The Fastweb–Vodafone merger marks a shift towards fixed–mobile convergence in Italy

15 March 2024 | Research

Article | PDF (4 pages) | European Country Reports| Fixed Services| Mobile Services| European Quarterly Metrics| Global Telecoms Data and Financial KPIs| Fixed–Mobile Convergence

Vodafone has finally found the long-awaited opportunity for market consolidation in Italy. Fastweb’s owner Swisscom offered EUR8 billion in cash on a debt-free basis to acquire 100% of Vodafone Italy and Vodafone accepted the offer on 15 March 2024. The deal fits well with both Vodafone Group’s divestment strategy and Fastweb’s ambitions to become a national fixed–mobile operator.

We believe that Vodafone chose the deal with Fastweb over forming a joint venture with Iliad because this deal has a higher chance of being approved and the approval should be far faster (the deal is expected to close in 1Q 2025, subject to regulatory approval).

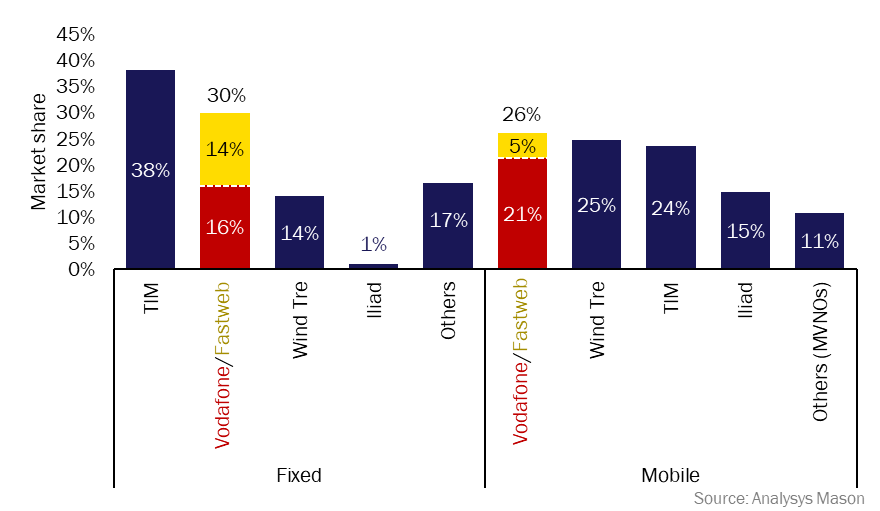

The merger will result in the creation of the Italy’s largest mobile network operator (MNO) and second-largest fixed operator (with a 26% and 30% share of the mobile and fixed markets, respectively). It will enable Fastweb to finally become a national MNO and strengthens its position in both the fixed and B2B market segments.

Fastweb will push hard on fixed–mobile convergence (FMC) to lock in its large fixed and mobile user base. Greater scale and cost synergies allow the new company to offer even more competitive tariffs, if needed, to put pressure on competitors (especially Iliad).

Vodafone found Fastweb’s offer to be more aligned with shareholders’ interests than Iliad’s bid

Vodafone declined Iliad’s bid despite having a higher valuation than Fastweb’s offer (see Figure 1). Instead, Vodafone accepted Fastweb’s offer because it is an outright sale rather than a joint venture, Vodafone will receive a larger cash payment and it will face fewer obstacles to regulatory approval (a key attraction for Vodafone). Indeed, the regulator may have imposed conditions on a merger with Iliad (the number of national MNOs would have reduced from four to three), as was the case with the Wind–Tre merger in 2016.1 Furthermore, the transaction can close much more quickly. Orange and MásMóvil in Spain waited for almost 2 years to obtain regulatory approval to form a joint venture; the Fastweb–Vodafone deal should take less than 1 year.

Figure 1: Comparison of the bids from Iliad and Swisscom to take over Vodafone Italy, 2024

| Iliad | Swisscom (Fastweb's owner) | |

|---|---|---|

| Deal | Establish a 50:50 joint venture (Iliad initially included the right to buy 10% of Vodafone’s shares every year, but this clause was removed in the bid submitted in January 2023) | Acquire 100% of Vodafone Italy |

| Valuation of Vodafone |

|

|

| Financial details | Vodafone receives a EUR6.5 billion cash payment and a EUR2.0 billion shareholder loan | Vodafone receives a EUR8.0 billion cash payment |

| Vodafone's decision | Offer refused on 31 January 2024 | Offer accepted on 15 March 2024 |

Source: Analysys Mason

The proposed transaction fits well with both Vodafone Group’s divestment strategy and Fastweb’s growth ambitions

Vodafone has been looking for in-market consolidation opportunities in countries with a low return on invested capital. Vodafone Italy’s EBITDA margin declined by 7.4 percentage points between 2018 and 2022, largely due to the intense price competition ignited by Iliad.2

The takeover of Vodafone gives Fastweb an opportunity to become a national fixed–mobile operator. Indeed, it will become the largest MNO and second-largest fixed operator in Italy in terms of the number of connections (Figure 2).

Figure 2: Fixed and mobile market share of connections, by operator, Italy, 4Q 2023

The key benefits of the deal for Fastweb include the following.

- Fastweb will complete the transition from MVNO to national MNO. It currently provides mobile services nationwide, mainly via a network agreement with Wind Tre. Fastweb owns spectrum (in the 3.5GHz and 26GHz frequency bands) but, unlike Vodafone, it does not own a mobile network.

- Fastweb will become an even stronger alternative operator in the fixed market. It will be able to provide 5G fixed-wireless access (FWA) and fibre services with speeds of up to 2.5Gbit/s in new areas.

- Fastweb will be able to build a larger portfolio of IT and communication services for B2B customers. It already has a prominent position in the wholesale connectivity segment thanks to its large proprietary fixed network.3 The greater scale provided by the acquisition will allow Fastweb to better cater for large organisations and the public administration sector.

The new company will push on fixed–mobile convergence to consolidate its large fixed and mobile customer bases

The deal is not likely to lead to big changes in retail price competition in Italy; the mobile market will continue to have four major MNOs. Indeed, it remains unclear how Fastweb will change its strategy in the mobile market in the long term (it has historically offered low-cost tariffs, but will be able to use Vodafone’s mobile network to offer premium tariffs).

The new company will have a significant opportunity to cross-sell Fastweb’s fixed services to Vodafone’s large mobile customer base. The presence of a big fixed–mobile operator will make it more difficult for Iliad (the current price-disruptor operator) to attract new customers.

The deal marks a notable shift towards FMC in Italy. The adoption of FMC bundles in Italy is growing, though it still remains lower than that in other European countries such as Belgium and Spain (the FMC share of fixed accounts in Italy was close to 38% in 2023, while it was above 50% in Belgium and Spain).4

1 Wind and Tre (previously owned by VEON and Hutchison, respectively) merged their operations in 2016. The two operators proposed the sale of some assets (mobile spectrum and sites) and the provision of roaming services to a new MNO (Iliad) to receive the approval from the European Commission (EC). The EC’s aims were to ensure that the Italian mobile market would continue to have four MNOs.

2 Vodafone Italy generated a loss before tax of EUR49 million in the 12-month period to December 2023. For more information, see Analysys Mason’s DataHub and the Global Telecoms Data and Financial KPIs research programme.

3 Fastweb is the only internet service provider in Italy (other than the two national wholesale operators) that owns a fixed access network. Fastweb’s fibre network covered at least 8 million premises in 2023 (around 25% of the total number of national premises). For more information, see Analysys Mason’s Italy telecoms market report 2023.

4 For more information, see Analysys Mason’s DataHub and Fixed–Mobile Convergence programme.

Article (PDF)

DownloadAuthor