Submarine cable launch numbers have surged since 2020 and another 68 cables are expected by 2027

According to the first edition of Analysys Mason’s Submarine cable tracker, 10 new submarine cables were launched in 2023, connecting a total of 21 countries across 7 regions.

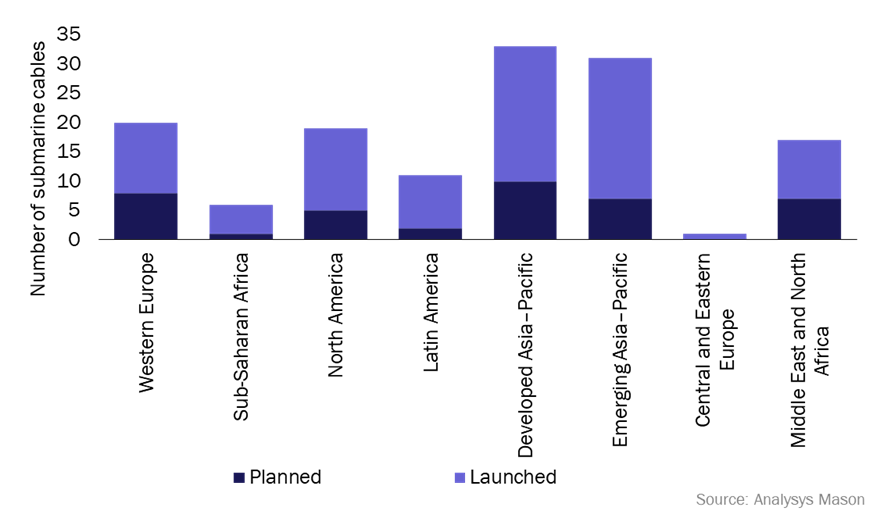

The total number of submarine cables has grown significantly since 2010, with accelerated deployment from 2020 onwards (Figure 1). More new submarine cables became operational in Western Europe between 2010 and 2023 than in any other region; 77 were launched in Western Europe during that period. Emerging Asia–Pacific ranked second, with 71 additional cables, followed by developed Asia–Pacific with 68. There were also 45 new cable launches in North America, 44 in the Middle East and North Africa, 30 in Sub-Saharan Africa, 28 in Latin America and 7 in Central and Eastern Europe.

Analysys Mason’s Submarine cable tracker details submarine cable investment from 2010 to February 2024. It includes data on 129 operational cables, 50 in deployment and 22 that are planned worldwide.

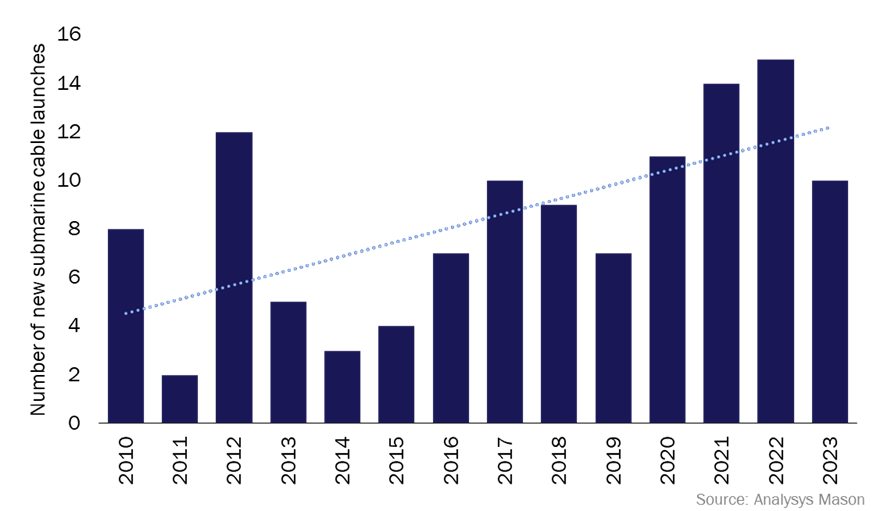

Figure 1: New submarine cable launches by launch date, 2010–2023

Submarine cable launches have increased since 2020 due to data traffic growth, hyperscaler investment and demands for resilience

The total number of submarine cable launches has increased steadily since 2010. Launch figures have intensified since 2020, with a total of 51 new cables entering service from 2020 onwards – over 25% of all cables launched since 2010. 45% of all submarine cable launches between 2020 and 2023 connected to Western Europe, with the number of operational cables in the region rising from 30 to 53. Launch figures in developed Asia–Pacific also increased rapidly, from 21 in 2020 to 33 in 2023, while those in emerging Asia–Pacific increased from 26 to 38.

The increase in the number of launches is due to a variety of reasons. The growth of the volume of data traffic worldwide has prompted investment in submarine cables. Investors are also targeting under-served regions to deliver capacity to countries with little or no prior international connectivity; and in some cases to give them access to new national markets. Investors are also adding cable routes to enable resilience through redundancy if cables are damaged or destroyed.

The entrance of hyperscalers to the submarine cable market is also driving this increase. Hyperscalers such as Amazon, Google, Meta and Microsoft have generated a huge amount of internet traffic in recent years and are moving to take greater control of the delivery of their services by investing in subsea cables. Analysys Mason expects at least 40 operational submarine cables to be owned or part-owned by hyperscalers by the end of 2026.

The longest submarine cables launched in the previous 2 years are as follows.

- Southern Cross NEXT. This cable was launched in 2022. It spans 15 840km between Australia, New Zealand, Fiji and the USA, and it has a total capacity of 72Tbit/s across 4 fibre pairs. The cable is owned by the Southern Cross Cables consortium, which includes Singtel, Spark, Telstra and Verizon, and cost USD350 million. The cable will complement the existing Southern Cross Cable Network.

- Equiano. Google’s Equiano cable was launched in 2023. The cable is approximately 15 000km in length and connects Portugal to South Africa. It has a total capacity of 144Tbit/s across 12 fibre pairs, and was built by Alcatel Submarine Networks (ASN). The cable incorporates optical switching at the fibre-pair level and spatial division multiplexing (SDM) technology for increased capacity.

- Pacific Light Cable Network (PLCN). The PLCN was launched in 2022 and is owned by Google, Meta and Pacific Light Data Communication (PLDC). The cable spans 12 800km between Hong Kong, the Philippines, Taiwan and the USA. TE SubCom supplied the optical equipment. The cable offers a total capacity of 120Tbit/s across 6 fibre pairs.

The number of submarine cable launches will continue to grow, with 68 new cables expected to be operational by 2027

It is likely that submarine cable launch figures will continue to grow in the coming years. As of February 2024, there are 47 submarine cables in deployment and an additional 21 are planned for launch over the next 3 years. Hyperscalers will continue to be a key driver of new launches and are involved in 24% of all planned or in-deployment projects.

Developed and emerging Asia–Pacific are the regions with the most planned/in deployment cables. This is driven by national governments and regional bodies (such as the Association of Southeast Asian Nations (ASEAN)) in the pursuit of digital economic and social development. National government-driven digital policies will also drive future cable launches in the Middle East and North Africa; 17 cables are planned or in deployment to connect the region with developed and emerging Asia–Pacific, Sub-Saharan Africa and Western Europe.

Figure 2: Submarine cables that are planned or launched, by region

The largest cables that are scheduled for launch in 2024 are as follows.

- 2Africa. This is expected to be the longest submarine cable in the world, spanning approximately 45 000km between 33 countries in emerging Asia–Pacific, the Middle East and North Africa, Sub-Saharan Africa and Western Europe. It will have a total capacity of 180Tbit/s across 16 fibre pairs. The cable is owned by Meta, China Mobile, Bayobab, Orange, center3 (stc Group), Telecom Egypt, Vodafone and WIOCC, with ASN as lead contractor.

- Bifrost. This is an open cable system that is expected to be launched in 2024. It will span over 15 000km, connecting the USA, Singapore, Guam, Indonesia, Mexico and the Philippines. The cable is owned by Meta, PT, Telin and Keppel T&T, with ASN as lead contractor. Keppel’s share of the cost of the cable is USD467 million.

- Echo. The Echo cable is owned by Google and Meta and is scheduled to be launched in 2024. The cable will connect the USA, Singapore, Guam, Indonesia and Palau, and its main trunk will span 16 026km. It will have a total capacity of 144Tbit/s and features 14 fibre pairs in its main trunk.

Article (PDF)

DownloadAuthor