The Bright Future of Optical Satcom

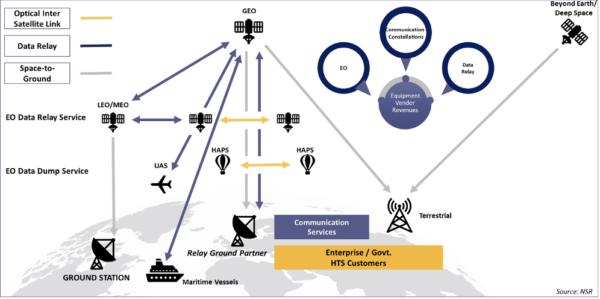

In the race to meet the soaring demand for high-volume, high-speed data transmission, satellite operators and connectivity service providers are on an uphill battle. Traditional radio frequency (RF) communications are starting to fall short, hindered by limited data downlink capacity and susceptibility to cyber threats. Enter optical satellite communications (OSCs), a compelling solution that bridges the gap between demand and RF limitations. With exceptional data transmission rates, bandwidth, low latency, and immunity to electromagnetic interference, optical systems are revolutionizing the Satcom and Earth Observation market. So, what is the demand for optical communication solutions in Earth Observation (EO) and Satcom? What are the likely areas of expansion for optical Satcom?

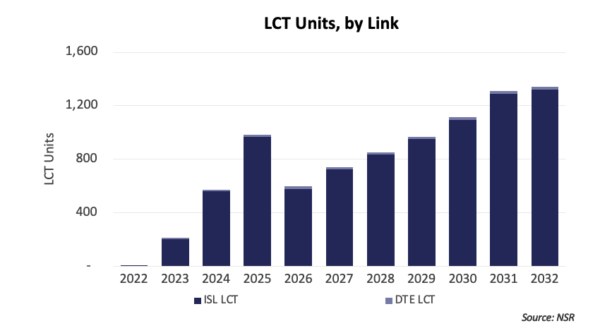

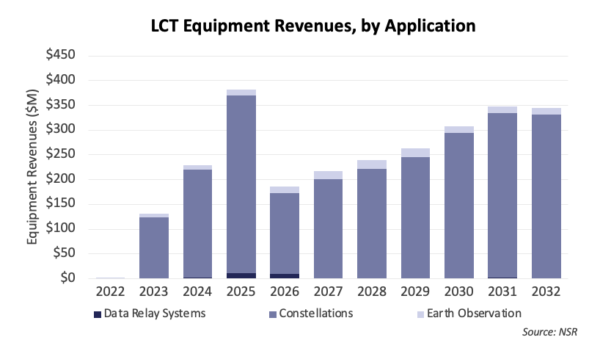

The optical communications market is poised for remarkable growth with the second-generation satellites equipped with Inter-Satellite Links (ISL). As network capabilities expand, the advantages of optical Satcom technology shine, particularly for ISLs connectivity. The non-geostationary (Non-GEO) communications constellations are propelling the demand for both ISLs and direct-to-Earth (DTE) Laser Communication Terminals (LCTs). In fact, NSR’s Optical Satellite Communications, 5th Edition report forecasts the launch of 8,600+ Laser Communication Terminals (LCTs) across EO and Satcom applications in the next decade. The lion’s share of these figures stems from commercial low Earth orbit (LEO) constellations, generating a cumulative equipment revenue of $2.6 billion between 2022 and 2032 and ISLs drive a staggering 98% of this opportunity.

The initial surge in demand is driven by government/military players and the war in Russia, and subsequent cyber-attacks on satellites have heightened the importance of security for commercial and government/military players. Optical Satellite Communications offers anti-jamming and interference-resistant properties for data security. And LCTs are a suitable solution for handling increasing data volumes with higher resolution imagery and video, requiring less power and offering cost efficiency compared to RF systems. The lack of spectrum licensing reduces setup costs and deployment timelines.

However, most LCT demand comes from closed markets like Starlink and (potentially) Kuiper, and high costs as well as lack of international standards hinder wider adoption. EO operators prefer integrating innovations into RF systems at a lower price. Thus, communication constellations' demand for ISLs takes the lead, followed by EO applications. But fortunately, with the advantages offered by optical satcom, the utilisation of LCTs is expanding beyond EO and Satcom applications.

Facilitating Aerial Operations

Optical satcom plays a vital role in advancing UAV operations, enabling real-time data transmission, high-definition video streaming, real-time navigation, and remote-control capabilities beyond-line-of-sight (BLOS). By leveraging optical satcom, UAV operators can extend the operational range of UAVs, enhance their autonomy, and ensure reliable and secure communication in challenging environments. The ability to transmit large volumes of data at high speeds enables data collection, monitor critical infrastructure, and optimize operations. LCT manufacturers are expanding their product portfolio to offer solutions for both for military and commercial airborne applications, extending the use cases where space-to-air, air-to-space and air-to-air, air-to-ground terminals can be utilised. General Atomics Aeronautical Systems (GA-ASI) successfully completed demonstration of air-to-air capability for military applications. This communication solution can be coupled with their existing product line including the MQ-9A Reaper, MQ-1C Gray Eagle 25M, MQ-9B SkyGuardian and SeaGuardian.

LCTs possess alluring features essential for various applications, including anti-jamming capabilities, immunity to interference, high security, and low probability of detection. These attributes make LCTs indispensable for intelligence, surveillance, and reconnaissance (ISR), broadband provisioning, and other high-altitude operations. Consequently, initial adoption and demand will be predominantly driven by the military segment to establish crosslink across other aircrafts, maritime vessels, and space systems.

In addition, LCT adoption is being driven by technology development programs initiated by government bodies and space agencies. Notably, Airbus and VDL group have signed partnership agreement for prototype and first flight test of “UltraAir” laser terminal in 2024, supported by ESA’s Scylight Programme and “NxtGen Hightech” programme. Furthermore, the United States Air Force has awarded Space Micro an AFWERX SBIR contract to develop an air-to-space laser communications pod capable of transmitting data rates up to 10 Gbps on USAF aircraft. The growth and widespread adoption of optical communications hinges upon the seamless integration of this technology onto airborne platforms and cost-effectiveness of air terminals compared to their space-qualified counterparts is expected to facilitate faster market take-up once technological reliability is proven.

However, challenges such as high-power requirements, atmospheric scintillation due to aircraft jittering or atmospheric turbulence could limit adoption of LCTs. The demand for LCTs in the military market also remains largely undisclosed due to the classified nature of many military programs. This makes it challenging to gauge the exact potential of this market. However, the adoption of LCTs in commercial airborne platforms is expected to experience substantial growth in the long-term.

Lasers Beyond Earth Orbit

The potential of optical communication terminals to achieve higher data rates has the power to revolutionize scientific missions, especially as the amount of data being collected continues to grow exponentially. The success of missions like the Laser Communications Relay Demonstration (LCRD) and the TeraByte InfraRed Delivery (TBIRD) payload on-board the pathfinder missions has already showcased the advantages of optical links for space-to-ground applications. These achievements are paving the way for further experimentation and adoption of optical communication in deep space missions, such as the upcoming Psyche Spacecraft.

For transmitting large volumes of data, space stations will heavily rely on optical communications. Nevertheless, the capacity of local edge processing nodes will impose limitations on the overall amount of data that can be downlinked. NASA is leading the way with the scheduled launch of the Integrated LCRD Low-Earth Orbit User Modem and Amplifier Terminal (ILLUMA-T) which will leverage laser communication between the International Space Station (ISS), the LCRD in-orbit system, and the ground. It is expected that commercial space stations will follow suit once operational.

Furthermore, the applications of optical terminals extend beyond the ISS and into space missions. The burgeoning lunar market is expected to drive the demand for optical terminals in cislunar communications. Missions like Orion Artemis II will utilize the Optical Communications System (O2O) onboard, enabling data rates of up to 260 Mbps, a step change for current Kbps or low Mbps rates seen in lunar missions.

With an anticipated surge in lunar missions in the next decade, there is a growing demand for Laser Communication Terminal (LCT) equipment manufacturers. Additionally, the increased utilization of on-board sensors will generate vast amounts of data, necessitating faster transfer rates to handle the influx of information. Companies like Warspace are inching towards their roadmap for data relay services to the moon, Mars, and beyond as missions to these destinations continue to proliferate.

Unlike RF antennas, which prove cumbersome and costly for missions beyond Earth, such as lunar communications, ground service providers are expected to prefer Optical Ground Stations (OGS) for space-ground applications. OGS offer a more cost-effective and efficient alternative for establishing ground networks.

Given the longer development timelines and higher terminal costs associated with non-recurring engineering (NRE) expenses, space agencies will initially serve as the primary customers for missions beyond Earth. The services market will outweigh manufacturing, given the frequency and volume of data downlinked, as well as the premium costs associated with the service compared to Earth-based space-ground communications.

The Bottom Line

The adoption of OSC technology is witnessing a rapid surge, with the market poised for steady growth beyond 2025. This transition marks a shift from an equipment-centric phase to an emergent, robust ecosystem. Government and military organizations are particularly drawn to the high data rates and anti-jamming capabilities of optical equipment, leading to increased adoption of LCTs by these key players. The demand is primarily concentrated in the ISLs segment, driven by communication constellations with large volumes of data transfer.

In the short term, the government and military segment will act as key drivers, setting standards, engaging in commercial and R&D contracts, and accelerating the market towards commercialization. As optical Satcom technology matures and associated challenges are mitigated, it has a bright future that will unlock a plethora of use cases across aviation, maritime, ISS, and beyond Earth applications.

Author

Prachi Kawade

Senior Analyst, expert in space and satelliteRelated items

Article

D2D services must balance capabilities, expectations and willingness to pay

Predictions

Predictions for the space industry in 2026

Podcast

Military satcom and commercial capacity integration: why secure orchestration matters