The global submarine fibre-optic telecoms cable market will grow between 2023 and 2029

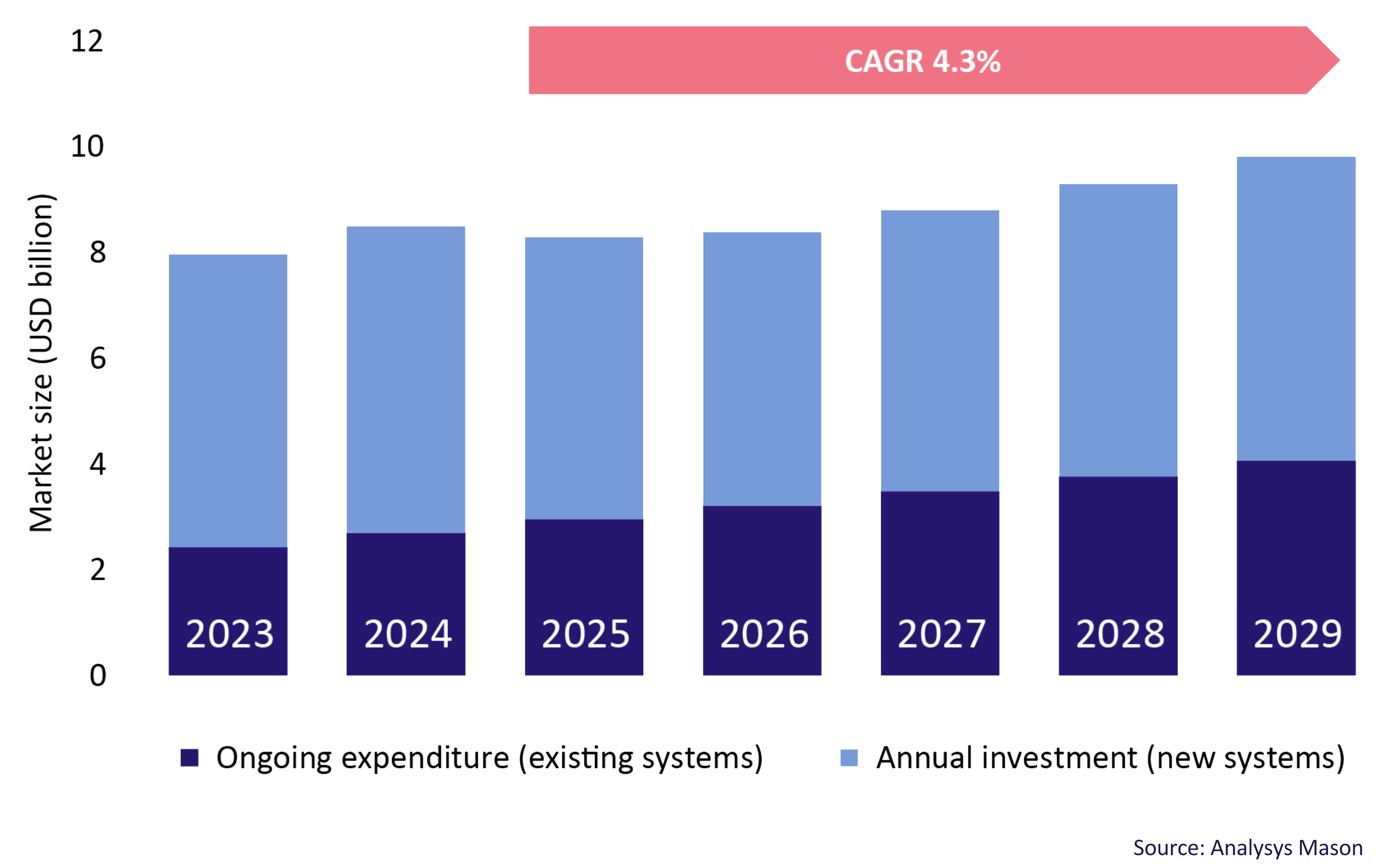

Analysys Mason’s Submarine cable market: worldwide forecast 2023–2029 shows that the levels of investment in, and expenditure on, submarine fibre-optic telecoms cables will continue to be high until at least 2029. Indeed, Figure 1 shows that the global submarine fibre-optic telecoms cable market (including investment in new systems and expenditure on operating and maintaining existing submarine cable systems) is expected to rise from USD7.96 billion in 2023 to USD9.80 billion by 2029.1

Figure 1: Submarine cable market investment and expenditure, worldwide

Our new forecast predicts that significant market growth will come from hyperscalers, which are investing in new routes to support the launch of services in new regions, or to maintain control of costs. Growth will also come from a continued increase in traffic on key routes, as well as efforts to improve the resiliency of international communications by increasing route diversity.

New cables will be deployed worldwide between 2024 and 2029, but the trans-Pacific and intra-Asia–Pacific routes will account for the largest share of deployed submarine cable (in terms of cable length) during this time.

Annual investment in new systems is expected to grow slowly between 2023 and 2029, but it is already at a recent high. Ongoing expenditure on the operation and maintenance of existing systems will rise rapidly as both the number of submarine cable systems and the cumulative length of all systems deployed increase. Indeed, ongoing expenditure will account for around 41% of the market by the end of 2029.

The implications of our research and insights for vendors are that:

- the ongoing demand for physical cable is robust

- cable capacity expansion will remain a market driver

- the submarine cable services segment is growing in importance.

Similarly, we believe that the main implications for investors are that:

- significant physical separation is required to ensure route diversity

- hyperscalers can alter the investment profile of submarine cables

- spare capacity will result in price pressure.

For more details or to discuss Analysys Mason’s submarine cable forecast further, contact Simon Sherrington, Research Director.

1 This excludes the value of services provided over telecoms submarine cables, which are not covered by these forecasts.

Submarine cable market: worldwide forecast 2023–2029

Author