5G capex: co-investment models for telecoms operators

10 September 2021 | Research

Michela Venturelli | Caroline Gabriel | Michelle Lam

Strategy report | PPTX and PDF (40 slides) | Operator Spending

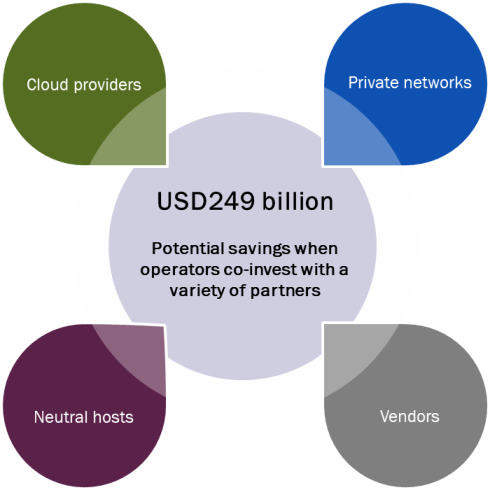

Operators are facing significant capex bills to migrate to 5G standalone and to expand their networks. Return on investment (ROI) will be challenging unless they share the cost with other operators, and increasingly with non-telecoms investors such as hyperscalers. Despite the risks, sharing models could save operators a collective USD249 billion over the 5G deployment cycle.

This report answers the following questions.

- What will be the cost of investing in RAN, fibre and cloud infrastructure to support advanced 5G in the 2020s?

- How much capex can operators save if they co-invest with other parties, or rely on wholesalers and neutral hosts?

- Which companies will be the best co-investment partners to provide significant resources without depriving the operator of its place in the 5G value chain?

- What are the main risks of co-investment and network sharing, and how can these be mitigated?

Operators can save by sharing costs but their partnership options will depend on their business model

Source: Analysys Mason

Authors

Michela Venturelli

Senior Analyst

Caroline Gabriel

Partner, expert in network and cloud strategies and architecture

Michelle Lam

Senior AnalystRelated items

Case studies report

Telecoms operator opex reduction strategies: case studies and analysis (North American operators)

Podcast

The end of big capex in telecoms: causes and implications

Case studies report

Telecoms operator opex reduction strategies: case studies and analysis (pan-European operators)