Starlink Vs Kuiper - The FPA race has begun

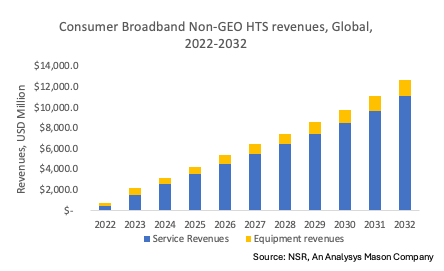

Massive Non-GEO HTS consumer broadband opportunities exists globally. At the moment, Starlink is driving growth with its ubiquitous solution, high speed low-latency offerings and aggressive pricing. Amazon’s Kuiper is also targeting the satellite internet market and is currently focused on the development of key technologies. According to NSR’s Consumer and Enterprise Broadband via Satellite, 22nd edition report, the Non-GEO HTS consumer broadband market is forecasted to aggregate to USD 72.3 billion in retail revenues during the 2022-2032 period. 85% of total revenues are attributed to services where Flat Panel Antenna (FPA) affordability and economics will be key to market acceptance and remain as one of the major success factors in this segment. Both Amazon’s Kuiper and SpaceX’s Starlink are racing to achieve the most affordable and customer centric FPAs to enable high bandwidth connections utilizing lower power and lower cost form factors.

Starlink’s shift in strategy

Starlink has been subsidizing FPA’s as part of its customer acquisition strategy. The company has been typically offering USD 499 - 599 for the starter kit but there are cases where aggressive pricing is offered to accelerate growth in its customer base such as EUR 199 in Spain and USD 99 in Nigeria. But in its recent announcement, Starlink stated that they are no longer absorbing losses in the satellite terminal vertical, achieving FPA manufacturing costs of USD 600 in 2023. This is clearly a major milestone for the business, improving the probability of success. Economies of scale, technological developments and margin offset from Starlink Premium & mobility customers (USD 2,500 – USD 150,000) are the key factors enabling this shift in strategic positioning.

Future of FPAs

Clearly Kuiper and Starlink are in the race of realizing the most affordable, low-profile form factor FPAs, enabling high bandwidth and low-latency connectivity. Project Kuiper announced that in 2020, they achieved the invention of a new antenna architecture and that has led to the design and development of three FPA variants, and offered a first look to the industry in March 2023:

- For residential and small business customers – The terminal measures 11-inch square and 1-inch thick. It weighs around five pounds without mounting brackets and is capable of delivering up to 400 Mbps. The company plans to price these terminals in the less than USD 400 range.

- Most affordable FPAs – FPAs size will be 7-inches and will weigh 1 Pound. The terminal will be capable of delivering speeds up to 100 Mbps.

- FPAs for enterprises, governments, and Telcos – These will measure 19 X 30 inches and will be capable of offering speeds up to 1Gbps.

In response, Starlink has designed and recently received FCC approval for its next-generation Starlink terminals, which feature lower profile form-factors compared to existing Starlink terminals:

- The first device measures 11.4 X 9.8 inches, which is a significant reduction from the first-generation Starlink dish.

- The second FPA offers high performance and measures 22.4 X 14.7 inches.

Clearly, the race between the two tech giants is leading to innovations in FPAs and NSR estimates that this will be a major success factor for price sensitive applications such as consumer broadband.

The Bottom Line

The intensifying competition between Starlink and Kuiper holds the promise of substantial benefits for end users, especially in the consumer broadband segment. As these industry giants continue their endeavours to reduce FPA costs and offer competitive pricing for high bandwidth low-latency services, consumers stand to gain significantly. With the satellite internet sector becoming more competitive, the potential outcome is the availability of more affordable and higher-quality broadband options for underserved and remote regions. This ongoing FPA race is not merely a technological rivalry, it represents a concerted effort to bring high-speed, low-latency broadband to consumers worldwide. Both companies are committed to lowering manufacturing costs & form factors and fostering competitive pricing strategies, aligning with the overarching goal of making satellite internet economically viable and accessible to a larger addressable market. And of course, such strategies should contribute to closing their respective business case as well, leading to profitability. In the end, the true winners in this competition will be the consumers who can access fast, reliable internet services, at attractive prices.

Achieving 2 million subscribers and cutting terminal costs from USD3,000 to USD600 within a three-year timeframe is a major feat for Starlink. It is only a matter of time before Starlink and Kuiper achieve parity in pricing with current GEO-HTS solutions. A strategic response from industry incumbents will need to be crafted and implemented ASAP.

Author