More is not always better; operators in high-income countries should experiment with limited data plans

Data is now central to any mobile service offer. Indeed, many operators, particularly those in high-income countries, are trying to differentiate from their competitors by offering more data, thereby resulting in the proliferation of plans with very large or unlimited data allowances.

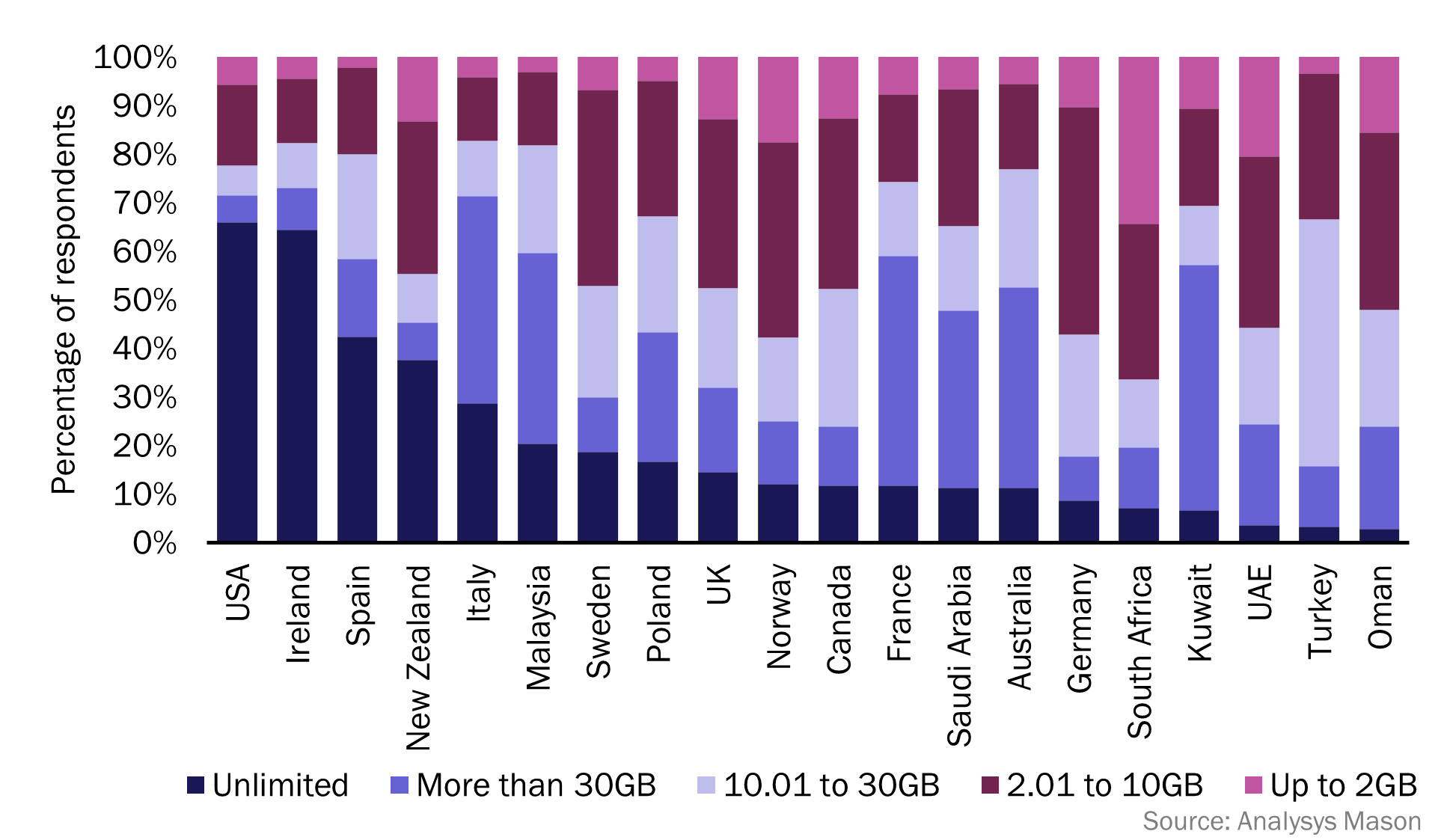

The results of Analysys Mason’s latest consumer survey show that unlimited data plans have become very popular in high-income countries. Indeed, more than 50% of subscribers in Ireland and the USA have access to unlimited data, as do approximately 40% of subscribers in New Zealand and Spain (Figure 1).

Figure 1: Self-reported mobile data allowance by country, worldwide, 2023

Consumers have a rapidly growing need for data, but they currently have more data than they can use; data overage is uncommon in North America and Europe. This abundance of data raises questions for operators.

The relationship between data allowances, usage and customer satisfaction is not straightforward

Consumers’ monthly spending increases with data allowance size, so operators are keen to offer more data in order to grow their ARPU. However, they need to be careful not to rush customers into plans with data allowances that exceed their needs, as this may be have a negative impact on customer satisfaction. Some of the main findings related to data consumption and customer satisfaction from our latest consumer survey are as follows.

- Satisfaction with data allowances has a limited correlation with customer satisfaction. Statistical regression analysis reveals that, in high-income countries, there is little to no correlation between satisfaction with data allowances and Net Promoter Scores (NPSs). This suggests that offering more data is likely to have minimal impact on customer satisfaction. The same analysis also reveals that price satisfaction is a much stronger predictor of NPS than data allowance satisfaction in most countries, followed by customer service satisfaction (in high-income countries) and network and speed satisfaction (in middle-income countries).

- More is not always better. Consumer satisfaction, as measured by the NPS, typically increases with data allowance size. Larger data allowances allow mobile users to consume more online services, which has a positive impact on satisfaction. This positive correlation, however, does not go on indefinitely. The results from our consumer survey reveal that mobile users with access to unlimited data have lower satisfaction levels than those on plans very large data allowances (30GB or more per month). Customers on unlimited data plans may feel that they are under-using their data allowances or that their expensive plans are not worth the cost.

- Data allowances do not necessarily match consumers’ needs. Data usage and allowance sizes are linked, but countries with high levels of data usage do not necessarily have large shares of consumers on unlimited plans. For example, mobile users in Saudi Arabia have the highest average monthly data consumption per user in our sample (43GB in 2023), but only 11% reported being subscribed to an unlimited data plan. In contrast, the average monthly data consumption is below 18GB per month in the USA and Spain, but the share of unlimited data plans is significantly higher, at 66% and 42%, respectively. The high penetration of unlimited data plans in these two countries is likely to be linked to specific competitive dynamics. Indeed, all major mobile network operators in the USA offer unlimited data plans at only a slight premium over their most expensive limited data plan. Vodafone in Spain offers unlimited data allowances at various price points depending on the speed offered.

- Matching the size of consumers’ data plans with their data usage can yield higher levels of satisfaction and improve customer retention. Consumers that regularly remain within their monthly data allowance are happier and less likely to churn than those that go over their limit. Indeed, satisfaction levels, based on NPSs, are the highest among customers that use more than half of their data allowance but remain within their limit. Conversely, consumers that regularly go over their data limit are the least satisfied and have the highest intent to churn; on average, 44% of all respondents who go over their data allowances stated that they intend to churn compared to 18% of those that remain within their data limits.

These findings show that mobile operators should try to avoid rushing customers into plans with data allowances that exceed their actual needs. However, the competitive dynamics in most high-income countries do not make this possible.

The advance of unlimited data plans is somehow inevitable. Operators must look for ways to differentiate their offers other than by the size of their data allowances. Focusing on service attributes such as data speeds, network coverage and customer service satisfaction can help operators to make their services more relevant.

Article (PDF)

DownloadRelated items

Report

Analysys Mason research and insights topics for 2026

Article

L4S and fixed network slicing could boost operators’ QoE, but only when applications actually need it

Survey report

UAE: consumer survey