Verizon’s acquisition of Frontier represents another structural change in the US broadband market

17 September 2024 | Research

Article | PDF (4 pages) | Fixed Services| Fixed–Mobile Convergence| North America Metrics and Forecasts

Verizon agreed, on 5 September 2024, to buy Frontier for an enterprise value of USD20 billion, including Frontier’s USD11 billion debt. The transaction is subject to approval and expected to close in 18 months.

This deal represents another significant structural change in the US broadband market. AT&T formed a joint venture (‘Gigapower’) with BlackRock in 2023 for part of its fibre roll-out and T-Mobile created joint ventures with KKR and EQT to acquire Metronet and Lumos, respectively, in 2024. Verizon’s deal differs because the operator will wholly own all the fibre assets. The risk for Verizon is lower because Frontier already has an installed base of customers. The deal is expected to increase the competition in the market because Verizon has better retail capabilities than Frontier.

Verizon will gain access to the 7.2 million households that are currently covered by Frontier’s fibre network, as well as 2.2 million fibre subscribers in over 25 states. As such, we estimate that the cost of the transaction per subscriber is USD9000 and the cost per home passed is USD2800.

Verizon’s number of fibre connections will increase to approximately 10 million as a result of the deal; its fibre coverage will extend to 25 million households. Verizon plans to grow its coverage further to between 27 million and 28 million by 2026 in order to cover around 20% of all US households. For comparison, AT&T is on track to reach its target of 30 million homes passed with fibre by 2025. T-Mobile’s joint ventures will together cover over 10 million households by 2030.

Frontier was looking for a buyer due to financial difficulties; the transaction fits well with Verizon’s growth ambitions

Frontier exited Chapter 11 bankruptcy in April 2021. It launched a strategic review and appointed an M&A specialist to its board of directors in 2024. It explored options for partnerships and joint ventures; for example, it was reportedly in talks with Stonepeak, an investment fund. However, alternative options appeared less attractive than Verizon’s offer.

The key benefits of the deal for Verizon are as follows.

- The deal will add size and scale to Verizon’s broadband footprint.

- Verizon will be able to expand its addressable market for core mobility, streaming, connected home, B2B and small and medium-sized business (SMB) services.

- The transaction is expected to bring run-rate operating cost synergies. Verizon predicts that these will reach at least USD500 million by year three. However, this might be limited due to the lack of overlap between the footprints of Verizon and Frontier.

The acquisition will increase competition in the US market because Verizon has better retail capabilities than Frontier

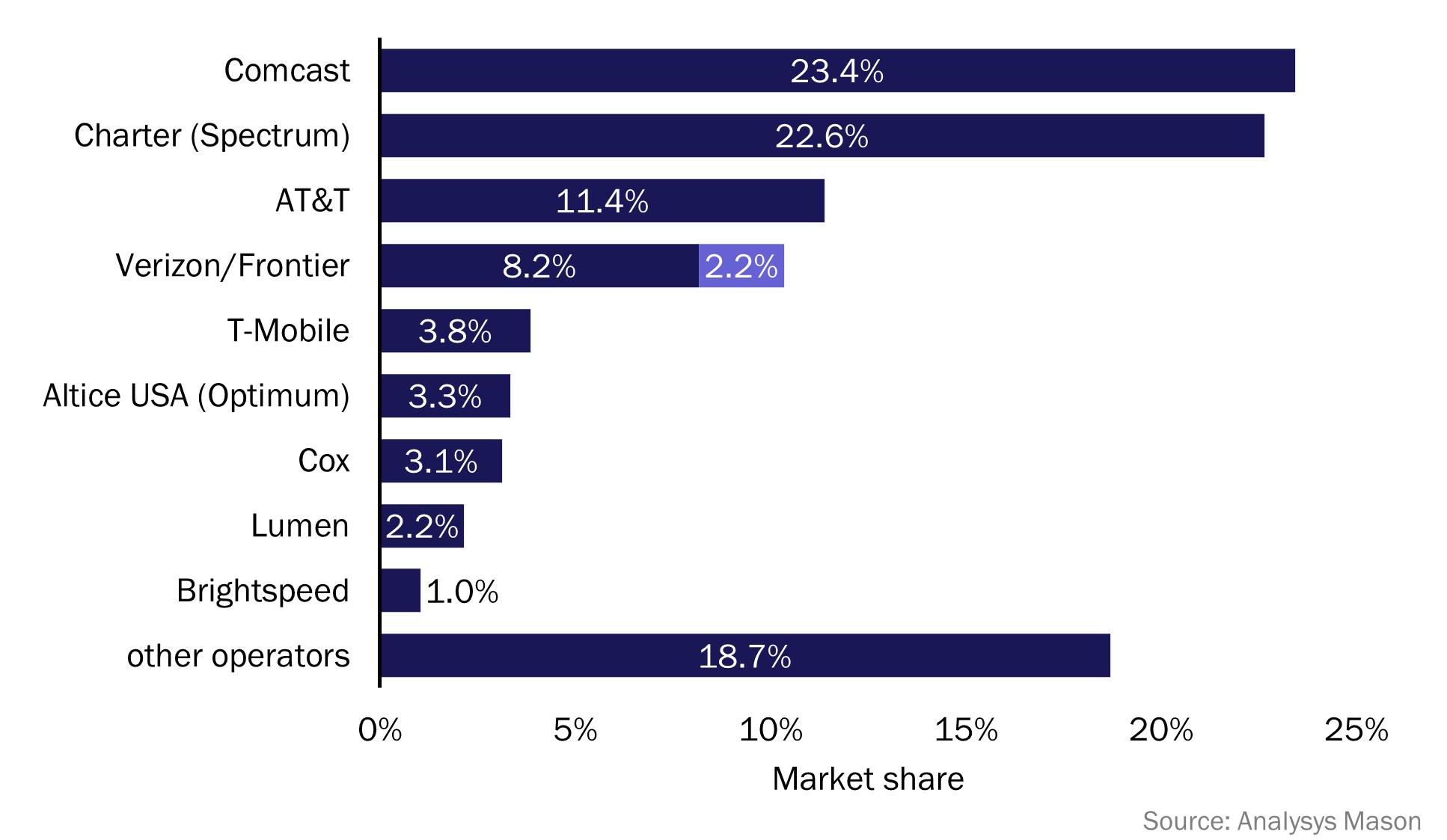

Verizon will have nearly 14 million fixed broadband subscribers following the transaction; this will bring it closer to AT&T and the leading cablecos, Comcast and Charter (Figure 1).1 Verizon does not plan to make any changes to its fixed-wireless access (FWA) strategy. It wants to provide its customers with a choice between fibre and FWA, unlike AT&T, its main fibre competitor.

Figure 1: Fixed market share of connections by operator, USA, 1Q 2024

Verizon’s and Frontier’s combined roll-out target has not changed. However, the transaction will have a substantial impact on the market because Verizon has much stronger retail capabilities than Frontier.

- The take-up of Verizon’s mobile services in areas where fibre is available is greater than in regions where there is no fibre coverage. Verizon will be able to use Frontier’s fibre coverage to further improve mobile customer loyalty and strengthen its market position.

- The share of homes passed that take a fibre connection is higher for Verizon than for Frontier. The availability of Verizon’s retail offer across Frontier’s footprint should increase the take-up of fibre services among households covered by Frontier’s network.

- Verizon’s fixed–mobile convergence (FMC) revenue will increase because the operator will be able to offer mobile services to Frontier’s fibre subscribers. It will also be able to offer bundled fibre to its existing mobile customers that do not yet have access to fibre (though this approach proves to be more difficult2). FMC subscribers tend to be more loyal than standalone subscribers, which in turn should reduce churn. Indeed, Sowmyanarayan Sampath, Executive Vice President and CEO of Verizon Consumer Group said, “we see a 50% reduction in mobility churn when we bring the two products together in front of the customer and a 40% reduction in fibre churn,” during a conference call on 5 September 2024.

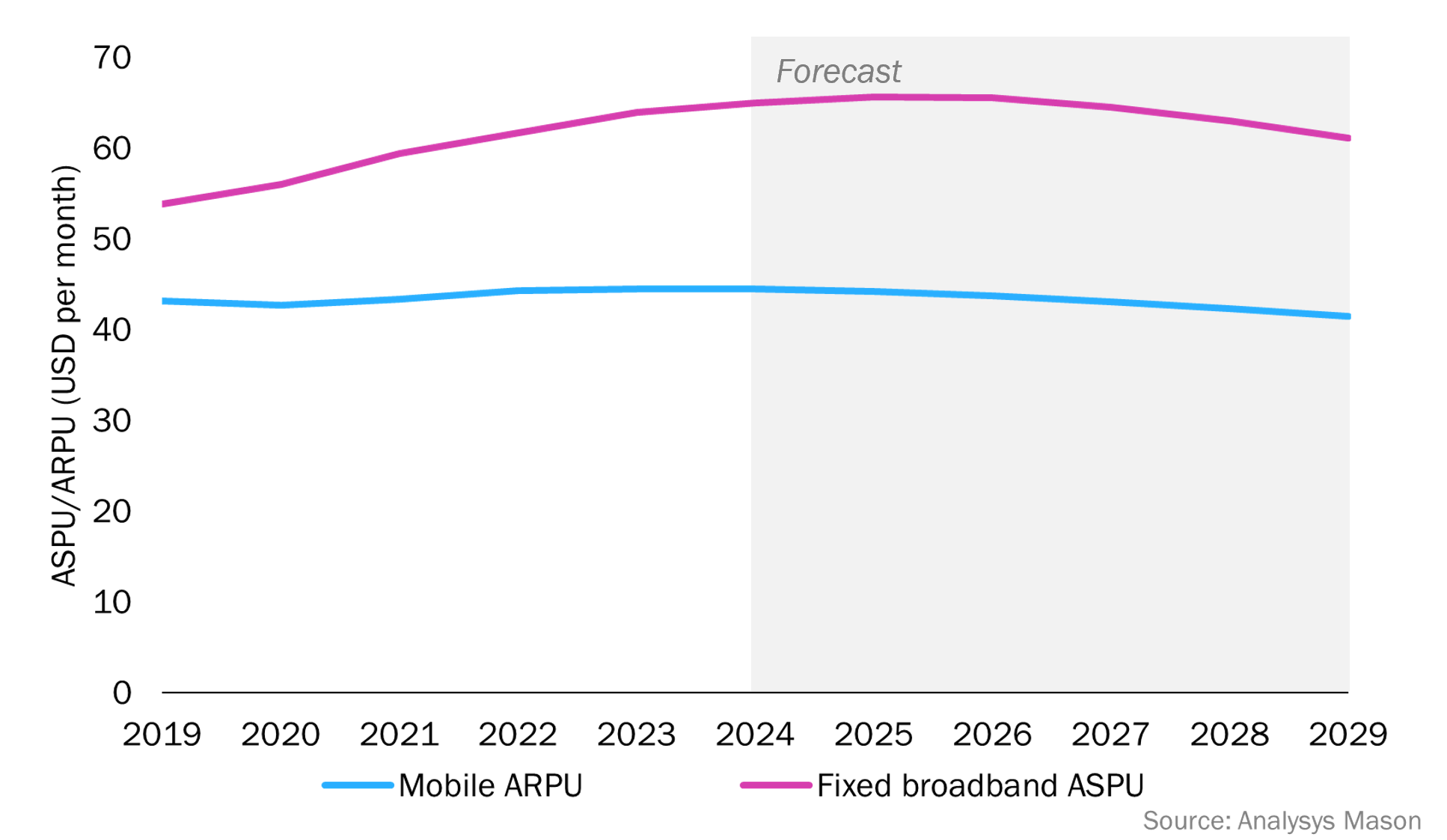

Verizon’s increased FMC capabilities and its efficient utilisation of Frontier’s network is likely to put more pressure on other US operators. Prior to the deal, we forecast that mobile ARPU and fixed broadband ASPU would have CAGRs of –1.4% and –1.2%, respectively, between 2024 and 2029 (Figure 2). The decline may be sharper if the transaction receives approval.

Figure 2: Mobile ARPU and fixed broadband ASPU, USA (forecast made prior to the Verizon announcement)

The telecoms market in the USA is starting to look like those in other high-income countries

The telecoms market in the USA has historically been very different from those in other developed countries. It has been characterised by the dominance of the big cablecos, high mobile and fixed prices and the limited take-up of FMC. However, things are changing now. All three large mobile network operators (MNOs) have fixed networks, thereby elevating their FMC capabilities. Mobile and fixed broadband markets are approaching saturation, and ASPU will decline during the forecast period as price competition increases. This will encourage operators to continue to focus on FMC to increase client loyalty.

We estimated that the FMC share of total telecoms revenue would reach 28% by 2029, prior to Verizon’s announcement. We now expect that the take-up of FMC will grow more rapidly and will come closer to the average in Western Europe. However, FMC penetration will not reach European levels because the fixed broadband coverage of MNOs in the USA is much less broad than that of MNOs in Europe. The US telecoms market will also continue to have a high share of cable connections, a greater focus on FWA and a limited availability of wholesale fibre access.

Verizon’s deal may not be the last structural change in the fibre broadband market in the USA. Many other players (such as Altafiber, Brightspeed, Google Fiber, SiFi, Windstream and Ziply Fiber) are potential M&A targets. It also remains uncertain how cablecos will respond to losing market share and whether MNOs will offer each other wholesale fibre access to elevate their FMC capabilities.

1 For more information, see Analysys Mason’s DataHub and the Americas Metrics and Forecasts module. We recently expanded our core historical coverage for the USA to include 11 named fixed operators.

2 For more information, see Analysys Mason’s Fixed–mobile bundles can erode value rather than generate it – operators need to act carefully.

Article (PDF)

DownloadAuthor