Telefónica's 30% annual revenue from value-added services does not provide a blueprint for other operators

26 February 2024 | Research

Article | PDF (4 pages) | Fixed Services| Mobile Services| Global Telecoms Data and Financial KPIs| SME Services| Video, Gaming and Entertainment| Enterprise Services| Fixed–Mobile Convergence

Telefónica announced at its Capital Markets Day 2023 event that value-added services (VAS) beyond connectivity accounted for 30% of its revenue in the 9-month period to 3Q 2023. This represents an increase of 14 percentage points compared to 2016.1

Telecoms operators worldwide are eagerly looking for new services and products to sell to their customers on top of basic connectivity packages. In contrast with Telefónica’s enviable 30% share of revenue from VAS, many operators are finding it difficult to achieve even a 10% share of revenue from VAS.

Telefónica’s figure of 30% may be less impressive than it looks.

The services that likely contribute most to VAS revenue are video (not a new strategy) and IT provided via Telefónica Tech (a separate business unit established in 2019, which spent EUR1 billion on acquisitions between 2019 and 2023). Falling revenue from connectivity services also contributed to an increase in the VAS share of revenue.

It remains to be seen how (or if) other telecoms operators can successfully diversify their revenue beyond their core segment. The revenue picture from Telefónica’s VAS services may be more complicated than first appears.

Telefónica believes that non-connectivity services will be among the main drivers of revenue growth between 2023 and 2026

Telefónica Group forecasts that its revenue will grow by 1% each year between 2023 to 2026. Revenue in its consumer and business divisions (which accounts for 60% and 21%, respectively, of its revenue in the 9-month period to 3Q 2023) will grow at a CAGR of 1.5% and 5%, respectively, over the same period.

Both divisions share a similar strategy for driving revenue growth: Telefónica will continue to expand its operations beyond connectivity to enlarge the addressable market and upsell more services and products to its customers.

- Consumer division. It offers a broad range of non-traditional services in almost all its national subsidiaries, such as energy, entertainment, fintech, gaming, health and smart home services.

- Business division. It is building a wide portfolio of ICT services and solutions, powered by Telefónica Tech, mainly via acquisitions, such as 5G private networks, cloud, cyber security, IoT, AI & Big Data, network slicing and SD-WAN.

Telefónica believes that the addressable market within its footprint for non-connectivity services will be double the size of that for connectivity services in the 3-year period to 2026.2

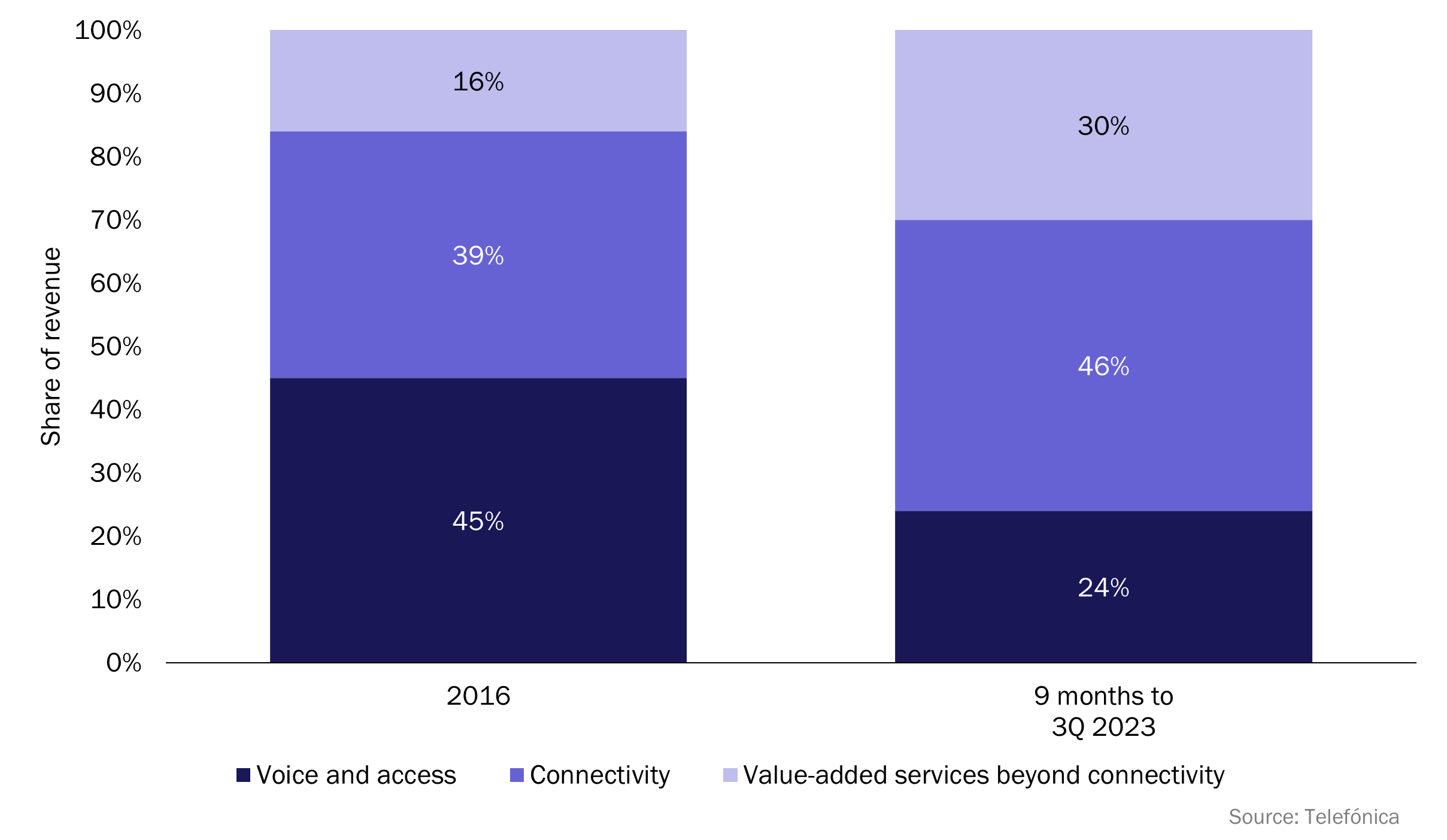

Figure 1 shows the change in Telefónica Group’s revenue mix from 2016 to 2023. 45% of its customers took at least one service beyond connectivity in 3Q 2023.3 This figure includes customers that take a TV service as part of their subscription.

Figure 1: Revenue by category, Telefónica Group, worldwide, 2016 and 9 months to 3Q 2023

Telefónica’s 30% revenue figure is less impressive upon close inspection

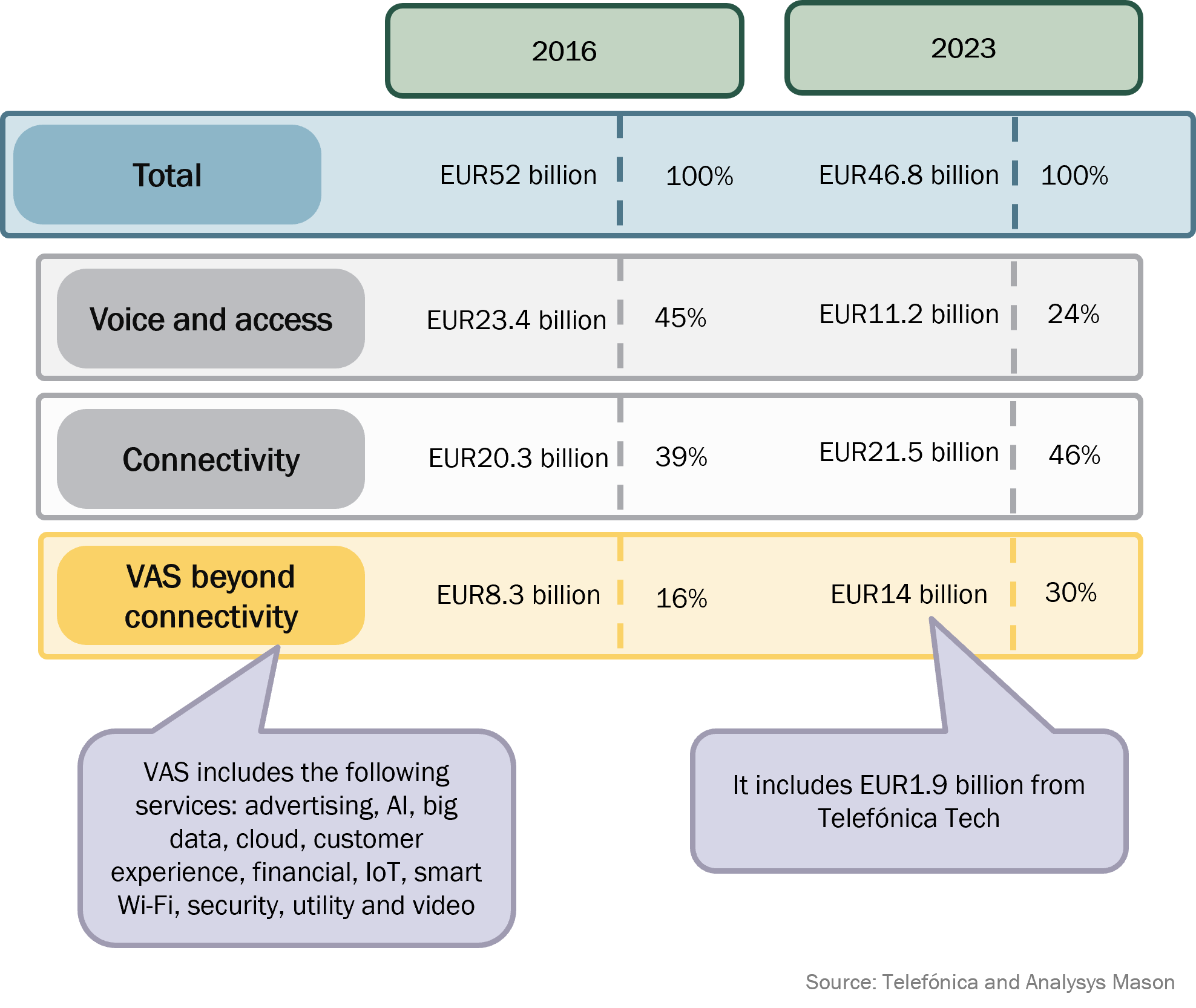

Figure 2 displays the breakdown of Telefónica’s revenue. The data sheds some light on the high share of revenue from VAS.

- The decline in core revenue (due to the group’s strategic decisions to sell operations in certain markets) played a role in the 14 percentage point increase in Telefónica’s share of VAS revenue.4 Changes in the UK also improved this figure – Telefónica has traded a stake in O2, a mobile-only operator with very little non-connectivity revenue, for a 50% share in Virgin Media, which has a large cable TV business.

- Telefónica Tech business unit generated EUR1.9 billion in 2023 (26.7% increase year-on-year). The increase in revenue is the result of organic growth and of the EUR1 billion acquisitions completed in fast growing segments between 2019 and 2023.5 Growth in VAS revenue would have been slower if we exclude Telefónica Tech.

- VAS beyond connectivity includes a wide range of services (as Figure 2 shows). Analysys Mason believes that video forms the main share of the EUR14 billion.

Figure 2: Breakdown of Telefónica group’s revenue by service (EUR billion), 2016 and 20236

Questions remain about how operators can diversify their revenue beyond connectivity

The strategy of selling services and products beyond connectivity is not new. Many telecoms operators worldwide aspire to become multi-service providers, to drive revenue growth beyond simply increasing tariffs. We expect that this will remain a key trend to monitor in 2024.

The data released by Telefónica leaves open questions about operators’ strategies for diversifying revenue. It does not necessarily provide a case study that other operators can replicate.

- What are the costs associated with launching services and products beyond connectivity? Telefónica entered new markets, either by establishing joint ventures or with acquisitions. Some acquisitions completed by Telefónica Tech have high multiples (around 13x EV/EBITDA) – justified by the acquisitions of companies in fast revenue growing segments.7

- What are the margins on VAS beyond connectivity? How do they compare with the margins that operators have on connectivity services?> VAS are typically offered via partnerships (a capex-light approach), in contrast to capex-intensive telecoms services. This suggests that VAS have slimmer margins than connectivity services. Operators should consider margins on VAS in terms of customer lifetime, rather than on a product-by-product basis.

- How can operators (successfully) compete with the established players in the non-core segments? The key risk is that operators invest (heavily) to compete with established operators in new market segments, highly competitive and with lower margins compared to their core business.

1 Telefónica (8 November 2020), Capital Markets Day 2023 (see slide 14).

2 Telefónica (8 November 2023), Capital Markets Day 2023 (see slide 29). The data refers to the consumer, enterprise and API-based market segments.

3 This number refers to the entire group, including the UK.

4 Analysys Mason estimates that the combined revenue from voice, access and connectivity services declined by 25% to EUR32.7 billion from 2016 to 2023.

5 Telefónica Tech business unit’s revenue increased by 26.7% year-on-year in 2023; if we exclude M&As, revenue increased by 21.7% over the same period. In 2022, revenue increased by 57% year-on-year, “thanks to the consistent revenue performance at constant perimeter (~+27% year-on-year) and strategic value-accretive acquisitions” (Telefónica, 2022 annual report, page 24).

6 The data for 2023 includes 50% of Virgin Media–O2 joint-venture results. Analysys Mason estimated the revenue split by category (voice and access, connectivity and VAS beyond connectivity) for 2023 using the proportion of each revenue category reported for the nine-month period to 3Q 2023.

7 Telefónica Tech bought Cancom UK&I (in 2021), Incremental (in 2022) and BE-terna (in 2022). It valued the companies with a multiple of 13.5x, 14.2x and 13.7x EV/EBITDA, respectively. Telefónica was valued at around 6x EV/EBITDA in 2022.

Article (PDF)

DownloadAuthor