Successful standalone broadband operators will face increased pressure from converged operators over time

Most telecoms markets in Europe have been characterised by an increase in the number of operators that offer both fixed and mobile services. M&A has been a significant contributing factor to this, partly due to pressure caused by fixed–mobile convergence (FMC) bundling strategies. However, the fixed broadband market share of standalone operators is increasing in several countries in Europe (Figure 1). In this article, we examine the conditions that have enabled this trend and assess the implications for other countries.

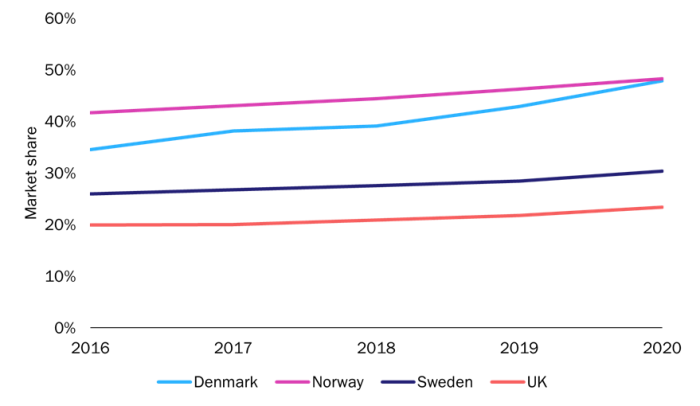

Figure 1: Fixed broadband subscriber market share, standalone fixed broadband operators, Denmark, Norway, Sweden and the UK, 2016–2020

Source: Analysys Mason, 2022

Standalone operators in Denmark, Norway, Sweden and the UK have increased their market shares

Altibox and smaller local standalone fibre operators have been growing their market share in Norway. Norway has little FTTP overbuild and Altibox, in particular, has achieved extremely high FTTP take-up rates. Altibox and its partners were very early investors in FTTP and these networks are not open to wholesale access. This, plus the very high FTTP roll-out costs in the country, has minimised the incentives for converged operators to offer FMC bundles because they have little chance of improving their fixed broadband market share without offering fibre.

However, operators that have observed the success of Altibox will increasingly look to compete in FTTP coverage areas, either via network overbuild or by lobbying for wholesale access. The converged operators have an opportunity to build market share by cross-selling fibre to their mobile bases. Altibox has anticipated this threat and has acquired MNO Ice, which has enabled it to offer FMC bundles. Altibox can thus defend itself against the cross-selling threat from MNOs while boosting its mobile market share by upselling mobile to its fibre base.

Incumbent TDC is the only infrastructure converged operator in Denmark. However, it has so far been unwilling to offer convergence benefits to its customers because its large fixed and mobile market shares make it potentially susceptible to revenue cannibalisation. MNOs Telia and Telenor both offer fixed broadband through wholesale access arrangements, but do not offer FMC benefits. Their ability to offer such discounts may be constrained by wholesale rates. Standalone operators Waoo! and Stofa have historically had exclusive access to utility companies’ FTTP networks. These networks typically do not overlap and TDC has been slow to roll out FTTP, so both Waoo! and Stofa have had a technology advantage over the incumbent in the areas in which they operate. Fixed standalone operators’ net additions represented over 200% of total market net additions between 2016 and 2020.

Convergence has so far been strategically unimportant in Denmark (as in Norway) because there are few cases of a converged player competing with a standalone FTTP player in areas where both have access to fibre. However, fibre network owners are increasingly striking deals with multiple operators for access to their networks as take-up growth rates slow. For example, Norlys now has relationships with every major fixed broadband provider (access was previously only available to its subsidiary Stofa). Convergence will therefore become more important as a means of generating net additions. Indeed, Stofa has already expressed its intention to acquire an MNO to provide a platform for FMC bundles.

FTTP roll-out in the UK has lagged behind that elsewhere in Europe, and the telecoms market in the country has been characterised by a lack of infrastructure convergence. This has allowed operators that rely on wholesale access (such as TalkTalk) to maintain their fixed broadband market shares, despite not having its own successful mobile arm. Small, locally focused fibre challengers such as Gigaclear and Hyperoptic have been the real winners in recent years. Operators outside of the traditional ‘big four’ accounted for over half of all net additions in the UK in 2020 and fibre challengers accounted for 40% of all FTTP connections in the UK in 4Q 2021. Their combined growth in terms of the number of subscribers is outstripping that of the major operators. The success of these smaller fibre operators is largely due to their local sales strategies and monopolies on FTTP connectivity in some areas. Challengers can undercut the FTTP tariffs of the major players and can even provide services that cost less than competitors’ FTTC tariffs.

The Virgin Media–O2 merger has increased the prevalence of convergence in the UK, but so far the operator has only offered bonuses to converged customers, rather than discounts. However, it may make its offers more competitive should challengers begin to gain greater scale. BT will also overbuild altnet FTTP with its own FTTP, and its renewed focus on convergence will present challenges for standalone players. The presence of converged operators is not currently limiting the growth of fibre challengers, but it does put a limit on growth potential going forward because it will be harder for challengers to win customers from the converged players in the future.

Wholesale FTTP access is widely available in Sweden. MNOs should therefore have an advantage over standalone fixed players because they can cross-sell fibre connectivity to their mobile bases. However, standalone fixed players have continually increased their subscriber market shares, even after FMC offers were launched in 2018, though such gains have been quite modest. Standalone operators are increasingly competing by undercutting the prices of converged operators. The EBITDA margins of the converged operators have also generally increased since 2018. This suggests that converged operators are willing to cede some market share rather than lowering prices. Converged operators are using FMC bonuses rather than discounts to keep ARPA high.

Standalone operators are having success, but this may change as markets develop

Standalone FTTP operators have generally had success in markets where there is little overlapping FTTP infrastructure. Converged operators will struggle to slow down the progress of these operators if they can only offer xDSL and fixed-wireless access because consumers that take fibre will rarely churn to slower technologies (the difference in churn intention between DSL and fibre subscribers is likely to be greater than the difference between FMC and non-FMC subscribers).1 However, standalone fibre operators will increasingly face network overbuild and/or wholesale regulation that will eliminate their network advantage and increase the threat from converged competitors. Nonetheless, there may continue to be a role for fibre-specialist ISPs who can target price-sensitive customers in wholesale-dominant markets such as Sweden.

1 For more information, see Analysys Mason’s Fixed broadband churn metrics.

Article (PDF)

DownloadRelated items

Report

Analysys Mason research and insights topics for 2026

Article

L4S and fixed network slicing could boost operators’ QoE, but only when applications actually need it

Forecast report

Worldwide: fixed–mobile convergence forecast 2025–2030