Streaming video opportunities for operators: consumer survey

19 December 2024 | Research and Insights

Survey report | PPTX and PDF (11 slides); Excel | Video, Gaming and Entertainment| Global Pay-TV and Video Metrics and Forecasts

Video streaming services have reached a point of maturity that has implications across the market.

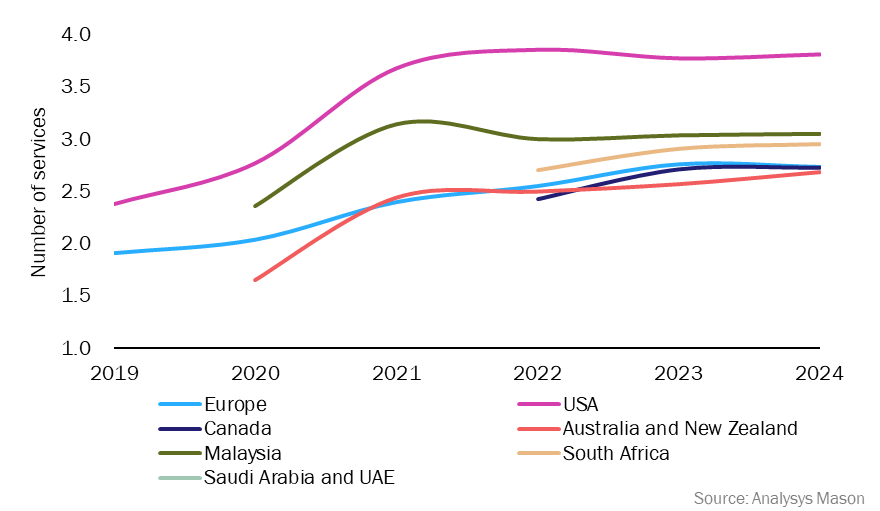

Figure: Average number of streaming video services used by paying respondents, by region

This chart reveals a significant trend in the video streaming industry: the stagnation of ‘service stacking’ (the number of streaming services a single household subscribes to). Analysys Mason’s recent survey of 18 500 consumers shows that this number has plateaued in many regions.

- Stagnation across regions. The average number of streaming services per household has seen minimal growth, moving from 2.7 services per user in 2022 to 2.9 in 2024. This stagnation is not uniform, with some regions (notably Asia) experiencing declines as early as 2022, and Europe in 2024.

- Factors behind the slowdown. In some countries, major services have shut down due to financial difficulties, such as Salto in France. In others, consumers have reacted negatively to price increases, particularly in the UK.

The stagnation in service stacking underscores the need for streaming providers to adapt. These providers are increasingly turning to telecoms operators as important retail partners. Telecoms operators have well-established customer relationships, and offer a valuable sales channel, helping to attract older audiences, reduce customer churn and neutralise issues such as password sharing. These topics, and more, are explored in this report.

By building partnerships with telecoms operators, streaming providers can enhance their reach and resilience in a competitive market. As the industry continues to evolve, these collaborations will be crucial in sustaining growth and meeting consumer demands.

Questions answered in this report

- How is service stacking evolving and what does this mean for the level of competition in the streaming video market?

- How important are telecoms operators as a retail channel for streaming video services?

- How much do video service providers benefit from bundling streaming video services with telecoms services compared to telecoms service providers?

- What is the business case for aggregating streaming video services?

Survey data coverage

The survey was conducted in association with Dynata in July 2024. The survey groups were chosen to be representative of the broader online consumer population in the countries covered. We set quotas on age, gender and geographical spread to that effect. There were at least 1000 respondents per country (except in Saudi Arabia and the UAE, where there were 750 per country).

Geographical coverage

- Asia–Pacific: Australia, Malaysia and New Zealand

- Central and Eastern Europe: Poland and Turkey

- Middle East and Africa: Saudi Arabia, South Africa and the UAE

- North America: Canada and the USA

- Sub-Saharan Africa: South Africa

- Western Europe: France, Germany, Ireland, Italy, Norway, Spain, Sweden and the UK

USD1649

Log in to check if this content is included in your content subscription.

Consumer survey

Analysys Mason's annual consumer survey tracks and measures consumers’ changing telecoms and media habits, device ownership, connectivity options and future plans

Author

Martin Scott

Research DirectorRelated items

Report

Analysys Mason research and insights topics for 2026

Tracker

Pay-TV quarterly metrics 2Q 2025

Article

Operators that want to reinvent their TV offers should learn from peers in the USA