SMB technology survey insights: getting back to business

14 March 2022 | SMB IT

Survey report | PDF | Business Applications| Cyber Security| Devices and Peripherals| IT and Managed Services| IT Infrastructure| UC and Digital Services

Listen to or download the associated podcast

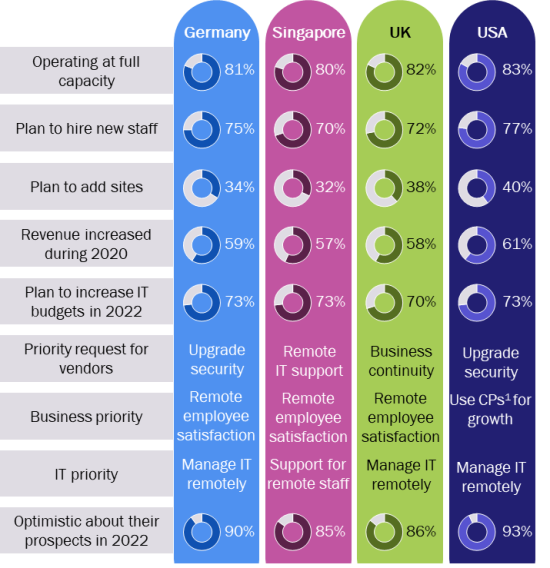

Analysys Mason surveyed 1149 small and medium-sized businesses (SMBs) in Germany, Singapore, the UK and the USA between December 2021 and January 2022. We asked SMBs how they have adapted to the changing business environment since the start of the pandemic and about their future plans.

These reports build on our previous surveys to provide updated insights into SMBs’ long-term strategies. SMBs are “getting back to business” (that is, instead of just trying to remain operational, they are focusing on revenue generation and business expansion, including hiring, opening locations and broadening their product or services offerings). This study assesses the drivers of SMBs’ future demand for IT and managed services and examines the key implications for vendors and service providers.

The results provide insights into:

- current SMB operating conditions and SMBs' future priorities

- SMBs' current technology usage and their planned investments

- the services and support needed by SMBs from vendors.

Key questions answered in these reports

- How have SMBs adapted to a changing operating environment?

- How has SMBs’ use of IT and managed services helped them to adapt their operations to new working conditions and how do SMBs expect the business environment to change in the future?

- What are the key drivers of SMBs’ future adoption of technology and what does this mean for vendors and providers?

- What types of support and services are SMBs demanding from vendors?

Overview of the key results of our survey, Germany, Singapore, UK and USA, 1Q 2022

Geographical coverage and survey sample

| Geographical coverage | Sample | |

|---|---|---|

|

|

|

Download our SMB technology demand survey reports here

Webinar: Getting back to business: a view into SMB IT spending

Register hereAuthors