CSPs’ spending on telecoms-related OSS/BSS software and services will reach USD80 billion by 2028

Communication service providers’ (CSPs’) spending on OSS/BSS software and services increased by 5.5% year-on-year in 2022 as they continued to invest in 5G and cloud-native solutions. We expect the growth to slow down during the forecast period as 5G matures and because monetising 5G services will continue to be difficult. CSPs will continue to modernise their OSS/BSS during the early part of the forecast period to enable the next level of automation and customer experience that is required for 5G, and to support new monetisation opportunities. However, the dynamic will change closer to the end of the forecast period when cloud-related spending will increase because CSPs will be expanding the range of services that they offer beyond those in the traditional CSP domain.

CSPs’ spending on OSS/BSS software and services will grow at a CAGR of 5.0% to USD80 billion between 2022 and 2028

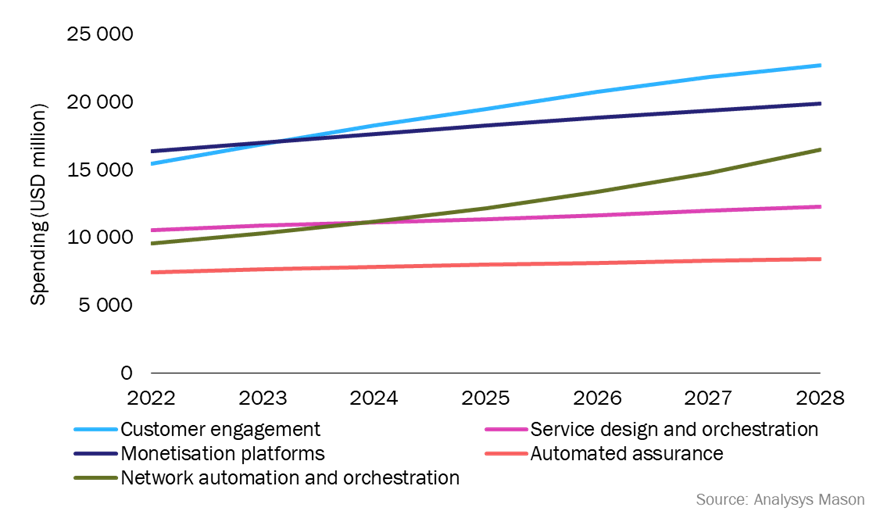

Figure 1 shows CSPs’ actual spend on OSS/BSS software and services in 2022, as well as the forecast for spending for 2023–2028. The data is split into five segments: automated assurance (AA), customer engagement (CE), monetisation platforms (MP), network automation and orchestration (NAO) and service design and orchestration (SDO).

Figure 1: CSPs’ spending on OSS/BSS software and services by segment, worldwide, 2022–2028

CSPs in North America (NA), Latin America (LATAM), Sub-Saharan Africa (SSA), the Middle East and North Africa (MENA) and emerging Asia–Pacific (EMAP) are expected to spend more than the worldwide average. The rapid growth in spending in EMAP will take place in all five OSS/BSS segments, but growth in spending in LATAM and SSA will be driven by the OSS market. CSPs in NA and Western Europe (WE) will continue to spend the most due to increasing investments in 5G standalone (SA) networks. However, the growth rate in WE is projected to lag behind that in NA because WE will be more vulnerable to the lasting effects of the energy crisis that has followed Russia’s invasion of Ukraine.

5G, SaaS and cloudification will be the main drivers of growth in CSPs’ spending on OSS/BSS software and services

As 5G technology advances, so do the expectation surrounding it. CSPs have moved beyond discussing the necessity of upgrading to 5G and are now focused on generating new revenue streams. 5G-related spend will continue increase rapidly in the first 1–3 years of the forecast period, with growth slowing down as technology starts to mature. Spending on cloud-based solutions will increase significantly during the forecast period, mainly because operators will need orchestrators that can automate and virtualise the functions and services that are new to CSPs. Spending on BSS has increased because cloud-based solutions are already prevalent in customer engagement systems, and CSPs’ spending patterns in OSS usually follow those of BSS.

- 5G. CSPs are making pivotal decisions about updating their OSS and BSS and related investments are expected to reach USD31 billion by 2028. 5G SA networks, with their new technology standards, complex new services with extended value chains and the management needed for partner channels, will help to drive new investments. In addition, CSPs also face the challenges of increasing operational efficiencies through hyper-automations of processes, and scaling the systems to cope with new service volumes. CSPs are expected to streamline and orchestrate all domains while improving data quality for all their OSS and BSS needs.

- The trend of OSS stack consolidation through vendor mergers and acquisitions is reducing the number of pure-play OSS/BSS providers. The need for efficient resource allocation, quick implementation and reduced integration costs will drive CSPs to invest in larger platform-based solutions that support multi-domain systems and all service types. Such solutions will enable an ecosystem of partners to operate with them. BSS will need to cater to new B2C, B2B, B2B2X and wholesale value chains. CSPs are expected to invest in solutions that give them the opportunity to generate revenue from services beyond those in the traditional telecoms market, which require new monetisation systems and partner management platforms.

- SaaS. Investment in OSS/BSS SaaS-based solutions is expected to grow at a CAGR of 18.4%, and the rate of growth will be highest in the MP, NAO and AA markets. CSPs’ perceptions of SaaS-based solutions, especially in the BSS sector, are changing, with SaaS becoming the preferred deployment model for customer engagement solutions. CSPs should prepare for more functions to be hosted on public or hybrid cloud environments because we predict that SaaS-based solutions will become common even for mission-critical functions in the near future. CSPs have adopted SaaS more slowly for OSS solutions, with the exception of charging and rating functions. CSPs have continued to be reluctant to use the SaaS deployment model for solutions that have mission-critical functions. However, we expect CSPs to increase their spending on SaaS as the scope of OSS widens to include more IT infrastructure.

- Cloudification. Hosted public cloud-related OSS/BSS spending is expected to reach USD18.9 billion by 2028, growing at a CAGR of 22.1%. As CSPs transition to 5G SA, the need for rapidly adaptable networks is driving spending on cloud computing solutions, including network orchestrators and systems of records that extend into IT. This shift requires significant changes, including the integration of OSS and BSS, industry-standard APIs, DevOps and AI/ML technologies. Public cloud-hosted solutions are already becoming prevalent in customer engagement, with more functions expected to be hosted on public clouds during the forecast period. Established telecoms vendors will have to evolve their stacks and prepare for increasing competition from public cloud providers, as they are well-positioned to offer additional functions that are relevant to the network domain.

Analysys Mason’s forecast reports provide high-quality market analysis

Our report, OSS/BSS software and services: worldwide forecast 2023–2028, provides data on CSPs’ spending on OSS/BSS software and services in 2022, as well as a forecast for spending between 2023 and 2028, with a detailed evaluation of product and professional services revenue and specific regional developments. It analyses the business environment and regional dynamics that influence the OSS/BSS market and provides key recommendations for vendors and operators, as well as the top-level outlook for five market segments.

Article (PDF)

DownloadAuthor

Alex Bilyi

AnalystRelated items

Framework report

Digital twins in telecoms: a framework for understanding the opportunity and ecosystem

Article

Agentic applications and no-code GenAI development are set to revolutionise operational systems

Strategy report

Network and service APIs: implications for CSPs’ operational systems