Password sharing may have lost Netflix billions of dollars in retail revenue, but operators can help

Listen to or download the associated podcast

The number of paying users of streaming video services worldwide grew by 13.5% year-on-year in 2021 to 704 million. However, this growth conceals the ever-increasing number of consumers that share their passwords with friends and family. This is a monetisation problem for streaming video providers in general, and for Netflix in particular.

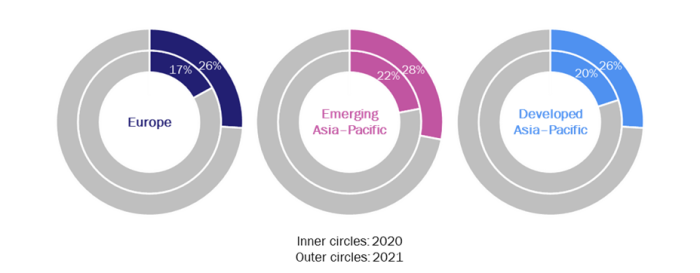

The proportion of users in Europe that use someone else’s account details for streaming video services increased from 17% in 3Q 2020 to 26% in 3Q 2021.1 Telecoms operators are well-placed to help streaming video providers to bring some of these users back on-board as paying customers.

The streaming video market is growing, but password sharing is on the rise

Streaming video continues to be a major growth engine for entertainment spending; the total retail revenue worldwide grew from USD97.7 billion in 2020 to USD126.7 billion in 2021, and the number of paying users grew by 13.5%. Content piracy is also well-established and has existed for as long as home recording has been practical.

It has long been argued that streaming video services help to convert previous ‘pirates’ (that is, users who illegally download content) into paying customers for content. Piracy levels are indeed falling in developed markets, but consumers are still willing to access content by sharing passwords to services that are paid for legally. This sharing is often in contravention of the terms and conditions of the use of those services.

Our annual survey of consumers revealed that the proportion of users in Europe that use someone else’s account details for streaming video services increased from 17% in 3Q 2020 to 26% in 3Q 2021 (Figure 1).2 This figure increased from 22% to 28% in emerging Asia–Pacific3 (even though piracy also surged in the region between 2020 and 2021) and from 20% to 26% in developed Asia–Pacific.4

Figure 1: Proportion of streaming video users that use someone else’s account, Europe, emerging Asia–Pacific and developed Asia–Pacific, 2020 and 2021

Source: Analysys Mason, 2022

Password sharing may have lost Netflix USD1.8 billion in retail revenue in EMEA alone in 2021

Several factors are probably driving consumers’ increased sharing of passwords.

- Rising retail prices. Netflix increased its standard tariff by 8–37% year-on-year in every European country included in our survey in 2021, with the exception of Poland. Its reported ARPU in Europe, the Middle East and Africa (EMEA) grew by 8.5% year-on-year in 2021 and its revenue increased by USD1.9 billion. However, the proportion of users that share passwords with others increased by nine percentage points year-on-year, which equates to USD1.8 billion in lost revenue, thereby practically halving Netflix’s revenue growth in the region for the year.

- Lower availability of free trials. Both Disney+ and Netflix have significantly reduced the availability of free trials to their services in certain regions, particularly in Europe. This has potentially caused people that chained together multiple free trials by using different online identities to settle on sharing an account with another person.

- Greater consumer choice. The average number of paid-for streaming video services used by consumers increased by 0.4 in Europe and 0.9 in the USA between 2020 and 2021. The growth rate of such ‘service stacking’ is likely to slow eventually, but we expect that it will continue as is in 2022 as content libraries further fragment when individual studios launch their own direct-to-consumer propositions.

These factors all contribute to tougher market conditions for streaming video players in 2022 and beyond. Netflix is already feeling this pressure: when one removes password sharers from the number of self-reported Netflix users in our consumer survey it appears that Netflix’s paying subscriber base shrank in countries such as New Zealand, Poland, Spain, Sweden, Thailand, Turkey and the UK in 2021.

There are several ways in which streaming video providers can monetise password sharers and operators can help them

Streaming video providers such as Netflix have used a number of strategies to combat password sharing directly.

- Some video players in Europe have followed Spotify’s lead in creating family accounts to cater for this need. For example, DAZN in Italy allows multiple user accounts within a single (more expensive) subscription. This approach is not yet widespread but could potentially be replicated elsewhere.

- Password sharing is partly an affordability issue in emerging markets, so Netflix has created cheaper service tiers specifically for lower-income economies (the Mobile and pilot Mobile Plus tiers). It also introduced a free tier in Kenya and Vietnam in late 2021.

Netflix has also directly policed password sharing by sending emails and using pop-ups that alert the user to the fact that password sharing is against their terms and conditions. Introducing features such as two-factor authentication could discourage this behaviour further, but is only a first step towards monetising users in emerging markets. Telecoms operators may be able to help. Much streaming video content is consumed over mobile connections, but the burgeoning fibre broadband market in emerging markets presents an opportunity to more-tightly bundle streaming video services with home-centric services. For example, the experience of having one’s own account could be differentiated from that of using someone else’s account solely on a handset if the service is tied to a smart TV set or set-top box.

Pay-TV providers and telecoms operators in developed markets may also be able to help streaming video providers to reduce password sharing, particularly among older viewers that may use their adult children’s accounts. The integration and aggregation of streaming video services into pay-TV services will be key for this demographic (who typically watch content on their main TV set). This would reduce the opportunity for password sharing because the streaming service would solely be integrated into the pay-TV service of the account holder.

1 The term ‘someone else’ is used to mean a friend or somebody else that is not in the user’s household.

2 For more information, see Analysys Mason’s Streaming video opportunities in Europe: consumer survey.

3 For more information, see Analysys Mason’s Streaming video opportunities in emerging Asia–Pacific: consumer survey.

4 For more information, see Analysys Mason’s Streaming video opportunities in developed Asia–Pacific: consumer survey.

Article (PDF)

DownloadAuthor