Starlink-Telstra partnership: A new route to rural connectivity?

The rural connectivity game has officially changed. Australia’s Telstra telecommunication company has become the first telco to sign a mobile service agreement with Starlink. The partnership aims to offer voice-only and voice plus Starlink enabled broadband packages to rural customers in hard-to-reach locations. This addition of NGSO to Telco offerings is the realization of a major value proposition. For a rural connectivity market looking for the next big solution, this partnership allows rural customers speedy access to low latency connectivity with the additional benefits of increased support and telco services direct from provider. For the NGSO entity, the market opens wider, increasing visibility and opportunity to capture additional direct to household (or premise) subscribers. This is a strategy with impact.

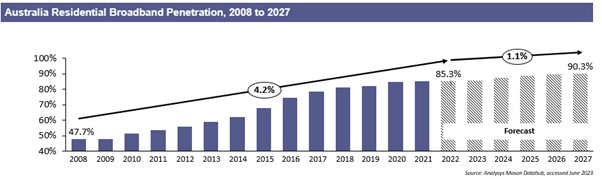

While assessing satellite industry approaches to increasing rural broadband connectivity, NSR’s recent Rural Broadband Connectivity report found Australia to be working towards reaching the final 15% of population over the next decade. Those involved in rural connectivity programs will be watching this partnership closely. Telstra’s announcement represents a huge opportunity to move the needle towards 100% without government action.

Australia’s Broadband Penetration at a Glance

The National Broadband Network (NBN) was first announced in 2009 using a mixture of connectivity options including satcom to achieve its goals. As current space-based assets age, discussions are now under way is to future of program satellite connectivity enabled access. The current urban vs. rural split sees nearly 88% in large cities have broadband access, approximately 83% in inner regional areas, 81% in outer regional zones, and 77% in remote parts of the country. NSR expects, with current plans, 90%+ connectivity will be achieved in the next 5 years as focus intensifies on connecting hard-to-reach locations.

The Telstra Plan

Details of the partnership’s plan are still emerging with pricing as-of-yet unconfirmed. This is Starlink’s first Australian reseller deal however, independently, Starlink has been active in Australia for the last year with a reported 120,00 customers already signed. Statements so far note that Telstra is now working with Starlink to deliver Low Earth Orbit (LEO) satellite connectivity to provide bundle packages of voice and fixed broadband services in remote and hard to reach places. Local tech support and professional installation (towards the end of 2023)will also increase deal attractiveness for customers hesitant to move away from broadband “norms”.

For rural connectivity, this “package deal” has wide reaching potential. Historically “Pure-play” consumer broadband connectivity struggles to capture low-ARPU customers. Telstra’s partnership pushes the power of “Starlink at scale". Helping to boost the number of CPE's that Starlink can distribute means the dish can 'get cheaper' which is better for end-users. Thus activity in Australia and similar countries sees Starlink able to lower prices for rural customers in developing regions where costing is a more significant restraint to connectivity.

The Opportunity

According to the Rural Broadband Connectivity: Challenges, Opportunities, and Case Studies for Satellite Connectivity report consumer broadband and social inclusion is set to account for nearly 38% of satellite connectivity revenues by 2031. Satellite connectivity service providers (S-CSP) looking to target Social Inclusion and Consumer Broadband Opportunities need to not only watch this space but start assessing potential strategies to compete.

Different countries are approaching the digital divide challenge from different angles. Each country has different targets of connectivity and throughput as seen in recent announcement by the United Kingdom and the United States. However, most targets are achievable within the current generation of GEO and NGSO system launches. For the Satellite Industry, initiatives such as ‘direct to household’ un-subsidized or lightly subsidized services will be critical to closing the digital divide. Regional specific pricing can support this plan, and satellite services combined with terrestrial providers are a key avenue to reach the last unconnected areas.

For regulators and rural broadband planners, Satellite services can be a critical solution in realizing immediate returns on connectivity. Starlink has demonstrated that the market is there, for the right price with rural customers looking to improve their own connectivity without significant government intervention. Further to this, Telstra and Starlink’s partnership offers increased public awareness, easier customer accessibility and an attractive bundled plan. This partnership positions both Telstra and Starlink as meeting customer needs and wants while growing revenues through the decade. This is a strategy worth assessing.

The Bottom Line

All business models and options should be on the table to solve rural broadband connectivity challenges. Rural Broadband Planners can benefit from space-based solutions. The Satellite Connectivity industry likewise should not wait for government subsidies or interventions. With many governments discussing the future of rural connectivity programs, the potential for fully commercial providers to capture rural broadband opportunity is developing. Early mover advantages are real as late-comers risk being trapped in battles to capture customer churn.

Author