Vendors must improve the power efficiency of their products to tackle Scope 3 emissions

Analysys Mason’s Environmental KPI tracker: network equipment vendors highlights the progress made by 13 of the largest network equipment vendors in reducing their emissions and reporting their environmental data. The tracker offers insight into the energy consumption, carbon emissions, circular economy metrics, waste production, recycling, emission factors and net-zero target dates of these vendors.

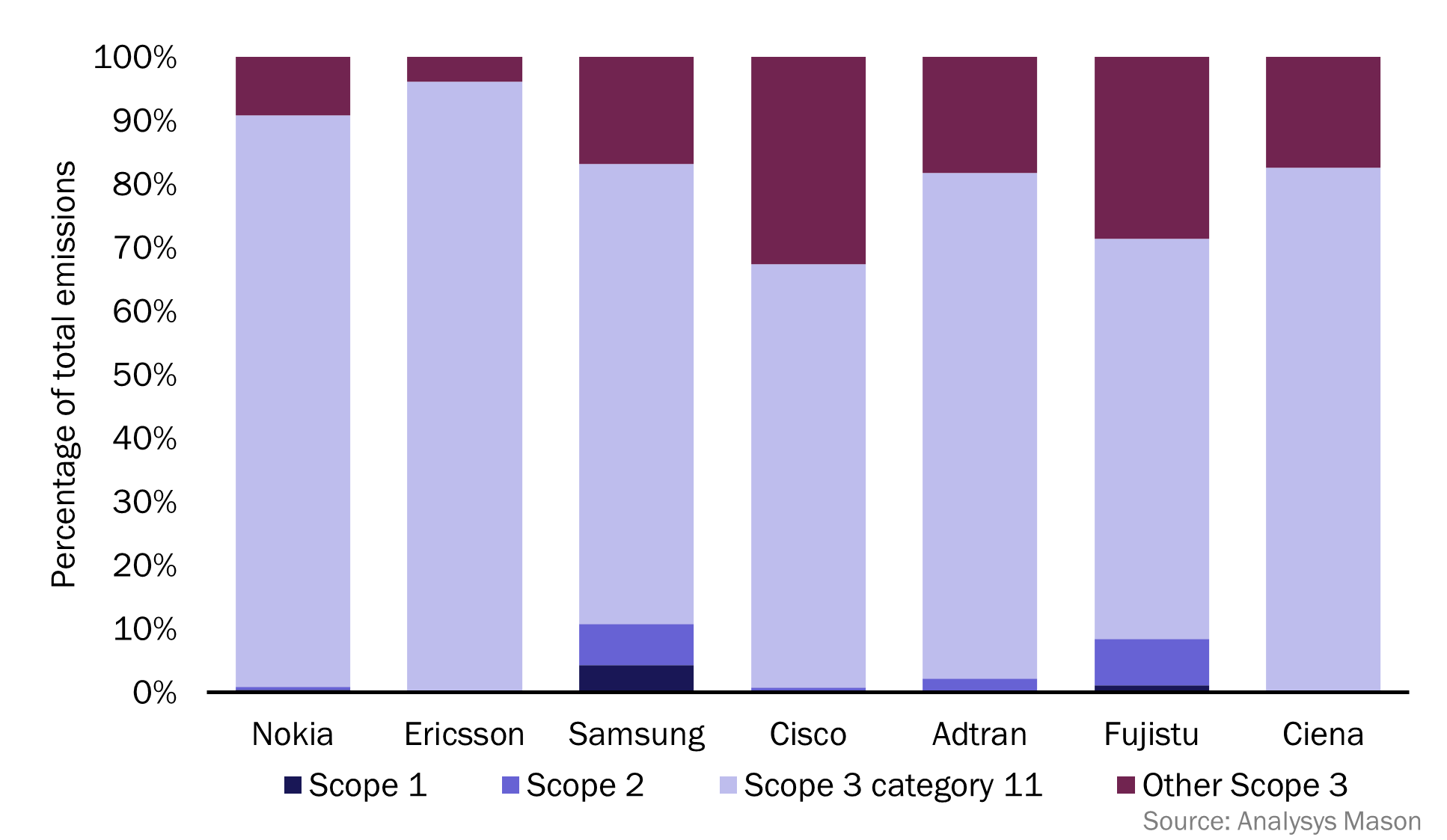

The findings from the tracker emphasise the ongoing challenges faced by vendors in reducing their emissions from Scope 3 activities and trying to lower their overall energy consumption, while addressing the rising demand for digital services1. 70–90% of the carbon emissions from several major network equipment vendors stem from the use of sold products (category 11 of Scope 3). Addressing this issue requires vendors to consistently improve the power consumption and efficiency of their products, thereby reducing the emissions created during customer use.

Many major network equipment vendors have yet to prioritise the use of renewable energy. There are challenges surrounding the availability of renewables across some of their global operations, but it is important that all vendors work with the broader ecosystem and global initiatives to drive renewable energy efforts.

Up to 95% of the emissions from any single network equipment vendor come from the use of sold products and services

All 13 of the major network equipment vendors featured in Analysys Mason’s Environmental KPI tracker: network equipment vendors publicly reported Scope 1 and 2 emissions between 2018 and 2022.2 Some have made considerable strides in reducing these emissions and have also committed to net-zero targets (Figure 1). Ciena has made the most notable progress: it reduced its Scope 2 emissions by 87% between 2018 and 2022 and has committed to a 2024 net-zero target. This is 6 years ahead of the 2030 target set by other vendors including Nokia, Ericsson and Fujitsu (Figure 1).

Figure 1: Reduction in Scope 1 and 2 emissions and net-zero targets of selected network equipment vendors, worldwide, 2018–2022

| Vendor | Reduction in Scope 1 emissions | Reduction in Scope 2 emissions (market-based definition) | Net-zero target |

|---|---|---|---|

| Ciena | 43% | 87% | 2024 (Scope 1 and 2 and certain Scope 3 emissions) |

| Ericsson | 29% | 66% |

2030 (Scope 1 and 2) 2040 (across the value chain) |

| Nokia | 8% | 63% | 2050 (across the value chain) |

| Fujitsu | 65% | 53% |

2030 (Scope 1 and 2) 2040 (across the value chain) |

| Cisco | 15% | 47% | 2040 (across the value chain) |

| NEC | 60% | 14% | 2050 (across the value chain) |

Source: Analysys Mason

All 13 of the vendors in our tracker disclosed a Scope 3 emission value in 2022, though 2 of the 13 vendors reported emissions in fewer than 4 of the 15 Scope 3 categories outlined by the Greenhouse Gas (GHG) Protocol.3 Most of the largest network equipment vendors are reporting emissions in 7 or more of the 15 GHG Protocol categories, and up to 95% of the total carbon emissions for these vendors are produced downstream from the use of sold products (Figure 2). Such emissions can also be thought of as Scope 1 and 2 emissions of the end user.

Figure 2: Breakdown of emissions by scope, selected network equipment vendors, worldwide, 2022

Many major network equipment vendors have been slow to move to renewable energy

Major network equipment vendors’ use of renewable energy has been relatively limited (or unreported). Indeed renewable energy accounts for only up to 30% of the total annual electricity consumption of over half of the vendors in our tracker. Cisco, Ericsson and Nokia have emerged as the leaders; renewable energy accounted for 91%, 82%, 63% of their total electricity consumption, respectively, in 2022. These three vendors have made significant strides to sign numerous, long-term renewable energy contracts such as power purchase agreements (PPAs) across their global operations and are investing in on-site solar and wind installations across their facilities worldwide.

Vendors should be driving product efficiency and supporting global efforts to bring down emissions

Vendors should be focusing on improving the energy efficiency of their products to address the large amount of emissions associated with the use of products sold (as illustrated in Figure 2). There are numerous measures that vendors can explore including:

- implementing power management features (such as those using AI/ML) that allow power consumption to be dynamically adjusted based on network load

- incorporating innovative cooling solutions to reduce the need for excessive cooling (this could involve using more efficient fans, liquid cooling systems or even passive cooling methods)

- implementing extended producer responsibility (EPR) programmes to incentivise the responsible disposal and recycling of products

- communicating category 11 emissions via marketing collateral and product documentation

- working to support and understand customers’ renewable electricity strategies

- facilitating the active changing of power sources for equipment to either the electricity grid or batteries depending on which is most efficient during peak/off-peak periods.

Some vendors will struggle to move to 100% renewable electricity due to the limited availability of such energy in several of their operating countries. It is important that these vendors are working with the broader ecosystem, governments and policy makers to increase the take-up of sustainable electricity. This may involve joining renewable energy communities such as RE1004 and subsidising local renewable energy sources in developing economies.

Major network equipment vendors have shown progress in curbing Scope 1 and 2 emissions and some are setting ambitious net-zero targets. However, challenges persist in tackling Scope 3 emissions and many vendors must start to tackle the large amount of emissions coming from the use of their products. Furthermore, several vendors have yet to prioritise the use of renewable energy. It is vital that major network equipment vendors use their position as large corporate companies to accelerate global renewable energy efforts.

1 Scope 3 emissions include contract manufacturing, upstream transportation and distribution, waste, business travel and employee commuting.

2 Scope 1: direct emissions from owned sources such as company facilities or vehicles; Scope 2: indirect emissions from purchased electricity, heating and cooling; Scope 3: all other indirect emissions within the supply chain, including those generated by suppliers, the transportation of goods, employee commuting, end use and financial investments.

3 Greenhouse Gas Protocol, Corporate Value Chain (Scope 3) Standard.

4 RE100, About us.

Author

Grace Langham

Analyst, expert in sustainability and ESGRelated items

Article

Using dark fibre to track geothermal energy offers network providers an opportunity to monetise their assets

Survey report

Fixed operator energy benchmarks 2024

Survey report

Telecoms operator renewable energy benchmarks 2024