Space travel and tourism: is suborbital ready for launch?

Virgin Galactic performed six suborbital spaceflights so far this year, increasing the hype surrounding the space travel market. One would think 2023 would be a turnaround year for Virgin Galactic, but announcements that it is laying off 18% of its current workforce and reducing flights of its VSS Unity to “concentrate on higher revenue opportunities” raise concerns about their health.

The suborbital market is very opportunistic, which only a few can afford, combining high and persistent demand, low competition, and high prices plus high capital expenditures. So, what does this mean for the suborbital space travel and tourism market? Is it ready to launch or is it a non-starter?

Demand keeps increasing

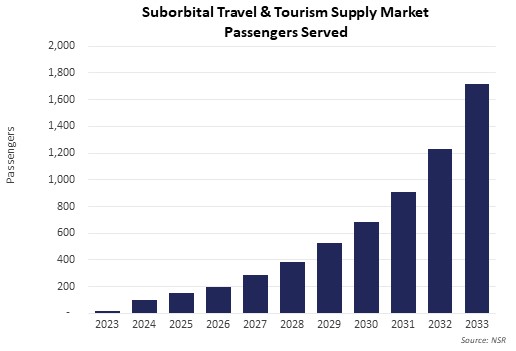

Indeed, demand does go up: NSR’s Space Travel & Tourism, 5th Edition report expects more than 6,000 cumulative passengers to be served by 2033. Despite a long story of delays, there is no slowing down of people wanting to go to the edge of space. In October, a female passenger flew to sub orbit holding a 17-year-old ticket, while Virgin Galactic has secured reservations for 800 passengers as of September, and World View has sold more than 1,200 tickets for its balloon-based vehicle.

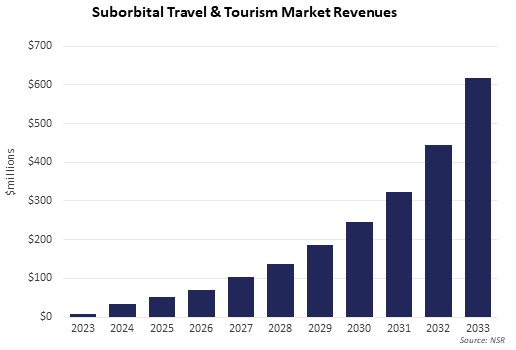

Despite this high market demand, cumulative revenues will only grow to around $2B by 2033, slowed by supply capability and technological readiness.

But restraints are intensifying

Safety measures play a key role when flying humans to space, translating into extensive testing, longer lead times and little spaceflight capacity. While demand for suborbital travel remains very high, even as tickets remain expensive, these safety factors limit the available flight capability, and thus the revenue opportunity significantly. Therefore, players who cannot generate enough revenue from ticket sales, fundraising, and billionaire funding, are forced to offer supplemental services to counter these market restraints.

Many players in the Space Travel & Tourism market are thus not putting all their efforts towards space tourism, and instead, offer additional services to generate revenue. Virgin Galactic eyes opportunities in research for private astronauts, as it can charge more than twice as much for a space tourism seat. PD Aerospace is also following a similar business, offering services on the fields of science, industry, service and Earth observation while World View has a strong focus on remote sensing payloads.

Furthermore, Virgin Galactic and Blue Origin, two of the key players in the suborbital market, are working on the development of their next-generation vehicles, which require a great amount of capital, contributing to higher charges. As such, the two companies might be forced to adapt their strategies to avoid delays of their Delta and New Glenn rockets in order to stay on schedule for a 2024 launch.

The Bottom Line

For years now the industry has been waiting for the suborbital market to take-off, but it hasn’t yet. In light of long lead times, it is reasonable for players in this market to expand their services into non-space-tourism to increase their revenue opportunities. However, considering the huge demand for space tourism, NSR does not expect these players to completely pivot away from it.

Suborbital space travel is restrained by supply and technological readiness, and it will take time to scale up launch capacity to serve even a fraction of the expectant demand. However, vehicle development takes years and considerable cost, so players seeking to stay afloat may need to widen their service portfolio to overcome these challenges and generate revenue, at least until the next generation of launch vehicles and the market are ready for launch.

Author