Telecoms operators can learn how to succeed in the UCaaS market from players such as Dstny and Enreach

15 May 2024 | Research

Article | PDF (3 pages) | SME Services| Enterprise Services

The European unified communications-as-a-service (UCaaS) market is expected to grow at a CAGR of 8% between 2023 and 2028. Some specialist players such as Dstny and Enreach have been experiencing much faster revenue growth than this, albeit largely via acquisitions. The market is evolving rapidly and there is much that operators can learn from these players.

In this article, we provide an overview of the European UCaaS market with a focus on the strategies of specialist UCaaS players, Dstny, Enreach and Gamma.

European UCaaS providers’ revenue has grown rapidly, often thanks to acquisitions

The European UCaaS market has grown rapidly in the last few years, partly due to the heightened demand for remote working since 2020. Many of the major providers such as Microsoft, Cisco and Zoom are global players, but several Europe-based players have also emerged and are capturing a significant market share, especially in the small and medium-sized (SME) segment. These European players provide proprietary solutions and also support integrations with third-party offerings.

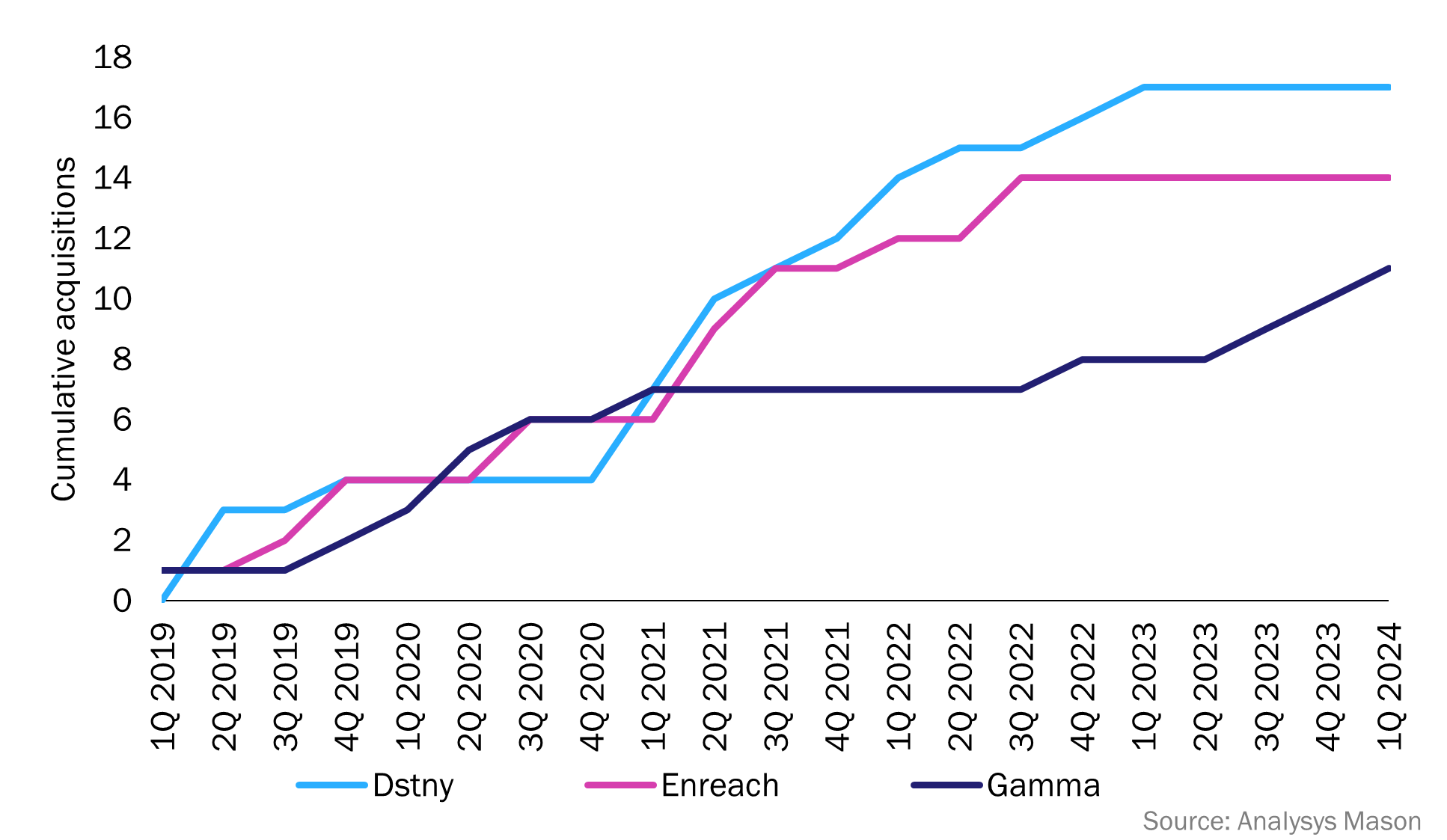

Dstny and Enreach are two such players. They are both active in multiple European countries and have portfolios that include fixed and mobile connectivity, contact centre services, analytics and third-party integrations. Gamma Communications (Gamma) is similar; it has a presence in multiple countries, but its home market (the UK) accounted for 85% of revenue in 2023. All three of these players have engaged in multiple acquisitions (Figure 1).

Figure 1: Cumulative number of acquisitions for selected European UCaaS providers, 1Q 2019–1Q 2024

The acquisitions have added scale in all three cases. Dstny’s revenue reached EUR255 million in 2023 and Gamma’s reached GBP522 million (EUR600 million). Enreach does not report its revenue but has 2.5 million users. The three companies have reached a combined active user base of more than 7 million for their proprietary solutions. This is a long way behind RingCentral (revenue of around EUR2 billion) or Zoom (revenue of over EUR4 billion), but all five of these companies have a similar share of the European SME market.

Dstny, Enreach and Gamma have also used acquisitions to extend their capabilities and portfolios. Popular targets have included:

- expertise in Teams integration (Dstny’s acquisition of Qunifi and Gamma’s acquisition of Exactive)

- contact centre capabilities (Enreach’s acquisitions of HeroBase, masvoz and Benemen, and Gamma’s acquisition of Telsis)

- business analytics

- AI.

There are also signs that Gamma, which has a smaller geographical footprint than Dstny and Enreach, is looking to enter adjacent markets given its acquisition of Satisnet, a security specialist, in 2023.

Acquisitions have led to rapid revenue growth, but underlying organic growth has been more limited. For example, Dstny increased its revenue four-fold between 2019 and 2023, but its revenue only grew by 7% year-on-year in 2023 (a year in which Dstny made only one acquisition).1 Analysys Mason forecasts that the European UCaaS2 market as a whole will grow at a CAGR of 8% between 2023 and 2028; this growth is somewhat slower than the rates achieved in 2020–2023.

Operators can learn some important lessons from these specialists

Few operators are growing revenue from cloud voice and UCaaS services as rapidly as the specialist players highlighted above. They may be missing out on an important opportunity; most European SMEs have yet to migrate to a cloud-based voice solution but will probably do so within the next 5 years.

There are some important lessons that operators that are keen to succeed in this market can learn from the specialist players.

- Local language and sales support is important. This was a key driver for Enreach’s acquisition of local partners in countries such as Finland, France, Spain and the Baltics. It is also one of the reasons why specialist players rely so heavily on indirect channel partners (these account for the majority of revenue).

- Mobile-centric and fixed–mobile convergence (FMC) solutions are likely to account for a growing share of the market. Mobile-centric solutions already dominate in the Nordic countries where Dstny is a major player. Enreach also emphasises its FMC capabilities. There is a significant opportunity for operators to use mobile-centric solutions to address new use cases such as front-line workers.

- Price may be more important than a big-name brand. Small businesses do not necessarily want to have the cheapest product, but they do expect competitive pricing, which provides an opportunity for players with simpler, cheaper solutions to do well. Many enterprises like to rely on big-name brands, but SMEs are often content with white-labelled solutions (as offered by Dstny) or smaller brands (such as Enreach).

- SMEs do not require the same features as larger businesses but are becoming increasingly demanding. It is hard for players that rely on their own, proprietary software, such as Dstny and Enreach, to keep pace with the rate of product development that global players are achieving. This has so far not been too much of an issue in the SME segment where demand is mostly focused on basic PBX features. However, expectations are rising.

- Integrated customer engagement tools will be important for many small businesses. Some of the features that are being prioritised for development are in the area of customer engagement, for example using conversational AI to deliver automated call-centre solutions or using analytics to drive improved customer engagement.

Operators have some unique opportunities to differentiate

Very few operators rely on their own proprietary UCaaS solutions, and most select their technology partners from the same small pool of providers. This can make it hard to differentiate. However, they do have some opportunities to differentiate by making use of their network assets and capabilities. For example, Vodafone has mobile-centric offers that support native dialling and is experimenting with solutions for mobile users including HD-collaboration and dual-personas using eSIMs. It is also aware of the significant potential for advanced voice services using communications platform-as-a-service (CPaaS), Vodafone APIs and conversational AI capabilities.

Operators have the opportunity to present holistic solutions by creating strong bundles and frictionless sales for UCaaS services alongside their broader portfolios of connectivity, security and cloud services. Many operators are investing in digital channels and portals to manage this, but designing the right commercial offers will also be important to succeed.

1 Analysys Mason estimate based on press releases.

2 For more information, see the ‘UC/hosted voice’ forecasts in Analysys Mason’s DataHub.

Article (PDF)

DownloadAuthor

Catherine Hammond

Research DirectorRelated items

Article

KDDI’s results demonstrate the challenges of entering new markets such as energy and finance

Strategy report

Strategies for telecoms operators to evolve their network-as-a-service (NaaS) propositions

Tracker

Cloud service providers' revenue tracker 2024