The valuation of stc pay at over USD1 billion shows the potential of mobile financial services in the Gulf region

08 December 2020 | Research

Article | PDF (3 pages) | Mobile Services| Middle East and Africa Metrics and Forecasts

Listen to or download the associated podcast

stc’s fintech subsidiary, stc pay, sold 10% of its shares to Western Union in November 2020 for USD133.3 million. This values the company at over USD1.3 billion, thereby making it the first fintech start-up in Saudi Arabia to reach ‘unicorn’ status. stc pay has managed to establish itself as the main digital payment and money transfer platform in the country in just 2 years, and it now has over 4.5 million users.

In this comment, we analyse the factors that have contributed to stc pay’s rapid growth in Saudi Arabia and discuss what operators in the region can learn from its success.

stc pay offers a mass-market payment platform that targets the tech-savvy population in Saudi Arabia

stc launched the stc pay mobile wallet in October 2018 as part of its revenue growth and diversification strategy and to contribute to the Saudi Vision 2030 development plan to improve financial inclusion and promote cashless payments.

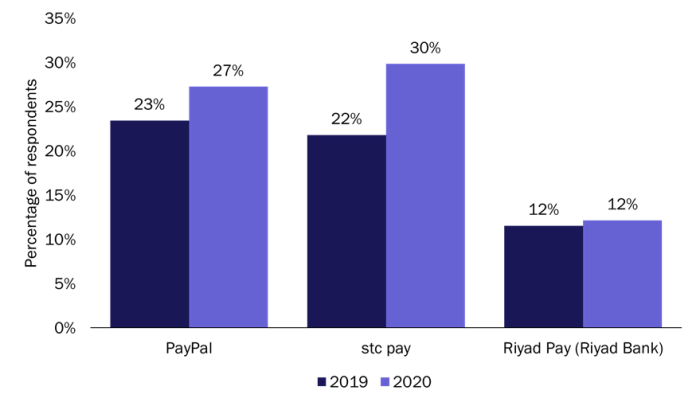

stc pay grew its user base from around 500 000 at the end of 2019 to 4.5 million at the end of October 2020. stc pay also became the top mobile money service used by smartphone users according to Analysys Mason’s Connected Consumer Survey, conducted between August and October 2020 (Figure 1).1

Figure 1: Penetration of the top three mobile money services in Saudi Arabia, 2019 and 2020

Source: Analysys Mason, 2020

stc pay differs from other operator-run mobile financial services in the Middle East (such as Ooredoo Money) in the following ways.

- The company runs as an independent entity. stc pay maintains close ties with its parent company in order to exchange technology know-how, but it has freedom regarding how it uses its resources and executes its strategy. This separation is required to comply with the Saudi Arabian Monetary Authority’s (SAMA’s) regulations.

- stc pay targets non-stc customers. stc pay was only available to stc customers at the time of launch, and only domestic wallet-to-wallet transfers were possible. It was later extended to non-stc customers and additional features were introduced.

- stc pay developed its payment platform in-house.2 stc pay was inspired by digital-first companies and adopted an agile software development approach in order to promote collaboration, flexibility and continuous improvement.

stc pay capitalised on the growing demand for digital payments by offering a well-designed app and developing an extensive partner network

The level of activity in the Saudi fintech industry has been increasing since 2019 thanks to a conducive regulatory environment and the emergence of a thriving ecosystem (including start-ups, investors, incubators, technology companies and universities). The number of active fintech companies increased from 20 in 2019 to 60 in 2020, and more than 10 companies were already at the commercialisation stage by October 2020. The number of smartphone payment transactions per month increased 6-fold year-on-year to 72.2 million by October 2020. 3

stc pay has benefitted from this favourable and supportive regulatory regime, as well as the strong financial backing from stc and its brand value. It has dominated the emerging fintech market thanks to its early-mover advantage, superior app experience (compared to those of traditional banks) and easy onboarding process for consumers and merchants. It has also focused on the following two high-growth segments.

- International money transfer services. stc pay targets the large expatriate population with a solution that is more convenient than using a money transfer centre, and has lower fees. Saudi Arabia is the second-largest remittance-sending nation in the world (after the USA) according to the World Bank.

- Cashless payments. stc pay has onboarded more than 13 000 merchants across Saudi Arabia (including major retailers, restaurants, petrol stations, supermarkets and coffee shops) to enable cashless payments. It has also partnered with food delivery companies.

stc pay has used social media channels extensively and has introduced a referral programme to promote its platform. It runs regular promotions (such as discounts on purchased goods and instant cashback offers) to grow its user base, increase app stickiness and drive spending.

stc pay plans to become a digital bank and will use its new capital to support its ambitious growth strategy both in Saudi Arabia and elsewhere

stc pay is now seeking to obtain a digital banking licence in order to offer a broader set of services. If it succeeds in securing such a licence, stc will inject a reported USD214 million into the company and Western Union (that owns 10% of the shares) will purchase an additional 5% stake for USD66.7 million. This new capital will help stc pay to support its long-term expansion plans in the Middle East. Indeed, it is currently in talks with regulators to get approval to operate in Kuwait and Bahrain, where stc has telecoms subsidiaries, as well as the UAE.

The acquisition of a banking licence will enable stc pay to differentiate itself from both local licensed fintech companies that offer similar services (such as AlinmaPay, BayanPay and Hala) and aspiring regional digital players (such as Noon and Careem). It will also enable the company to compete more effectively against traditional banks’ digital brands (such as Liv by ENBD and meem by GIB).

stc’s bet on fintech is paying off. This should encourage other operators in the Gulf region to take more risks to diversify their revenue. The regulations and competition in the financial services sector in other countries in the region may be less favourable than those in Saudi Arabia. However, operators could still learn from stc pay’s journey from being a wallet app provider to becoming a digital bank. For example, establishing a distinct operating entity showed commitment from senior management and a willingness to provide autonomy from the parent company. stc pay provides a superior user experience, targets important pain points of the population and integrates well with existing payment infrastructure. Operators could adapt these practices to their local context to unlock the full potential of mobile financial services in the region.

1 Analysys Mason’s Connected Consumer Survey 2020: digital services in the Middle East will be published in January 2021.

2 Fintech platform provider, Moven, partnered with stc pay in March 2020 to support the development of new services in Saudi Arabia. stc pay selected banking software company, Temenos, to help with the expansion into the Gulf region in October 2020.

3 SAMA Saudi Central Bank (2020), Monthly Statistics October 2020. Available at: https://www.sama.gov.sa/en-us/economicreports/pages/monthlystatistics.aspx.

Article (PDF)

Download