Operator investment patterns and business ambitions: four approaches for responding to revenue stagnation

15 November 2019 | Research

Strategy report | PPTX and PDF (20 slides) | Operator Investment Strategies

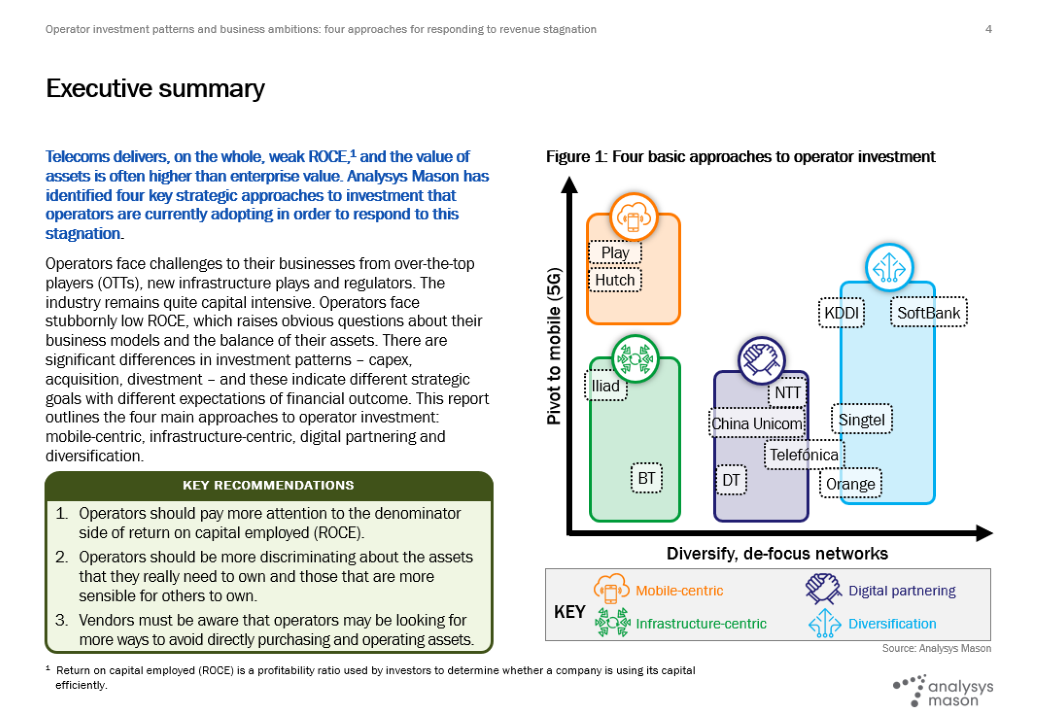

This report provides a view of investment trends that have been distilled from a representative sample of telecoms operators worldwide and provides an analysis of the different levels of investment in digital and traditional core telecoms spheres.

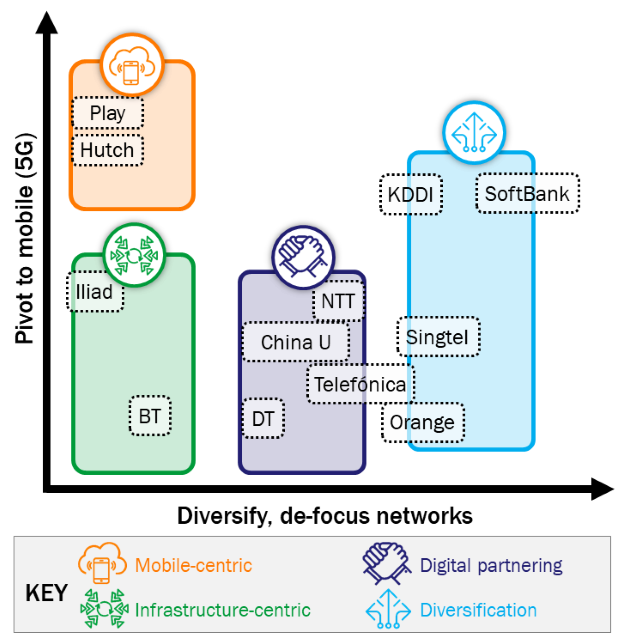

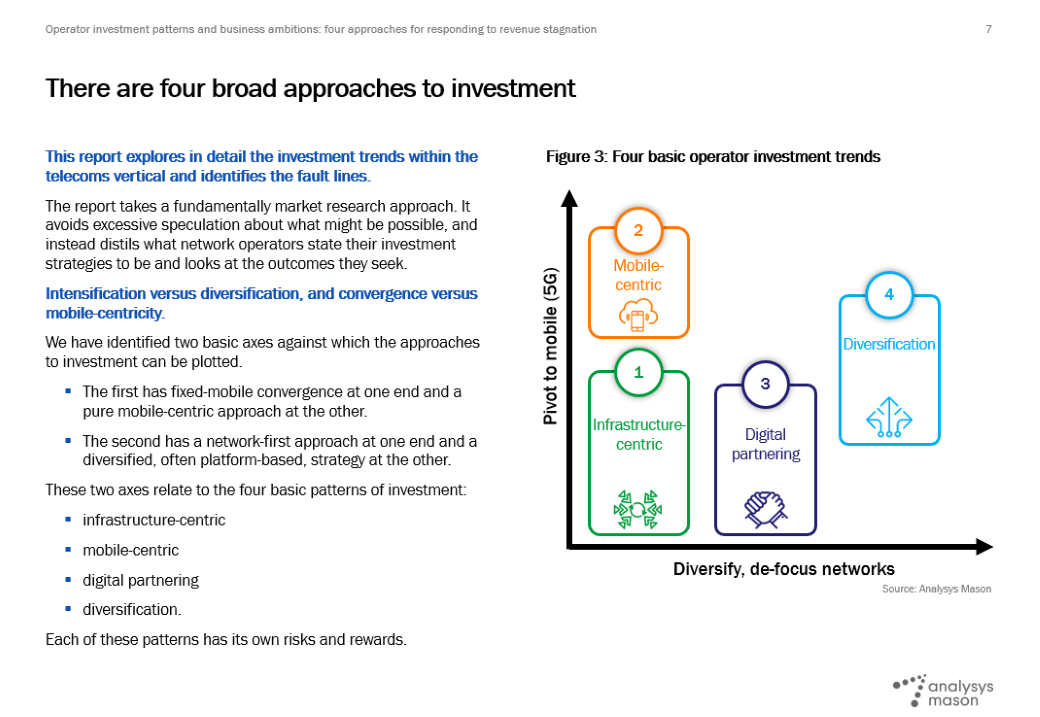

Analysys Mason has identified four main approaches to investment, and the report establishes a framework by which operators, vendors and investors can evaluate these proposed approaches in order to understand what business/financial outcomes those approaches might enable.

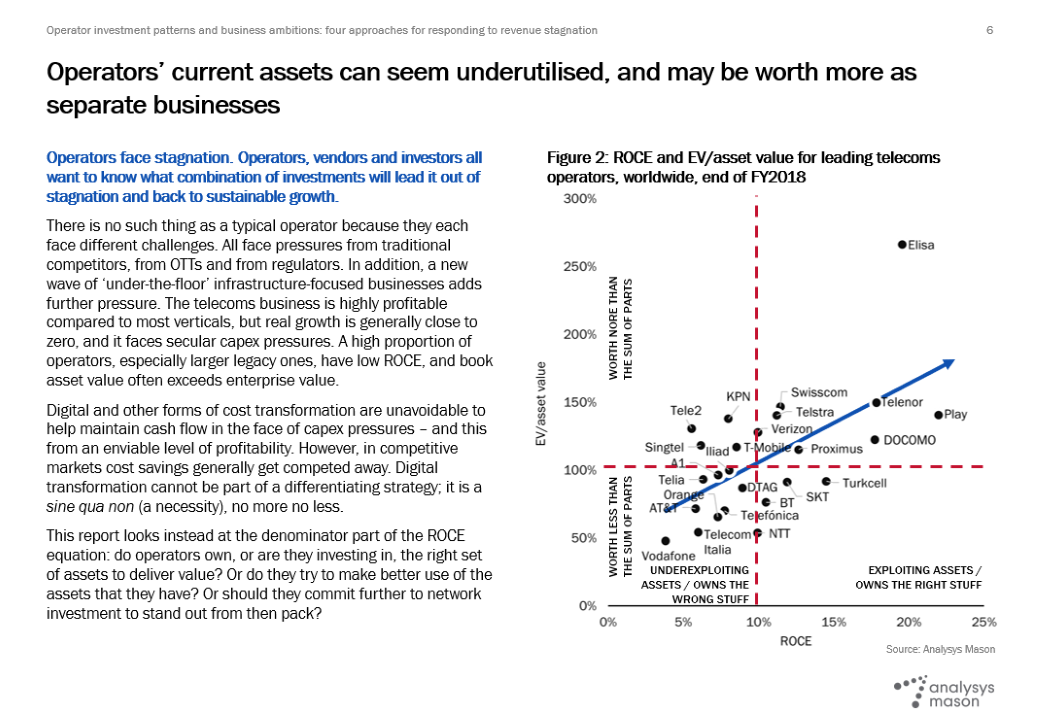

It serves as a complement to several of our reports, especially our capex forecasts, to give a picture of the possible evolution of investment and, therefore, asset bases of different types of operator. Many Analysys Mason reports focus on efficiency and revenue optimisation; this report focuses on the denominator side of the ROCE (return on capital employed) equation, the asset base.

In this report, we answer the following questions.

- How do operators think they will recover from stagnation, and what are they investing in to make this happen?

- What is the perceived balance of risks and rewards associated with a focus on intensification of network compared with a focus on diversification of assets?

- What does this suggest about long-term ambitions?

- How far into the digital world are operators investing?

Four basic approaches to operator investment

Sample pages

|

|

|

Log in or register to download the sample pages.

Author