5G capacity requirements and novel RAN architectures are the catalyst for new xHaul investments

The demands of 5G use cases and the adoption of new RAN topologies will drive a rise in operator spending on xHaul throughout the 2020s. This trend has led Analysys Mason to publish our xHaul: worldwide forecast report, which predicts that revenue from xHaul products and services will grow at a CAGR of 16% between 2022 and 2028. The report breaks down the revenue by xHaul component and region, and includes a division between product revenue and service revenue. Further splits include RAN architecture, cell site type and backhaul technology (fibre, key microwave bands and satellite).

xHaul revenue growth will be driven by three key trends: RAN disaggregation, the accelerating ‘fiberisation’ of cell sites and densification. The first of these sees the RAN being split into three elements: the radio unit (RU), distributed unit (DU) and centralised unit (CU). This architecture in turn defines the three elements of xHaul: fronthaul (RU-to-DU connection), midhaul (DU-to-CU) and backhaul (RAN-to-core).

Fiberisation to support 5G capacity will have the earliest impact on xHaul revenue

RAN disaggregation and densification have taken place quite gradually. The implementation of fibre backhaul to cell sites progressed steadily throughout the 4G era, but experienced a sharp acceleration in the early 2020s in readiness for 5G. This was mainly in anticipation of the increased data volumes that 5G would generate, though it also relates to the improved quality and consistency of experience that some 5G use cases will require. Hence, Analysys Mason forecasts that the expansion of fibre-to-the-tower networks will continue to proceed at a similar pace until at least 2028, even though the growth in mobile traffic will slow during the forecast period.1 Indeed, 68% of macrosites worldwide will be backhauled by fibre by 2028, and this figure will be over 90% in some individual countries.

Microwave technologies will still be used for a significant amount of backhaul, despite the increasing use of fibre.2 Indeed, the use of microwave for backhaul will only fall in terms of the absolute number of site connections from 2027 because of the growing number of sites overall.

The fastest revenue growth will come from fronthaul because virtualised disaggregated architecture demands new capabilities

Increased spending on fibre for xHaul will also be driven by the implementation of fronthaul, which will require fibre and active equipment that can support the extremely low latencies needed to transfer data and signals between the RU and baseband. Fronthaul has been a common element of the RAN architecture for 20 years, since remote radio heads were separated from the traditional integrated base station. Nonetheless, the capacity and latency requirements of 5G has put new demands on fronthaul equipment; for instance, latency is as little as 50µs one-way compared to 100µs for LTE fronthaul, 1–3ms for mid-haul and 10–40ms for 5G backhaul. As such, fronthaul will have to be extensively upgraded in centralised RANs, even where the baseband is non-virtualised, and the average cost per new fronthaul link will increase as much as two-fold to support 5G.

Virtualised RAN (vRAN) will also drive new fronthaul deployments and increased fronthaul costs. A midhaul link is required in the case of RANs where the baseband is split into two units. The combined number of fronthaul and midhaul connections will grow at a CAGR of 89% during the forecast period. Distributed cell-site gateways (DCSGs) will generate a further new revenue stream for vendors when the xHaul network also starts to be disaggregated and virtualised.

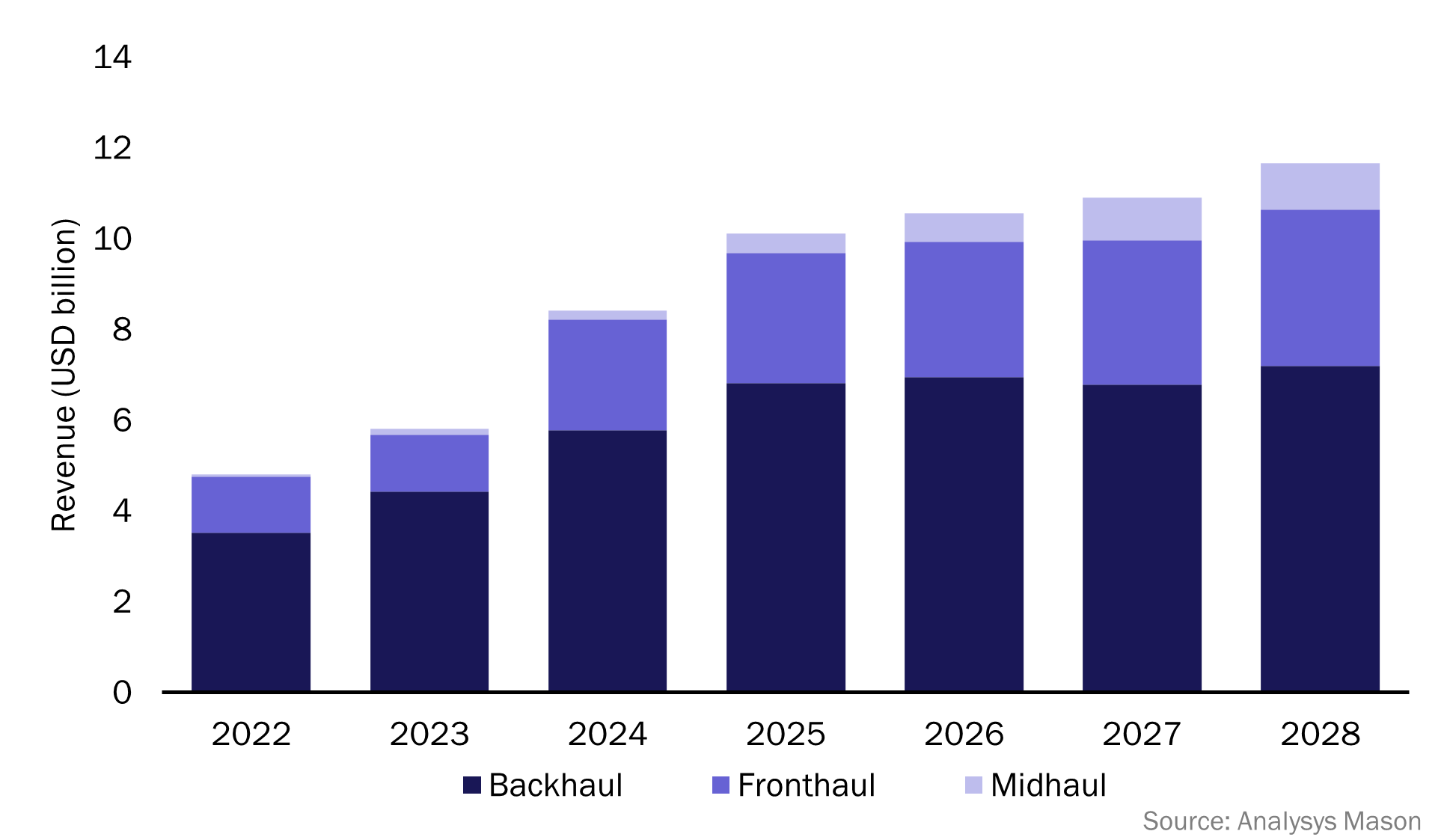

These two trends (5G and vRAN) mean that fronthaul will be the key driver of xHaul revenue growth (Figure 1). The sharp leap in revenue in 2024 is mainly related to 5G; backhaul revenue will increase by 30% year-on-year, while fronthaul revenue will rise by 92%, albeit from a smaller base since fronthaul accounted for only 22% of the total in 2023.

Figure 1: Vendor revenue from backhaul, fronthaul and midhaul, worldwide, 2022–2028

Densification, especially in enterprise networks, will drive the adoption of new xHaul topologies

Densification of outdoor and public networks has progressed more slowly than many expected at the start of the 5G era, partly because of the cost of siting and backhauling large numbers of small cells. However, some enterprise-centric outdoor environments such as ports, business parks and smart city centres require such large numbers of cells to meet coverage, capacity and reliability requirements. As such, 30% of xHaul revenue will come from non-tower sites, such as lampposts and low roofs, by 2028.

These non-tower sites (which will total about 680 000 worldwide by 2028) will drive innovation in xHaul topologies such as dynamic mesh. This will increase the efficiency of dense networks and enable the deployment of common, software-defined xHaul platforms in which the same infrastructure supports backhaul, fronthaul and midhaul.

Successful vendors will invest in these software-defined xHaul platforms, which will be able to be repurposed for future changes in architecture driven by next-generation RAN technologies or by increased densification. A common platform will support operators in their multi-phase migrations to new RAN architecture, while allowing integrated, centralised and virtualised RANs to coexist within the same operator footprint.

1 For more information, see Analysys Mason’s Wireless network data traffic: worldwide trends and forecasts.

2 For more information, see Analysys Mason’s Wireless backhaul vendors must continue to innovate in order to retain market share.

Article (PDF)

DownloadAuthor

Caroline Gabriel

Partner, expert in network and cloud strategies and architectureRelated items

Strategy report

Strategies for telecoms operators to evolve their network-as-a-service (NaaS) propositions

Article

The QoD network API is increasingly being rolled out by CSPs, but monetisation remains limited

Article

The network API ecosystem is seeking opportunities beyond its strong traction in bank anti-fraud