding, but also in terms of procurement. Customers are demanding increasing coverage, complexity and post-launch adaptability, including the option to sell satellites to new buyers later in their lifetime. While software-defined satellites have helped to meet these demands, they will only be as flexible and successful as the procurement processes driving them.

Manufacturers must lean in to risk-and-capex sharing initiatives, ‘as-a-service’ models and new ways of buying satellites to compete with constellations and with each other. Manufacturers will need to adopt flexible procurement, buying and owning strategies to win customers, to open access to new markets and regions and to integrate GEO into the growing LEO-centric and terrestrially compatible satellite communications networks.

Article (PDF)

DownloadAuthor

Dallas Kasaboski

Principal Analyst, expert in space infrastructureRelated items

Podcast

In-orbit services: the next step to improving security in space

Article

Geopolitics and sovereignty are (once again) a driving force for the space industry

Article

GOVSATCOM 2025 reveals that security and resiliency are driving increasing demand for in-orbit services