OTT video will generate more revenue than traditional pay-TV services; operators should update their approach

Listen to or download the associated podcast

The COVID-19 pandemic has accelerated the worldwide decline of operators’ pay-TV revenue and their share of OTT video revenue. At the same time, OTT video will generate more retail revenue worldwide than traditional pay-TV services by 2024. Operators’ responses to the acceleration of cord-cutting and cord-shaving must be to increase the flexibility of their propositions and to establish a way of working with OTT partners to aggregate their services within or alongside traditional pay-TV services if they are to mitigate the worst revenue losses. This article explores some of the key changes in market dynamics following the COVID-19 pandemic and how those changes will affect operators’ approaches to traditional pay TV, OTT video and video content more generally.

This article is based on two recently published Analysys Mason reports: Pay-TV services worldwide: trends and forecasts 2020–2025 and OTT video worldwide: trends and forecasts 2020–2025.

The COVID-19 pandemic has accelerated the decline of operators’ pay-TV and OTT video revenue worldwide

The COVID-19 pandemic has changed the way that consumers engage with TV and video content. The short- and long-term prospects for traditional pay-TV and operator OTT video services changed during 2020.

- Short term. The pandemic has accelerated established trends in video consumption. Several major new OTT services were launched during the initial outbreak of COVID-19 (such as Disney+ in Europe), and this has affected consumer viewing patterns. The number of traditional pay-TV subscribers was stable in 2020 – the total number of connections grew by 5 million to 1.209 billion. The disruption to sports content had a negative impact on retail revenue for traditional pay-TV services (ASPU fell by 3.5% year-on-year in 2020) and operator OTT services (the number of users increased by just 6% year-on-year).

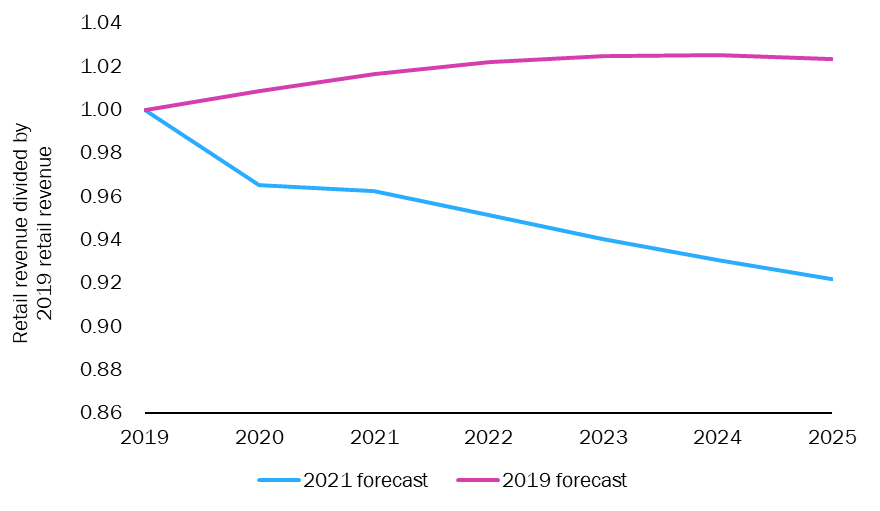

- Long term. The world is facing a period of economic recession and constrained consumer spending. It is therefore likely that cord-cutting will increase in 2021 and beyond. Figure 1 compares our forecast for retail revenue for operator TV and video services from before the COVID-19 pandemic (2019) with our 2021 view.

Figure 1: Retail revenue for operator TV and video services, 2019 and 2021 forecasts (1.00 = 2019 levels), worldwide, 2019–2025

Source: Analysys Mason

OTT video will generate more retail revenue worldwide than traditional pay-TV services by 2024

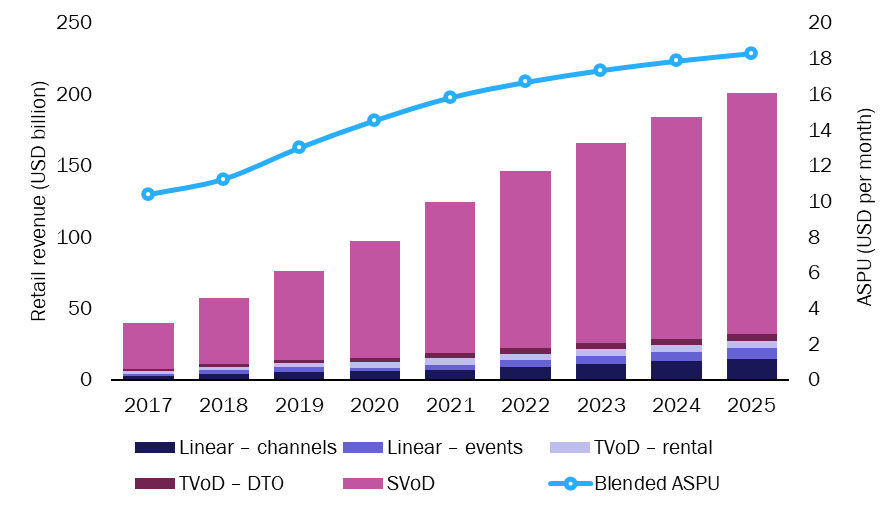

OTT video retail revenue worldwide grew by USD20.6 billion between 2019 and 2020 to USD97.1 billion. A few key players dominate the market, most significantly US SVoD provider Netflix, which accounted for 26% of retail revenue worldwide in 2020.

The COVID-19 pandemic boosted the number of users of OTT video services and their average spend in 2020, and we expect that this trend will continue. Consumers are more prepared to ‘stack’ (that is, subscribe to multiple) services than they were before the pandemic, and this will lead to further growth in the average spend per user (ASPU). OTT video and traditional pay-TV services are consumed side-by-side in most parts of the world. However, continued growth in the popularity of OTT video will come at the expense of that of traditional pay-TV services, such as cable, satellite and IPTV. We expect that retail revenue for OTT video will surpass that of traditional pay TV in 2024. OTT video will generate USD201.2 billion of retail revenue per year by 2025, compared to USD181.6 billion for traditional pay TV.

Figure 2: OTT video retail revenue by service type and blended ASPU, worldwide, 2017–2025

Source: Analysys Mason

Pay-TV providers’ most-effective response is to redouble their efforts to partner with and aggregate third-party OTT video services

The role of operators and pay-TV providers in directly distributing content via OTT services will increase during the next 5 years. The number of operator OTT video users will almost double from 57 million in 2020 to 110 million, worldwide, in 2025.1 However, operators must also consider their wider relationship with video content and with content partners because their own OTT services will account for just 7.2% of the total OTT video revenue worldwide in 2025.

- Operators must aim to capture or enable some of the wider growth in third-party OTT video (that is, services that are offered by companies such as Disney+ and Netflix, not their own OTT propositions). Operators’ super-aggregator approaches have gained pace, and tariffs that allow consumers to easily change the channels or OTT partners that are included in their subscription (such as TDC’s Bland Selv or BT’s new IPTV packages) will have been best placed to survive the disruption to sports event broadcasts in 2020.

- The commercial case for operators owning content assets and TV operations is shifting, as indicated by BT in May 2021, when it announced that it intends to spin-off BT Sport, and AT&T, which plans to merge WarnerMedia with Discovery’s assets and create a standalone content business. The shift in sports rights ownership from traditional players and operators to third-party OTT players may create new opportunities to form partnerships as Telecom Italia has with DAZN, for example, following the latter’s acquisition of Serie A rights in March 2021.

1 Operator OTT video refers to OTT video services offered by telecoms operators and pay-TV providers that have previously provided traditional pay-TV services. For more information on operator OTT services, see Analysys Mason’s Pay-TV services worldwide: trends and forecasts 2020–2025.

Article (PDF)

DownloadAuthor