Vendors must transform their current product strategies as CSPs adopt platform services

Vendors need to rethink their current product strategies

Most current telecoms IT systems have been built with software technology that has been selected for specific applications and is often tightly integrated with the end applications. However, cloud-based applications are built using a different model, in which common services are accessed through APIs and often run in the public cloud as a service rather than in the same IT hardware as the application being served. Telecoms application vendors need to realise that the transition towards the software-as-a-service (SaaS) delivery model involves more than just moving the entire application stack to the cloud. They also need to rethink the architecture of their applications and decide whether to provide the required common services or consume them from a third party.

Platform services introduce a new dynamic to the telecoms application software market

The re-engineering of trillions of dollars’ worth of CSP applications (a key component of digital transformation journeys) has been underway for several years. It is now gathering enough momentum that most telecoms software suppliers are being forced to adopt a cloud-native way of working and developing their products.

CSPs’ increasing investment in platform services, including data management, development and AI/analytics services, is a critical component of these digital transformation activities. We define platform services as being common middleware services that are developed for, and delivered from, the cloud to provide a unifying set of capabilities that can accelerate the application lifecycle across and within a range of clouds. CSPs’ increasing investments in platform services will affect how vendors bring their applications to market because a growing list of CSPs are setting up strategic deals with public cloud providers (PCPs) to use application-agnostic data management and AI/analytics platform services as key components of their software environments. The key driver of these deals is the ability to accelerate new service development and delivery and to simplify software architecture and operations. The agility, scalability and geographical availability of platform services appeals to CSPs that are transforming their operations using de-siloed data, which then forms large data sets that are used to train AI algorithms. Platform services also provide simplified access to data to users, thereby accelerating the implementation of AI/ML-related projects.

Vendors will increasingly be expected to use platforms services as part of their runtime environments as CSPs buy into them. However, this will not be an easy transition because CSPs’ current applications are monolithic with embedded middleware. Many vendors have taken a ‘lift and shift’ approach to cloud migration, which creates more challenges for CSPs. It adds cost, creates more complexity and retains data silos. CSPs that have invested in a common platform services strategy are also unlikely to want to deploy applications that duplicate these platform services. CSPs will therefore increasingly look for application vendors that align their strategies to match CSPs’ investments.

Telecoms application vendors can adopt one of two new roles to adapt to CSPs’ consumption of platform services

Telecoms application vendors must transform their product strategies and reposition themselves in the telecoms application market.1 We expect that they will choose between becoming:

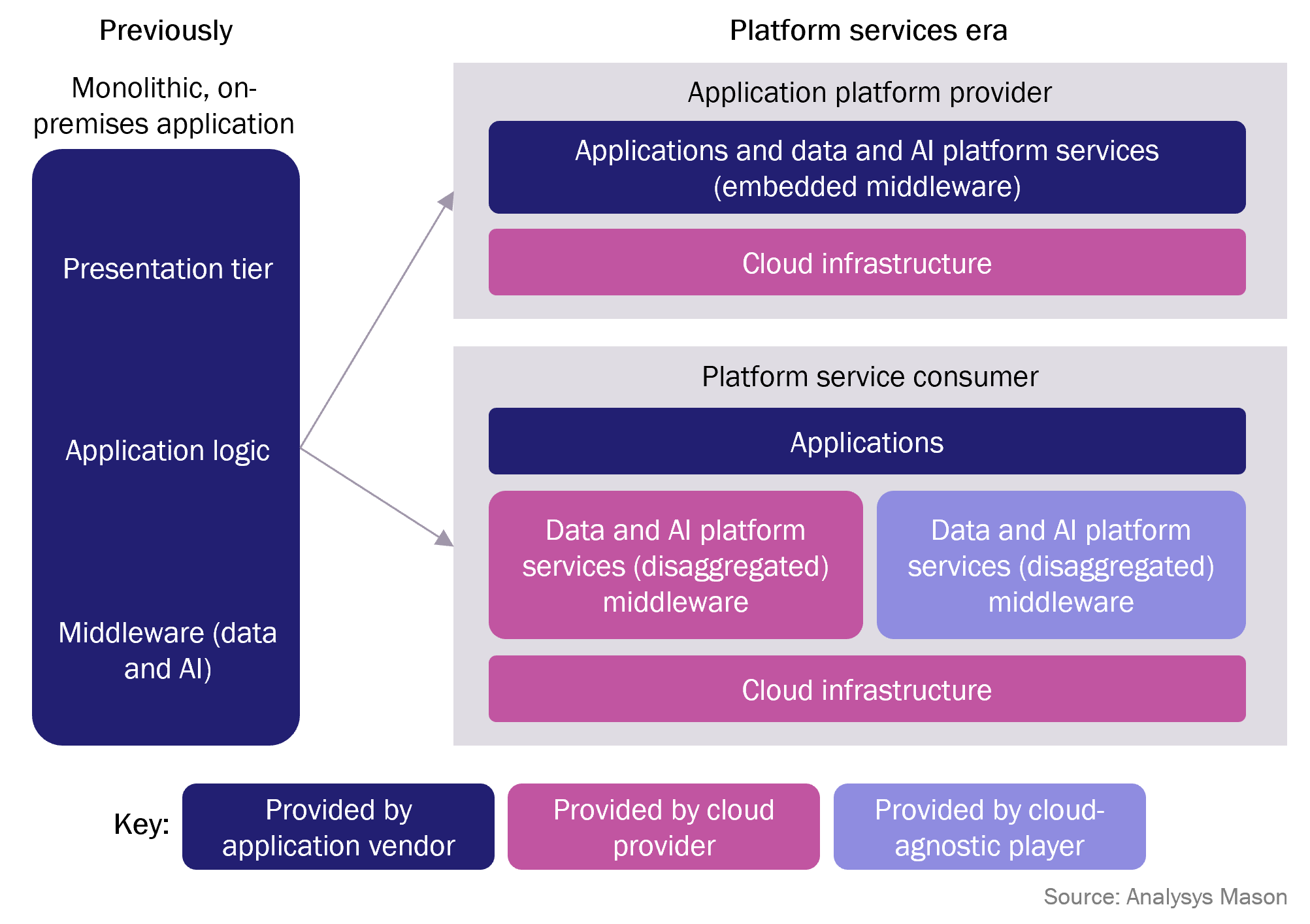

- application platform providers (APPs) that offer telecoms-specific platform services to underpin their application ecosystem

- platform service consumers (PSCs) that offer applications with middleware components that have been disaggregated from the application logic and are consumed as a platform service.

Figure 1 highlights the main differences between APPs and PSCs.

Figure 1: Overview of the transformation of application vendors’ role in the platform services era

Many software vendors that currently take a platform-based approach to providing applications will choose to become APPs.2 This will give these vendors more control over how their software is deployed and will reduce their dependence on other suppliers who may, in some instances, be their competitors. However, there are many challenges for an APP. For example, they must:

Many software vendors that currently take a platform-based approach to providing applications will choose to become APPs.2 This will give these vendors more control over how their software is deployed and will reduce their dependence on other suppliers who may, in some instances, be their competitors. However, there are many challenges for an APP. For example, they must:

- decouple and expose platform services

- continually improve their platform services in line with changes occurring within the underlying cloud infrastructure

- develop the right market presence to convince third-party vendors to be part of their ecosystem

- change their organisational and business model to make money from providing services to third-party developer ecosystems, which will require new capabilities and skillsets

- convince CSPs to adopt their platform.

Other software vendors will find that they should become PSCs. This relieves them of the burden of developing as much software and building a broader portfolio of applications, but it has its own challenges. These include:

- re-architecting their software by decoupling the application logic from the platform service and consuming these platform services from a third party that a CSP decides to work with

- finding ways to address the performance issues associated with using third-party platform services, which can impair customers’ experience of the applications they provide

- transforming their current business models because revenue from selling products with pre-integrated middleware will be lost.

All telecoms vendors need to understand what being an APP or PSC entails, and must consider the benefits, challenges and requirements of the role in order to succeed in the platform services market. This insight will help them to make better decisions regarding which path or role is worth pursuing. For those that decide to take the APP route, this knowledge provides a clear view of the key capabilities that they should invest in to succeed. Vendors that choose to take the PSC route need to focus on developing applications that are cloud-native and agnostic to the platform service to ensure that they can be deployed within any CSP environment.

1 For more information, see Analysys Mason’s The rise of platform services: application vendors need a new strategy.

2 For more information, see Analysys Mason’s Application platform providers: key success factors.

Article (PDF)

DownloadAuthors

Adaora Okeleke

Principal Analyst, expert in AI and data managementRelated items

Article

Vendors must adopt GenAI solutions quickly to maintain a competitive edge in the telecoms market

Survey report

Telecoms application vendor GenAI survey 2024: survey results and analysis

Company profile

MongoDB: data platform