SpaceX Starlink and Amazon Kuiper look set to dominate the satellite connectivity market

New entrants SpaceX Starlink and Amazon Kuiper offer significant amounts of low-cost global satellite capacity with low latency and high bandwidth. In this article, we analyse the impact that this has on the opportunity for incumbent satellite operators and other new entrants to the satellite connectivity market.

An unprecedented increase in the amount of satellite capacity supply is underway

Satellite capacity is increasing more rapidly than ever before; SpaceX Starlink is leading the way and Amazon Kuiper will follow suit in a few years’ time. Starlink already offers over 102Tbit/s of capacity and Kuiper is expected to deliver over 117Tbit/s when fully deployed (Figure 1), so these two players together will provide approximately 279Tbit/s of capacity. This represents a significant increase in worldwide high-throughput satellite capacity from just 2.3Tbit/s in 2019, and further growth is expected because Starlink is launching new satellites every 4–5 days.

Figure 1: Details of the SpaceX Starlink and Amazon Kuiper constellation deployments

Starlink is also entering into new markets worldwide, such as the consumer, enterprise, backhaul, military and mobility markets, and is thus challenging incumbents in all areas of the value chain. Amazon Kuiper is expected to take a similar approach once launched. This will reduce the opportunity for both incumbents and new entrants.

Starlink will remain bandwidth-constrained in some regions, especially when serving both fixed and mobile users

Neither Starlink nor Kuiper will have sufficient bandwidth to serve the total addressable market (TAM). Constellations are, by their nature, worldwide and bandwidth-inefficient, especially when providing capacity for multiple applications. SpaceX has implemented inter-satellite links in Starlink Gen 2, but its capacity is still under-supplied in most high-traffic regions (such as the Caribbean and the USA) and over-supplied in most other locations, including most oceans (which represent around 70% of the Earth’s surface). The low prices for the Starlink Mini service in some countries in recent months highlight the low utilisation rates for Starlink services, thereby pointing towards an oversupply issue.

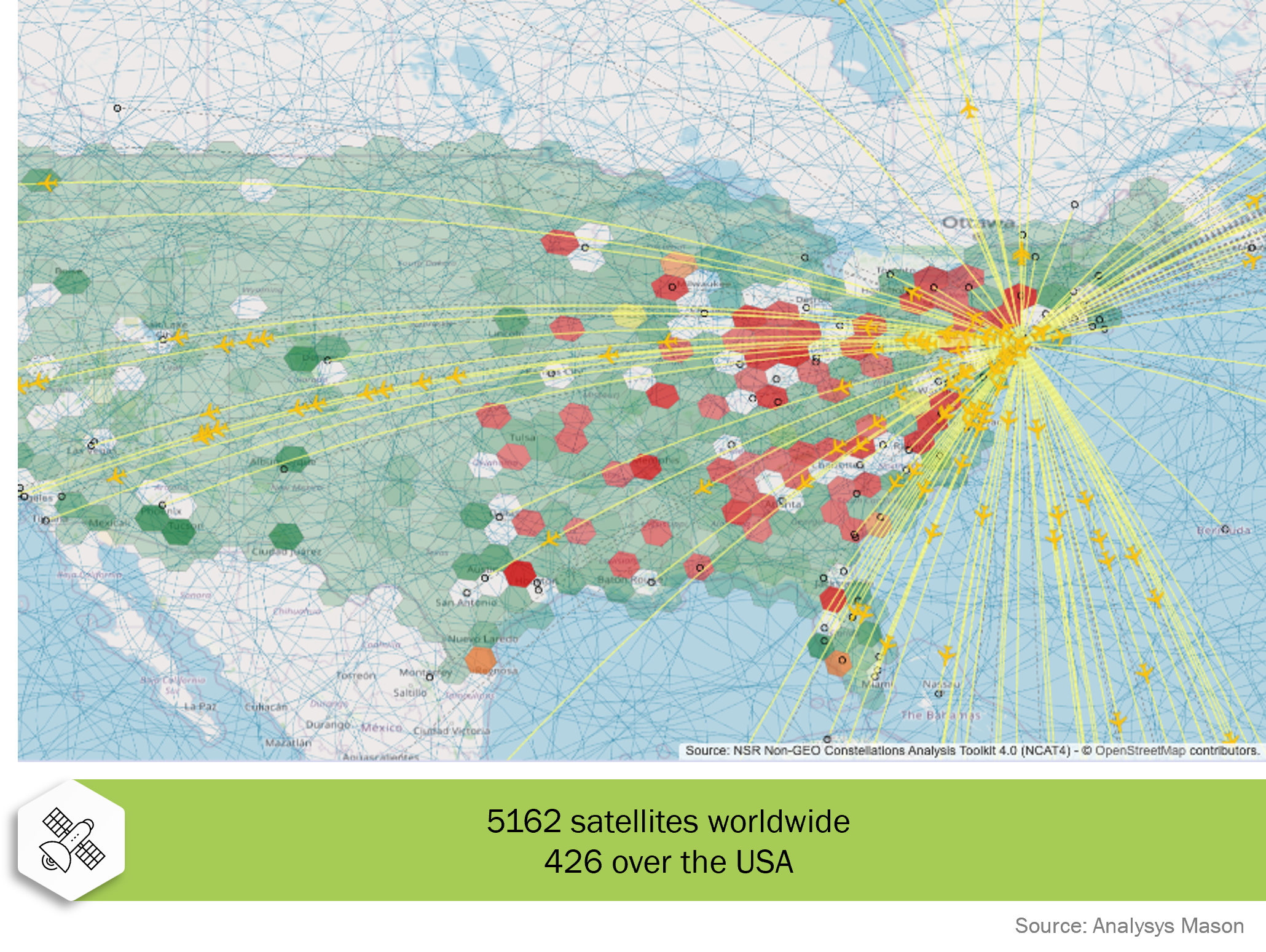

The simulation in Figure 2 shows how Starlink capacity is used for both fixed broadband and in-flight connectivity in the USA. The critical assumptions used in this analysis are as follows.

- In-flight connectivity (all outbound flights from JFK airport in the USA):

- 1300+ aircraft during February 2024 (78 aircraft flying over the USA at the time of the snapshot)

- 200Mbit/s per flying aircraft (dedicated).

- Fixed broadband:

- 1.4 million user terminals

- 300Mbit/s downstream

- oversubscription of 40-to-1.

Figure 2: SpaceX Starlink network simulation, USA

This simulation shows that there is congestion. Furthermore, this simulation is only for one airport and Starlink’s fixed subscribers in the USA; the situation becomes more problematic when multiple airports and airlines are added, as well as any other traffic type. It is therefore important for Starlink and Kuiper to assess supply, especially in high-value markets with supply constraints.

It is unclear whether incumbents will be able to challenge Starlink and Kuiper

Neither SpaceX Starlink nor Amazon Kuiper will be able to fully control the global satellite connectivity market, so incumbents must consider how they can compete. Analysys Mason expects that the nature of the competition from Starlink and Kuiper will vary with time, as follows.

- Short term (1–2 years from now). We expect that Starlink will continue to be competitive in all areas. It will also use new channels to expand its addressable market. For example, major satellite service providers in the maritime market such as KVH, Marlink and Speedcast will become Starlink resellers because they believe that their future is in the non-geostationary orbit (non-GEO) space, despite the lower associated margins. Their strategy is to balance reselling low-Earth orbit (LEO) services with providing their existing GEO offerings to achieve healthy revenue growth.

- Medium term (3–5 years from now). The launch of Kuiper will cause a step increase in global satellite capacity and will further disrupt the market. This will force prices further downwards, especially in over-supplied regions. As a result, most players will face challenges in terms of pricing pressure and churn across their customer base, so must develop a ‘plan B’. This could include vertical or horizontal consolidation, partnerships, multi-orbit strategies or entering new verticals such as Earth observation (EO).

- Long term (more than 5 years from now). The massive supply push will continue rapidly, but congestion will persist for some applications and in high-traffic regions.

There will be opportunity for incumbents to innovate, despite intense competition from SpaceX Starlink and Amazon Kuiper

Incumbents face an ever-increasing threat from Starlink and, eventually, Kuiper. Seemingly endless funding, vertical integration and leading-edge innovation make both companies formidable foes in the race to provide worldwide connectivity. However, an addressable market remains for satellite operators that can offer a compelling alternative. It is impossible to match the pace of SpaceX’s launches, but innovations such as multi-orbit offerings, flexible software-defined satellites and multi-mission payloads may ensure success for other players. For example, providing downstream know-how from Inmarsat via solutions such as NexusWave could be the right strategy. It is vital that incumbents consider options and take risks to ensure their share of the addressable market while SpaceX and, eventually, Amazon strengthen their market positions.

Article (PDF)

DownloadAuthor